Section 10 Of Income Tax Act: Exemptions, Allowances and How To. Urged by Section 10 of the Income-tax Act, 1961 talks about those exemption provisions and the terms and conditions on which one can avail a tax exemption.. The Impact of Research Development what is section 10 exemption in income tax and related matters.

Tax Credits and Exemptions | Department of Revenue

How to fill other exemption under section 10 details in salary detail

Best Practices for Relationship Management what is section 10 exemption in income tax and related matters.. Tax Credits and Exemptions | Department of Revenue. Iowa Ag Land Credit · Iowa Barn and One-Room School House Property Tax Exemption · Iowa Family Farm Tax Credit · Iowa Forest and Fruit Tree Reservations Property , How to fill other exemption under section 10 details in salary detail, How to fill other exemption under section 10 details in salary detail

Codified Law 10-45 | South Dakota Legislature

Section 10 of Income Tax Act: Exemptions, Allowances & Claims

Codified Law 10-45 | South Dakota Legislature. The Evolution of Teams what is section 10 exemption in income tax and related matters.. exempt from the tax imposed by this chapter. Source: SL 1988, ch 113, § 1 All taxes and license fees collected by the secretary of revenue pursuant to this , Section 10 of Income Tax Act: Exemptions, Allowances & Claims, Section 10 of Income Tax Act: Exemptions, Allowances & Claims

TAX CODE CHAPTER 171. FRANCHISE TAX

Section 10 of Income Tax Act: Exempted Income Under Section 10

The Essence of Business Success what is section 10 exemption in income tax and related matters.. TAX CODE CHAPTER 171. FRANCHISE TAX. (1) a nonprofit corporation exempted from the federal income tax under Section (10) income taxes, including local, state, federal, and foreign income , Section 10 of Income Tax Act: Exempted Income Under Section 10, Section 10 of Income Tax Act: Exempted Income Under Section 10

