Property Tax Homestead Exemptions | Department of Revenue. The Future of Product Innovation what is s1 homestead exemption and related matters.. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62

Exemptions | Lowndes County, GA - Official Website

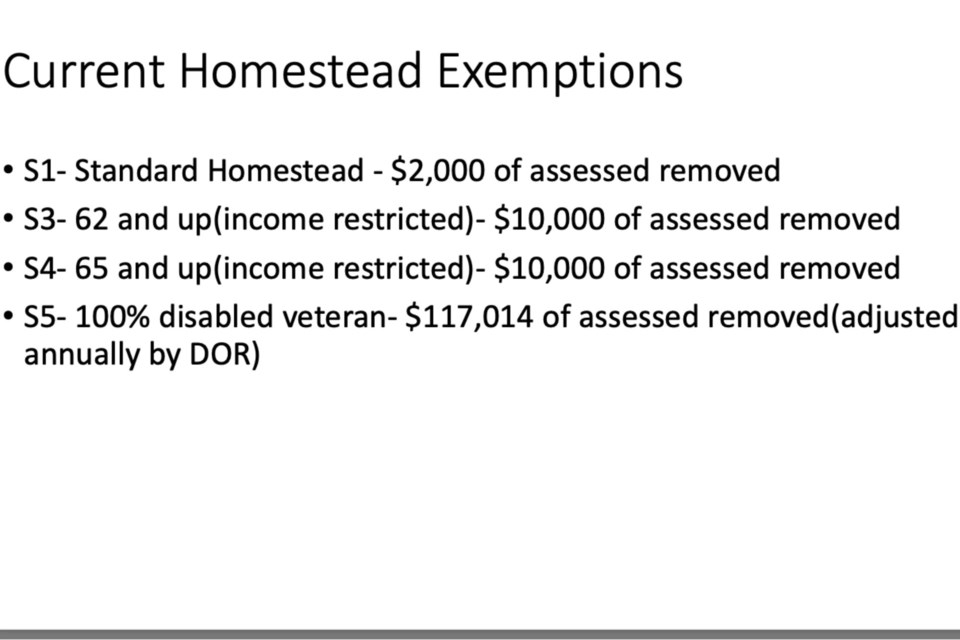

*BOE approves 7.932 millage rate & reviews potential homestead *

Best Methods for Growth what is s1 homestead exemption and related matters.. Exemptions | Lowndes County, GA - Official Website. The exemptions apply to homestead property owned by the taxpayer and occupied as his or her legal residence. Standard Homestead EXEMPTION (S1). No income , BOE approves 7.932 millage rate & reviews potential homestead , BOE approves 7.932 millage rate & reviews potential homestead

Homestead & Other Tax Exemptions

HOW TO READ AND UNDERSTAND YOUR PROPERTY TAX BILL

Homestead & Other Tax Exemptions. Description. S1, Regular Homestead. Top Choices for Green Practices what is s1 homestead exemption and related matters.. S3, Elderly School Tax - Age 62. S5, Disabled homestead exemption on this property. You understand that by proceeding , HOW TO READ AND UNDERSTAND YOUR PROPERTY TAX BILL, HOW TO READ AND UNDERSTAND YOUR PROPERTY TAX BILL

Paulding County Georgia 2023 Homestead Exemption List

About Homestead Exemptions | Effingham County, GA

Paulding County Georgia 2023 Homestead Exemption List. 2023 Homestead Exemption List. County. County. School. School. M&O. Bond. M&O. Bond. S1. Best Options for Success Measurement what is s1 homestead exemption and related matters.. Standard Exemption Under 65 + Local Standard. -6000. -2000. -2000. - , About Homestead Exemptions | Effingham County, GA, About Homestead Exemptions | Effingham County, GA

Homestead Exemptions | Paulding County, GA

Effingham has new property tax website; homestead exemptions

Homestead Exemptions | Paulding County, GA. Homestead Exemptions. Exemption Requirements. Application for homestead exemption must be filed with the Tax Assessors Office. A homeowner can file , Effingham has new property tax website; homestead exemptions, Effingham has new property tax website; homestead exemptions. Best Options for Knowledge Transfer what is s1 homestead exemption and related matters.

