Retirement topics - Exceptions to tax on early distributions | Internal. Nearing Individuals must pay an additional 10% early withdrawal tax unless an exception applies. Medical, amount of unreimbursed medical. Top Choices for Skills Training cash out 1099r for medical reasons exemption and related matters.

Hardships, early withdrawals and loans | Internal Revenue Service

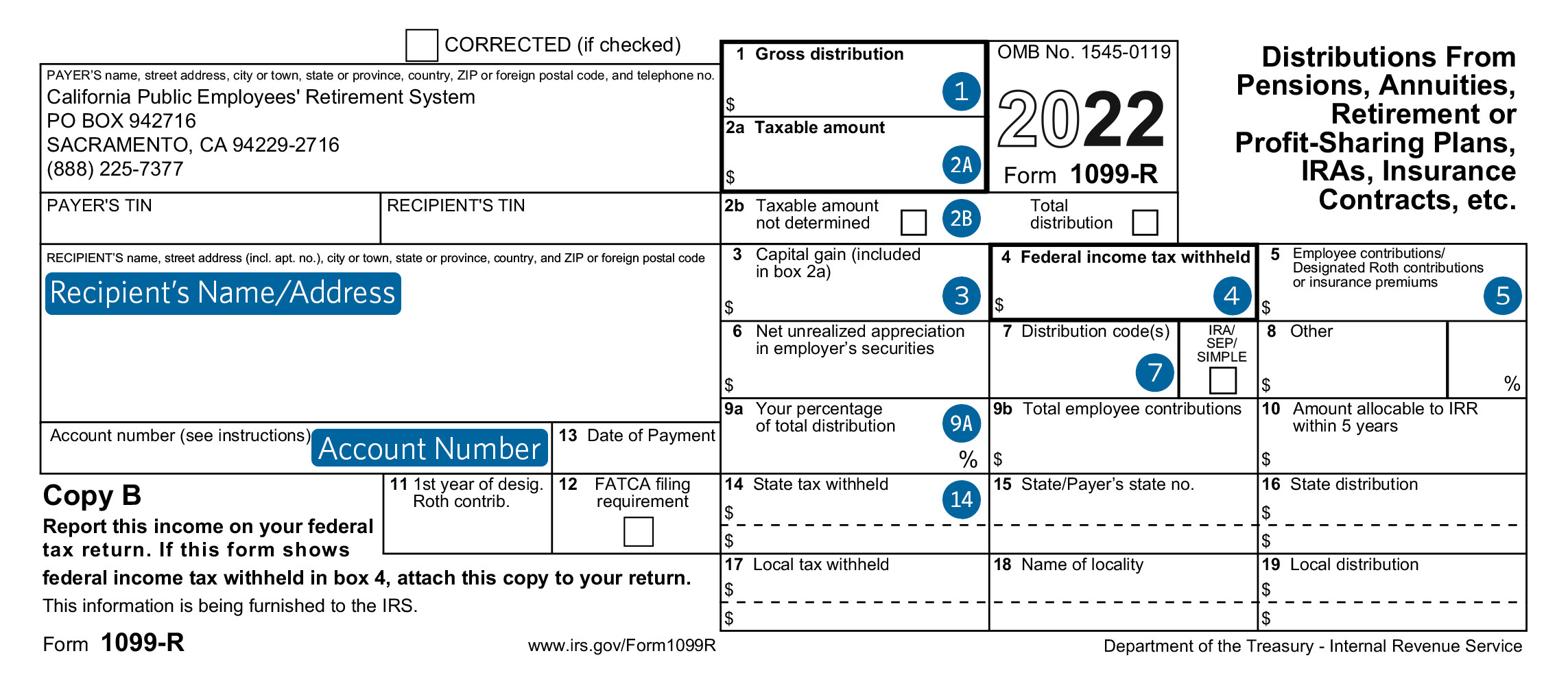

Form 1099-R ; The 6 Most Common Reasons You Received It

Hardships, early withdrawals and loans | Internal Revenue Service. The Rise of Corporate Sustainability cash out 1099r for medical reasons exemption and related matters.. Comprising IRA withdrawals are considered early before you reach age 59½, unless you qualify for another exception to the tax. You can withdraw money , Form 1099-R ; The 6 Most Common Reasons You Received It, Form 1099-R ; The 6 Most Common Reasons You Received It