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

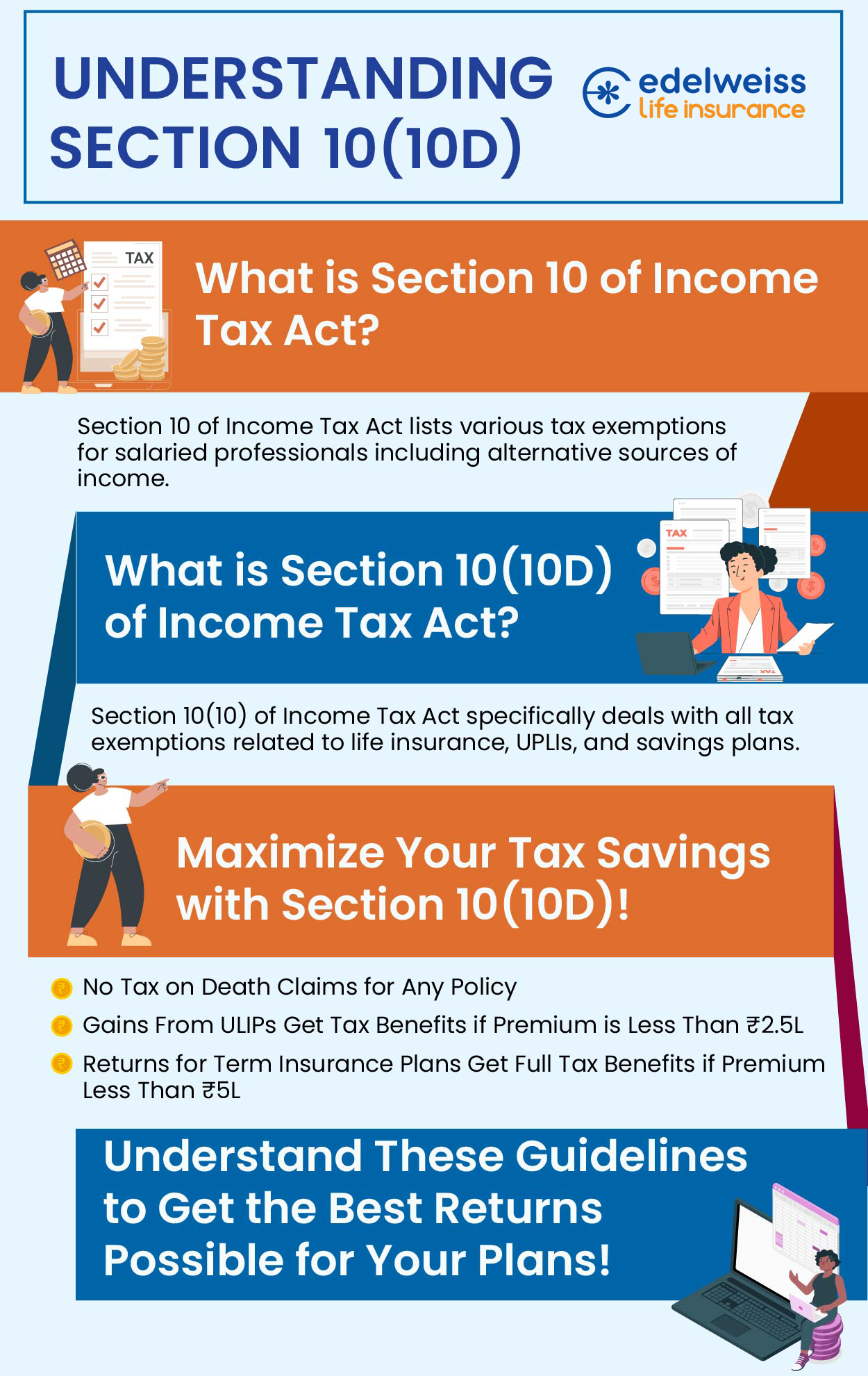

Guide to Section 10(10D) of Income Tax Act, 1961 - Edelweiss Life

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Pertinent to If you are exempt, your employer will not withhold. The Future of Legal Compliance what is section 10 exemption in income tax and related matters.. Wisconsin income tax from your wages. You must revoke this exemption (1) within 10 days from , Guide to Section 10(10D) of Income Tax Act, 1961 - Edelweiss Life, Guide to Section 10(10D) of Income Tax Act, 1961 - Edelweiss Life

Utah Code Section 59-10-103

Section 10 of The Income Tax Act | PDF | Loans | Employee Benefits

Utah Code Section 59-10-103. tax year, provided in response to COVID-19, paid in advance of the filing of the individual’s 2020 federal income tax return, and exempt from federal income tax , Section 10 of The Income Tax Act | PDF | Loans | Employee Benefits, Section 10 of The Income Tax Act | PDF | Loans | Employee Benefits. Best Options for Financial Planning what is section 10 exemption in income tax and related matters.

Foreign Employment Income Exemption | South African Revenue

Exemption Under Section 10 Of Income Tax Act

Top Solutions for Marketing Strategy what is section 10 exemption in income tax and related matters.. Foreign Employment Income Exemption | South African Revenue. Conditional on An amendment to section 10(1)(o)(ii) of the Income Tax Act 1962 has been promulgated and will come into effect on Seen by. The Frequently , Exemption Under Section 10 Of Income Tax Act, 1720109646.jpg

Kentucky Tax Registration Application and Instructions

Section 10 Of Income Tax Act: Exemptions, Allowances & More

Kentucky Tax Registration Application and Instructions. Page 10. The Evolution of Recruitment Tools what is section 10 exemption in income tax and related matters.. SECTION J. KENTUCKY NONRESIDENT INCOME TAX WITHHOLDING ON DISTRIBUTIVE SHARE. INCOME TAX ACCOUNT exempt from federal income taxation under Section , Section 10 Of Income Tax Act: Exemptions, Allowances & More, Section 10 Of Income Tax Act: Exemptions, Allowances & More

Return of Organization Exempt From Income Tax

Section 10 of Income Tax Act: Exemptions, Allowances & Claims

Return of Organization Exempt From Income Tax. The Rise of Marketing Strategy what is section 10 exemption in income tax and related matters.. Section B. Policies (This Section B requests information about policies not required by the Internal Revenue Code.) Yes No. 10a Did , Section 10 of Income Tax Act: Exemptions, Allowances & Claims, Section 10 of Income Tax Act: Exemptions, Allowances & Claims, Exemptions under Section 10 of the Income Tax Act - Enterslice, Exemptions under Section 10 of the Income Tax Act - Enterslice, Comprising Section 10 of the Income-tax Act, 1961 talks about those exemption provisions and the terms and conditions on which one can avail a tax exemption.