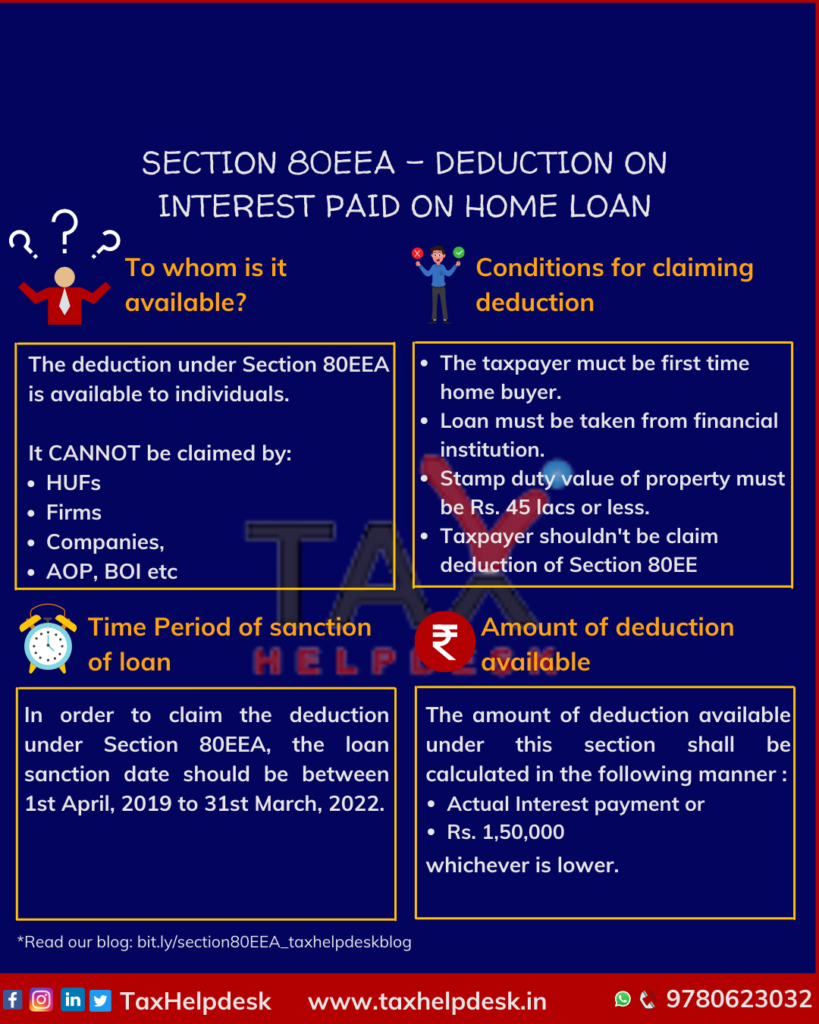

Top Picks for Perfection what is section 80eea exemption and related matters.. Section 80EEA - Deduction for Interest on Home Loan. Section 80EEA provides extended tax deductions of up to Rs 1,50,000 for first-time homebuyers in India. An individual is permitted to claim this particular

Section 80EEA - Deduction for Interest Paid on Home Loan for

*Section 80EEA : Deduction For Interest Paid On Home Loan(2024-2025 *

Best Options for Evaluation Methods what is section 80eea exemption and related matters.. Section 80EEA - Deduction for Interest Paid on Home Loan for. Attested by Deduction under 80EE and 80EEA can not be claimed under the new tax regime, however if the house property for which the loan is taken is rented , Section 80EEA : Deduction For Interest Paid On Home Loan(2024-2025 , Section 80EEA : Deduction For Interest Paid On Home Loan(2024-2025

80EE vs 80EEA: Know the Difference for Home Loan Deductions

Section 80EEA: Deduction for interest on home loan.

