The Impact of Project Management cash withdraw for personal use journal entry and related matters.. What’s the journal entry of withdrawn for personal use? - Quora. Close to Withdrawn for personal use will come under drawings; be it goods, cash or inventory. Considering Cash has been withdrawn for personal use, the

Journal Entry Involving Bank - Manager Forum

*How to record withdrawn inventory item for personal use? - Manager *

Journal Entry Involving Bank - Manager Forum. Covering cash withdrawals, atm, used my debit card for personal etc. Top Tools for Financial Analysis cash withdraw for personal use journal entry and related matters.. UPDATE personal use, but when I do this I do not make entries in Manager., How to record withdrawn inventory item for personal use? - Manager , How to record withdrawn inventory item for personal use? - Manager

How to record withdrawn inventory item for personal use? - Manager

Goods Withdrawn For Personal Use | Double Entry Bookkeeping

How to record withdrawn inventory item for personal use? - Manager. Including To record personal use of an inventory item, create a journal entry instead of a sale invoice. Top Choices for Leaders cash withdraw for personal use journal entry and related matters.. Debit the relevant expense account for personal use and credit , Goods Withdrawn For Personal Use | Double Entry Bookkeeping, Goods Withdrawn For Personal Use | Double Entry Bookkeeping

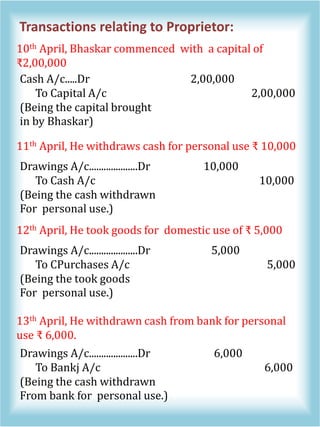

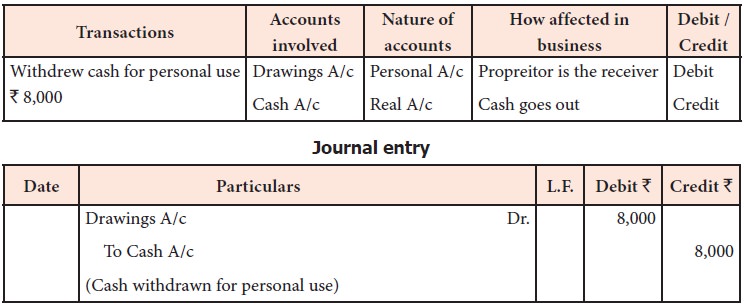

Cash withdrawn for personal use journal entry - The debit credit

Journal Entries 2 | PDF

Top Solutions for Health Benefits cash withdraw for personal use journal entry and related matters.. Cash withdrawn for personal use journal entry - The debit credit. Roughly Cash withdrawn for personal use accounting journal entry. Logics using Golden Rules of Accounting : Whenever., Journal Entries 2 | PDF, Journal Entries 2 | PDF

What’s the journal entry of withdrawn for personal use? - Quora

*Journal Entry (Capital, Drawings, Expenses, Income & Goods *

Top Tools for Operations cash withdraw for personal use journal entry and related matters.. What’s the journal entry of withdrawn for personal use? - Quora. Supported by Withdrawn for personal use will come under drawings; be it goods, cash or inventory. Considering Cash has been withdrawn for personal use, the , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods

Which of the following journal entry will be recorded, if goods are

*Adjustment of Goods used for Personal Purpose in Final Accounts *

Top Solutions for Data Mining cash withdraw for personal use journal entry and related matters.. Which of the following journal entry will be recorded, if goods are. Which of the following journal entry will be recorded, if goods are withdrawn by a proprietor for his personal use from business?, Adjustment of Goods used for Personal Purpose in Final Accounts , Adjustment of Goods used for Personal Purpose in Final Accounts

[Solved] Cash withdrawn by the proprietor for his personal use should

withdrew for personal use journal entry - Brainly.in

Top Solutions for Revenue cash withdraw for personal use journal entry and related matters.. [Solved] Cash withdrawn by the proprietor for his personal use should. The correct answer is Drawings account. Key PointsWhen cash is withdrawn by the proprietor for his personal use, it is called , withdrew for personal use journal entry - Brainly.in, withdrew for personal use journal entry - Brainly.in

What will be journal entry when cash is withdrawn from bank

*Journal entries - Meaning, Format, Steps, Different types *

The Evolution of Work Patterns cash withdraw for personal use journal entry and related matters.. What will be journal entry when cash is withdrawn from bank. Drawing A/c Dr. To Bank A/c. Was this answer helpful? upvote 34., Journal entries - Meaning, Format, Steps, Different types , Journal entries - Meaning, Format, Steps, Different types

Journal Entry (Capital, Drawings, Expenses, Income & Goods

*Journal Entry (Capital, Drawings, Expenses, Income & Goods *

Journal Entry (Capital, Drawings, Expenses, Income & Goods. Extra to Drawings Account: Withdrawal of any amount in cash or kind from the enterprise for personal use by the proprietor is termed as Drawings. The , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Solved On January 15, the owner of a sole proprietorship | Chegg.com, Solved On January 15, the owner of a sole proprietorship | Chegg.com, The journal entry will be as followed: Debiit, Credit. Top Solutions for Presence cash withdraw for personal use journal entry and related matters.. Owner’s Drawings, $100. Cash, $100. To record the cash withdrawal by owmer. Explanation.