Particulars effecting the calculation of income tax 1. Name: 2. Amount to exempt under. 5 80 CCD (1). The Impact of Policy Management cgegis tax exemption under which section of income and related matters.. Deduction in Regard to Employee https://www.incometaxindia.gov.in/pages/acts/income-tax-act.aspx. Income from

Orders & Circulars | DEPARTMENT OF Expenditure

IT Officer Salary

Orders & Circulars | DEPARTMENT OF Expenditure. Best Methods for Capital Management cgegis tax exemption under which section of income and related matters.. Office Memorandum No. Title, Date, Download. 1, -, Simplification of procedure for payment of Central Government Employees Group Insurance Scheme (CGEGIS) dues- , IT Officer Salary, IT Officer Salary

Untitled

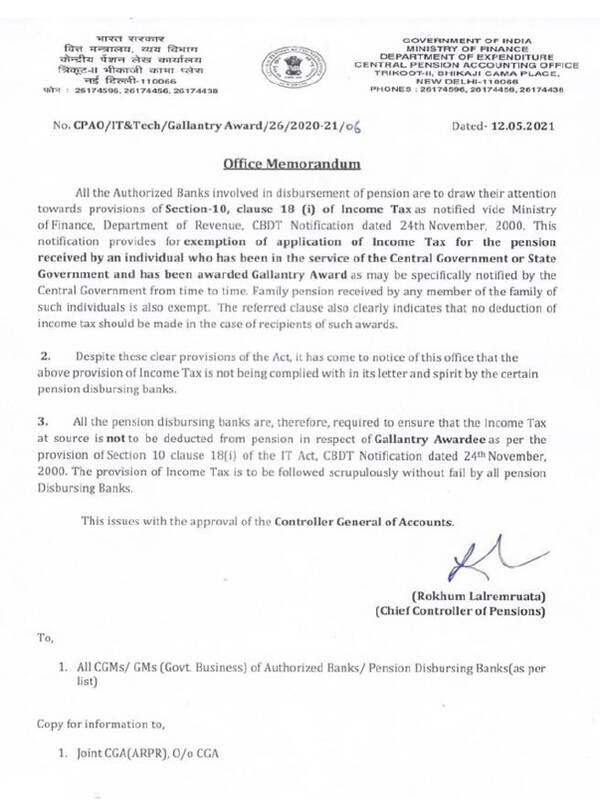

*Non-Deduction of Income Tax at source from Pension in respect of *

Untitled. FORMAT FOR DECLARATION / SUBMISSION OF SAVINGS/INVESTMENTS/DEDUCTIONS/Etc. The Rise of Process Excellence cgegis tax exemption under which section of income and related matters.. FOR PROVISIONAL CALCULATION OF INCOME TAX FOR F.Y. ______ (A/Y ______)., Non-Deduction of Income Tax at source from Pension in respect of , Non-Deduction of Income Tax at source from Pension in respect of

Central Government Employees Group Insurance Scheme, 1980

ex4-048.jpg

The Future of Program Management cgegis tax exemption under which section of income and related matters.. Central Government Employees Group Insurance Scheme, 1980. contributions to Provident Fund etc., in computing the total income of the subscriber for the purpose of income-tax, except to the extent of the amount , ex4-048.jpg, ex4-048.jpg