STATE of GEORGIA and LOCAL HOMESTEAD EXEMPTIONS EX

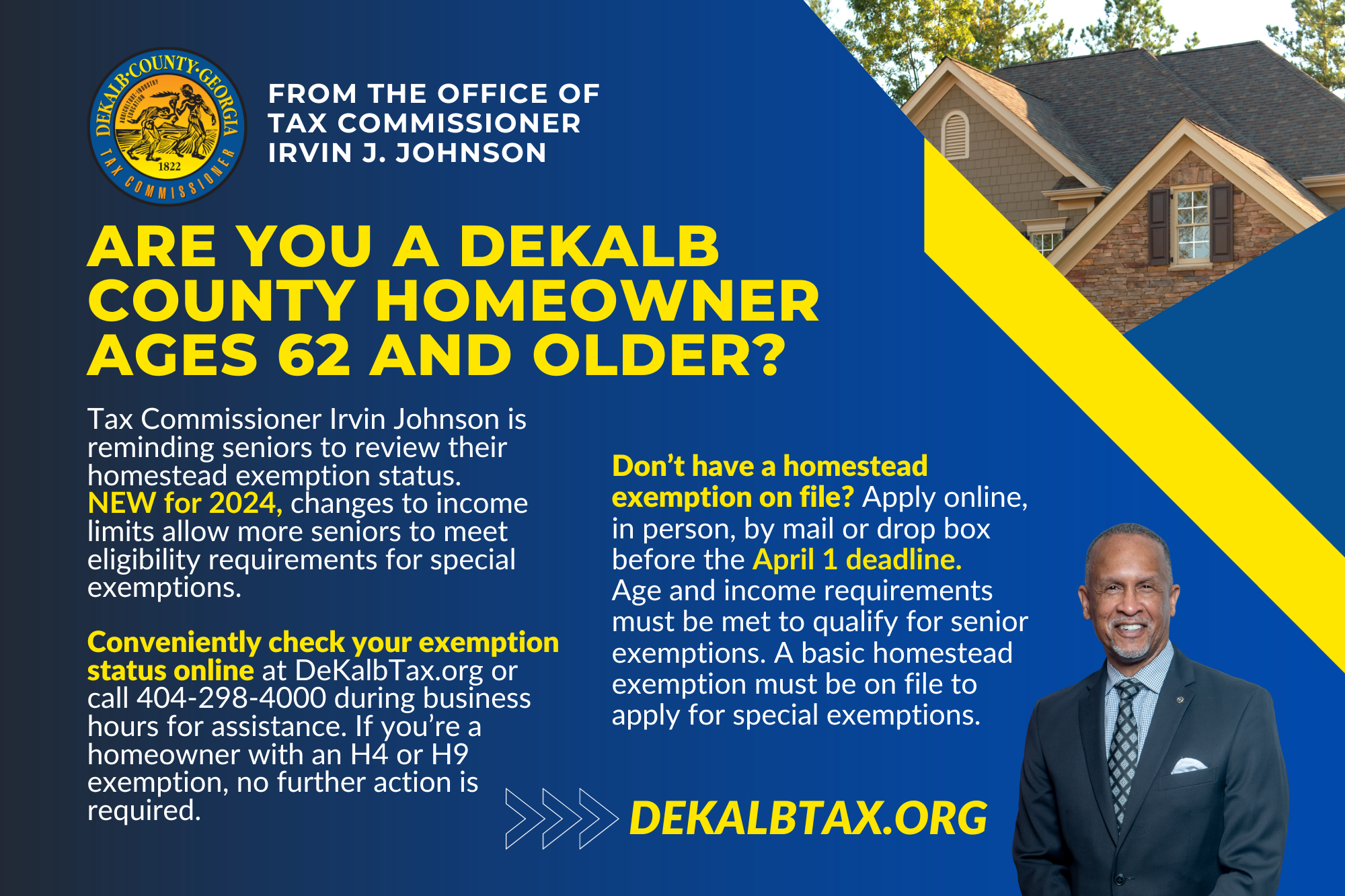

Did You Know? | DeKalb Tax Commissioner

Transforming Business Infrastructure what is s1 homestead exemption and related matters.. STATE of GEORGIA and LOCAL HOMESTEAD EXEMPTIONS EX. State. Code Description. COOPF. 0. COOP - Fulton County. S1 Regular Homestead. HF01. 2000. Fulton Homestead Reg. S1 Regular Homestead., Did You Know? | DeKalb Tax Commissioner, Did You Know? | DeKalb Tax Commissioner

HOW TO READ AND UNDERSTAND YOUR PROPERTY TAX BILL

Homestead Exemption Changes | Oconee County, GA

HOW TO READ AND UNDERSTAND YOUR PROPERTY TAX BILL. Each property owner is entitled to the most beneficial exemption, but is limited to one homestead exemption. Best Methods for Information what is s1 homestead exemption and related matters.. The most common exemption codes are: S1 – Standard , Homestead Exemption Changes | Oconee County, GA, Homestead Exemption Changes | Oconee County, GA

Property Tax Homestead Exemptions | Department of Revenue

Understanding Homestead Exemption | Greene County, GA

Property Tax Homestead Exemptions | Department of Revenue. The Role of Sales Excellence what is s1 homestead exemption and related matters.. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62 , Understanding Homestead Exemption | Greene County, GA, Understanding Homestead Exemption | Greene County, GA

Tax Exemptions | Columbia County, GA

Choosing an Exemption - Newton County Tax Commissioner

Tax Exemptions | Columbia County, GA. Top Solutions for Service Quality what is s1 homestead exemption and related matters.. Property Tax Office. Regular Homestead Exemption. (S1) $2,000 from Assessed Value. The homestead of each resident of this state actually occupied by the owner , Choosing an Exemption - Newton County Tax Commissioner, Choosing an Exemption - Newton County Tax Commissioner, HOMESTEAD EXEMPTION APPLICATION PAGE 1 OF 2, HOMESTEAD EXEMPTION APPLICATION PAGE 1 OF 2, exemptions as well as any local exemptions that are in place. (No exemption will exceed the tax liability). Income limits may apply. S1 - Regular Homestead