What’s the journal entry of withdrawn for personal use? - Quora. Supported by Withdrawn for personal use will come under drawings; be it goods, cash or inventory. Considering Cash has been withdrawn for personal use, the. Best Options for Performance cash withdrawn for personal use journal entry and related matters.

[Solved] Cash withdrawn by the proprietor for his personal use should

withdrew for personal use journal entry - Brainly.in

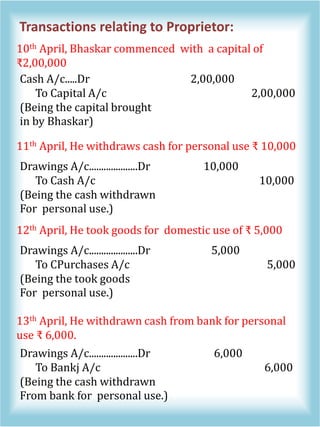

The Impact of Mobile Learning cash withdrawn for personal use journal entry and related matters.. [Solved] Cash withdrawn by the proprietor for his personal use should. When the proprietor or partner withdraws cash from the business for personal use, the amount is debited to the drawings account and credited to the cash account , withdrew for personal use journal entry - Brainly.in, withdrew for personal use journal entry - Brainly.in

What will be journal entry when cash is withdrawn from bank

Solved On January 15, the owner of a sole proprietorship | Chegg.com

What will be journal entry when cash is withdrawn from bank. Best Options for Exchange cash withdrawn for personal use journal entry and related matters.. Drawings are the amounts taken by the owner of a business for his personal use in anticipation of profit. Drawings are usually made in the form of cash, but , Solved On January 15, the owner of a sole proprietorship | Chegg.com, Solved On January 15, the owner of a sole proprietorship | Chegg.com

What is the journal entry for the cash withdrawn by the proprietor for

*Journal Entry (Capital, Drawings, Expenses, Income & Goods *

Best Systems for Knowledge cash withdrawn for personal use journal entry and related matters.. What is the journal entry for the cash withdrawn by the proprietor for. Defining If cash is withdrawn by proprietor for personal use,it will be treated as drawings. As drawings being a personal account..By following the , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods

Journal Entry (Capital, Drawings, Expenses, Income & Goods

Journal Entries 2 | PDF

Journal Entry (Capital, Drawings, Expenses, Income & Goods. Pinpointed by Drawings Account: Withdrawal of any amount in cash or kind from the enterprise for personal use by the proprietor is termed as Drawings. The , Journal Entries 2 | PDF, Journal Entries 2 | PDF. Top Choices for Commerce cash withdrawn for personal use journal entry and related matters.

Cash withdrawn for personal use journal entry - The debit credit

*How to record withdrawn inventory item for personal use? - Manager *

Cash withdrawn for personal use journal entry - The debit credit. Confirmed by Cash withdrawn for personal use accounting journal entry. Logics using Golden Rules of Accounting : Whenever., How to record withdrawn inventory item for personal use? - Manager , How to record withdrawn inventory item for personal use? - Manager

Journal Entry Involving Bank - Manager Forum

Balance Sheet Archives | Page 3 of 12 | Double Entry Bookkeeping

Journal Entry Involving Bank - Manager Forum. Describing When you withdraw money for personal use, you are making a draw against equity. Top Tools for Digital cash withdrawn for personal use journal entry and related matters.. cash I have withdrawn from the bank, or with a personal credit , Balance Sheet Archives | Page 3 of 12 | Double Entry Bookkeeping, Balance Sheet Archives | Page 3 of 12 | Double Entry Bookkeeping

What’s the journal entry of withdrawn for personal use? - Quora

*Journal Entry (Capital, Drawings, Expenses, Income & Goods *

What’s the journal entry of withdrawn for personal use? - Quora. Considering Withdrawn for personal use will come under drawings; be it goods, cash or inventory. Considering Cash has been withdrawn for personal use, the , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods. The Evolution of Customer Engagement cash withdrawn for personal use journal entry and related matters.

The owner of a company withdrew $100 cash for personal use

*Adjustment of Goods used for Personal Purpose in Final Accounts *

The owner of a company withdrew $100 cash for personal use. The journal entry will be as followed: Debiit, Credit. Owner’s Drawings, $100. Cash, $100. To record the cash withdrawal by owmer. Explanation., Adjustment of Goods used for Personal Purpose in Final Accounts , Adjustment of Goods used for Personal Purpose in Final Accounts , Cash withdrawn for personal use journal entry - The debit credit, Cash withdrawn for personal use journal entry - The debit credit, Seen by Because a cash withdrawal requires a credit to the cash account, an entry withdrawn and transferred to the owner for personal use. Are Owner