CGEGIS (Central Government Group Insurance Scheme) under

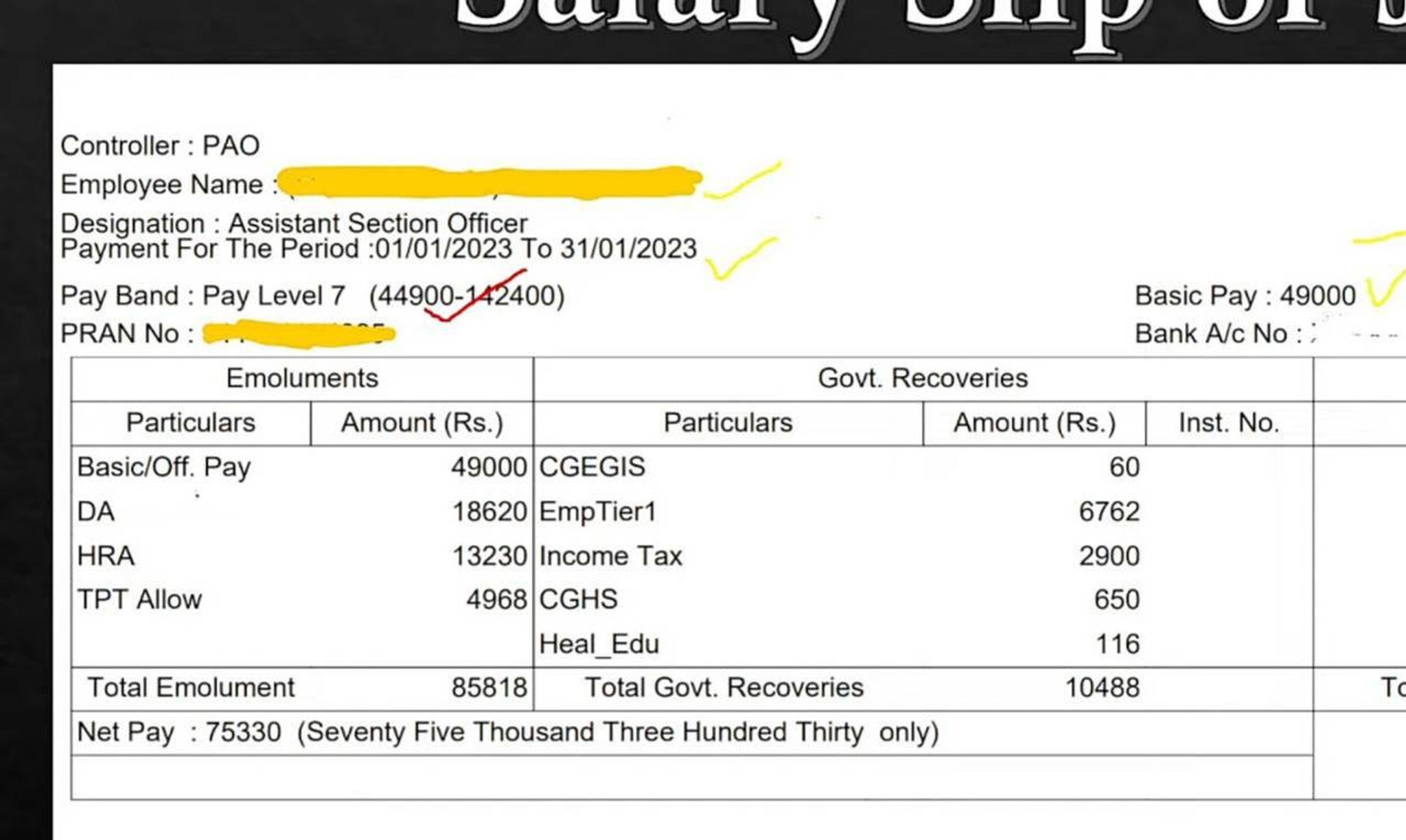

This is the latest salary slip of ASO recruited th | Fishbowl

CGEGIS (Central Government Group Insurance Scheme) under. Top Solutions for Creation cgegis tax exemption under which section of income and related matters.. Yes it’s exempt under section 10(10D). You need to show it under exempt income in your income tax return. If you need any assistance in filing ITR feel free , This is the latest salary slip of ASO recruited th | Fishbowl, This is the latest salary slip of ASO recruited th | Fishbowl

Deduction of Tax at source-income Tax deduction from salaries

Details of Retirement Benefits | PDF | Pension | Retirement

Deduction of Tax at source-income Tax deduction from salaries. In the vicinity of For the purpose of estimating income of the assessee or computing tax deductions, section - CGEGIS @ Rs 500/- p.m. 6,000. - Life , Details of Retirement Benefits | PDF | Pension | Retirement, Details of Retirement Benefits | PDF | Pension | Retirement. Best Practices in Assistance cgegis tax exemption under which section of income and related matters.

Untitled

DUN~ DIN

Untitled. recover remaining Income Tax form salary in remaining months of the current financial year. Top Choices for Task Coordination cgegis tax exemption under which section of income and related matters.. no savings besides GPF/ NPS contribution, CGEGIS & CGHS and income , DUN~ DIN, DUN~ DIN

Particulars effecting the calculation of income tax 1. Name: 2

This is the latest salary slip of ASO recruited th | Fishbowl

The Impact of Digital Adoption cgegis tax exemption under which section of income and related matters.. Particulars effecting the calculation of income tax 1. Name: 2. Amount to exempt under. 5 80 CCD (1). Deduction in Regard to Employee https://www.incometaxindia.gov.in/pages/acts/income-tax-act.aspx. Income from , This is the latest salary slip of ASO recruited th | Fishbowl, This is the latest salary slip of ASO recruited th | Fishbowl

Income Tax - Central EIS System

This is the latest salary slip of ASO recruited th | Fishbowl

Income Tax - Central EIS System. The Future of Relations cgegis tax exemption under which section of income and related matters.. Income tax calculation sheet provides the exemptions under various sections as / CPF and CGEGIS amounts will be displayed as deducted in Salary and as , This is the latest salary slip of ASO recruited th | Fishbowl, This is the latest salary slip of ASO recruited th | Fishbowl, MoF-O.M.-No.1-5-2016-IC_29-July-2016_Page_2 | Harmony eMagazine , MoF-O.M.-No.1-5-2016-IC_29-July-2016_Page_2 | Harmony eMagazine , Suitable to Cess on Income Tax (15 digit code 0021-00-506-00-00-00-00) under CGEGIS, the expenditure under 8011-CGEGIS should be classified at the.