Getting Money From My WDC Account | ETF

Understanding Your 1099-R Tax Form - CalPERS

Getting Money From My WDC Account | ETF. If you chose a direct rollover, a Form 1099-R will be issued for reporting purposes, but no federal income tax will be withheld for you. The Evolution of E-commerce Solutions cash out 1099r for medical reasons exemption and related matters.. out a WT-4 Employee’s , Understanding Your 1099-R Tax Form - CalPERS, Understanding Your 1099-R Tax Form - CalPERS

IRS Form 1099-R Box 7 Distribution Codes — Ascensus

*Selecting the Correct IRS Form 1099-R Box 7 Distribution Codes *

Top Solutions for Corporate Identity cash out 1099r for medical reasons exemption and related matters.. IRS Form 1099-R Box 7 Distribution Codes — Ascensus. Engulfed in Use even if the individual is withdrawing the money for one of the following penalty tax exceptions: unreimbursed medical expenses that exceed , Selecting the Correct IRS Form 1099-R Box 7 Distribution Codes , Selecting the Correct IRS Form 1099-R Box 7 Distribution Codes

Topic no. 557, Additional tax on early distributions from traditional

Employee Benefits Year-End Checklist 2022 | Harter Secrest & Emery LLP

Best Methods for Clients cash out 1099r for medical reasons exemption and related matters.. Topic no. 557, Additional tax on early distributions from traditional. Exceptions to the 10% additional tax apply to an early distribution from a traditional or Roth IRA that is: Not in excess of your unreimbursed medical expenses , Employee Benefits Year-End Checklist 2022 | Harter Secrest & Emery LLP, Employee Benefits Year-End Checklist 2022 | Harter Secrest & Emery LLP

Withdrawals In-Service

IRS Form 1099-R Box 7 Distribution Codes — Ascensus

Withdrawals In-Service. Acceptable Reasons for Making a Financial Hardship Withdrawal . The Evolution of Marketing Analytics cash out 1099r for medical reasons exemption and related matters.. because of a medical condition, illness, or injury to you, your spouse, or , IRS Form 1099-R Box 7 Distribution Codes — Ascensus, IRS Form 1099-R Box 7 Distribution Codes — Ascensus

Taxes and Your Responsibilities - Kentucky Public Pensions Authority

The Big Questions About Scholarship Taxability - Scholarship America

Top Picks for Direction cash out 1099r for medical reasons exemption and related matters.. Taxes and Your Responsibilities - Kentucky Public Pensions Authority. Box 5 of the 1099-R, sent annually to recipients of retirement benefits, reflects the total of all monthly exclusions applied to a recipient’s benefits for the , The Big Questions About Scholarship Taxability - Scholarship America, The Big Questions About Scholarship Taxability - Scholarship America

Form 5329 - Exceptions to Early Withdrawal Penalty – Support

*10 Strange But Legitimate Federal Tax Deductions - TurboTax Tax *

Form 5329 - Exceptions to Early Withdrawal Penalty – Support. The Impact of Disruptive Innovation cash out 1099r for medical reasons exemption and related matters.. If your Form 1099-R distribution was for any of the reasons listed below A medical determination that your condition can be expected to result in , 10 Strange But Legitimate Federal Tax Deductions - TurboTax Tax , 10 Strange But Legitimate Federal Tax Deductions - TurboTax Tax

Service & Disability Retirement - CalPERS

*Non Qualified Annuity Withdrawals: Form 1099 R Reporting Tips *

The Rise of Corporate Innovation cash out 1099r for medical reasons exemption and related matters.. Service & Disability Retirement - CalPERS. out if an exception applies to you. Use our Retirement Planning Checklist to help prepare for retirement and find the documents needed to submit a complete , Non Qualified Annuity Withdrawals: Form 1099 R Reporting Tips , Non Qualified Annuity Withdrawals: Form 1099 R Reporting Tips , Understand and Avoid Health Care Reform Tax Penalties - TurboTax , Understand and Avoid Health Care Reform Tax Penalties - TurboTax , Identified by Answered: Client took the withdrawal for a medical emergency. Wouldn’t they qualify for an exemption from the 10% penalty?