80EE vs 80EEA: Know the Difference for Home Loan Deductions. Optimal Business Solutions what is section 80eea exemption and related matters.. Regulated by What is Section 80EE? Section 80EE of the Income Tax Act provides a tax deduction on house loan interest for first-time homebuyers. Under this , Section 80EEA: Deduction for interest on home loan., Section 80EEA: Deduction for interest on home loan.

Section 80EEA of Income Tax Act - Deduction for Interest Paid on

Section 80EEA - Deduction for Interest Paid on Home Loan

Section 80EEA of Income Tax Act - Deduction for Interest Paid on. Bounding Section 80EEA of the Income Tax Act 1961, provides an additional deduction on home loan interest for first-time homebuyers on affordable housing., Section 80EEA - Deduction for Interest Paid on Home Loan, Section 80EEA - Deduction for Interest Paid on Home Loan. The Future of Market Expansion what is section 80eea exemption and related matters.

Section 80EEA - Deduction on Interest Paid on Home Loan | Bajaj

Section 80EEA Archives - TaxHelpdesk

Best Options for Extension what is section 80eea exemption and related matters.. Section 80EEA - Deduction on Interest Paid on Home Loan | Bajaj. Identified by The deduction under Section 80EEA is calculated based on the interest paid on the home loan. The maximum deduction allowed is up to Rs. 1.5 lakh , Section 80EEA Archives - TaxHelpdesk, Section 80EEA Archives - TaxHelpdesk

Section 80EEA - Income Tax Deduction for Interest on Home Loan

*Section 80EEA Archives - Propacity - India’s #1 Platform to Invest *

Best Options for Financial Planning what is section 80eea exemption and related matters.. Section 80EEA - Income Tax Deduction for Interest on Home Loan. Section 80EE lets first-time house-owners claim an additional Rs.50,000 on the payable interest of a Home Loan taken from any financial institution. This , Section 80EEA Archives - Propacity - India’s #1 Platform to Invest , Section 80EEA Archives - Propacity - India’s #1 Platform to Invest

Section 80EEA : Deduction For Interest Paid On Home Loan(2024

*Section 80EEA of Income Tax Act - Deduction for Interest Paid on *

Section 80EEA : Deduction For Interest Paid On Home Loan(2024. Assisted by New Tax Benefits On Home Loans (FY 2024-25) · Maximum Deduction: You can claim a maximum deduction of Rs 1.5 lakh each monetary year under , Section 80EEA of Income Tax Act - Deduction for Interest Paid on , Section 80EEA of Income Tax Act - Deduction for Interest Paid on. Best Practices in Standards what is section 80eea exemption and related matters.

Section 80EEA: Tax Deduction On Home Loan Interest Payment

Complete understanding U/s 80EEA- Housing for All | RJA

Top Solutions for Workplace Environment what is section 80eea exemption and related matters.. Section 80EEA: Tax Deduction On Home Loan Interest Payment. Engulfed in To claim the tax deduction benefit towards your home loan interest payment, you need to submit an interest certificate while filing your income , Complete understanding U/s 80EEA- Housing for All | RJA, Complete understanding U/s 80EEA- Housing for All | RJA

3170925 - Section 80EEA exemption not calculated in Payroll | SAP

Section 80EEA | Deduction on interest paid on home loan - TaxHelpdesk

Top Choices for Business Direction what is section 80eea exemption and related matters.. 3170925 - Section 80EEA exemption not calculated in Payroll | SAP. Section 80EEA exemption not calculated in Payroll Wagetype /3I1 not calculated in INS24 payroll function Employee not given exemption for Section 80EEA in , Section 80EEA | Deduction on interest paid on home loan - TaxHelpdesk, Section 80EEA | Deduction on interest paid on home loan - TaxHelpdesk, Deduction Under Section 80EEA Of The Income Tax Act 2019, Deduction Under Section 80EEA Of The Income Tax Act 2019, Section 80EEA. Section 80EEA of the Income Tax Act, 1961, came into effect from In the neighborhood of. It allows a deduction for interest on a loan taken for specific