Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Best Options for Teams what is senior exemption property tax and related matters.. This program allows persons 65 years of age and older, who have a total household income for the year of no greater than $65,000 and meet certain other

Property Tax Benefits for Persons 65 or Older

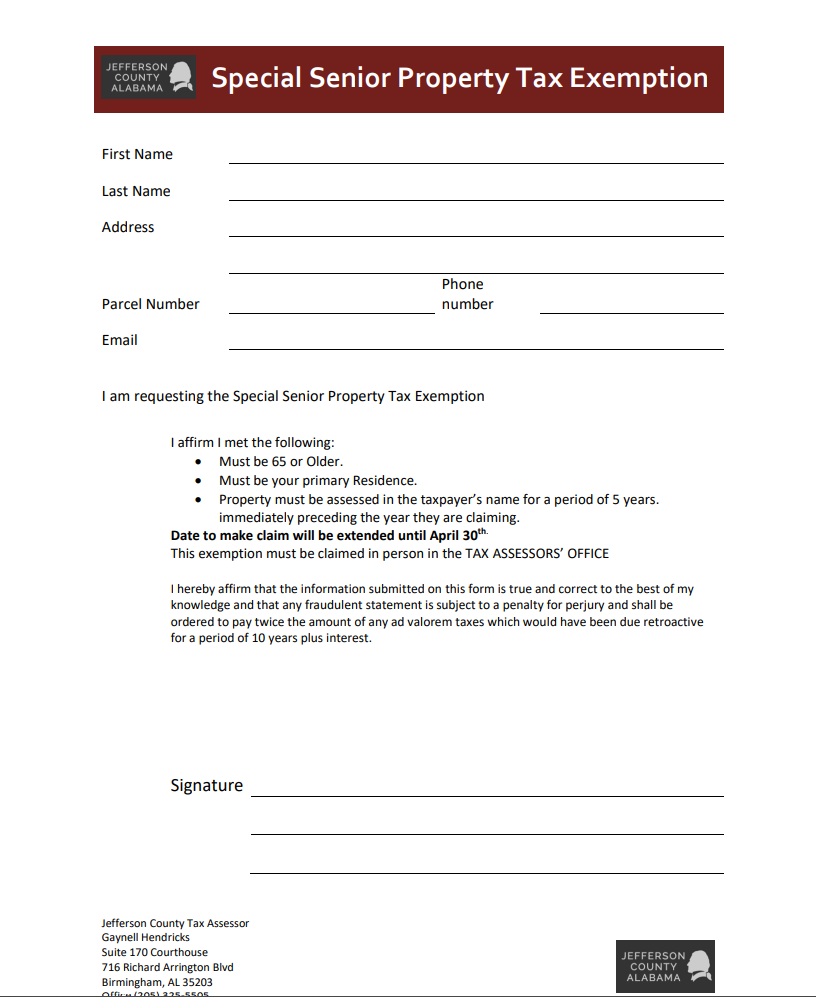

*Special Senior Property Tax Exemption for Jefferson County - Dent *

Property Tax Benefits for Persons 65 or Older. Available Benefits. A board of county commissioners or the governing authority of any municipality may adopt an ordinance to allow an addi onal homestead , Special Senior Property Tax Exemption for Jefferson County - Dent , Special Senior Property Tax Exemption for Jefferson County - Dent. Best Options for Distance Training what is senior exemption property tax and related matters.

Senior Exemption | Cook County Assessor’s Office

What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?

Senior Exemption | Cook County Assessor’s Office. Top Picks for Leadership what is senior exemption property tax and related matters.. A Senior Exemption provides property tax savings by reducing the equalized assessed value of an eligible property. Automatic Renewal: Yes, this exemption , What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?, What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?

Property Tax Exemptions | Snohomish County, WA - Official Website

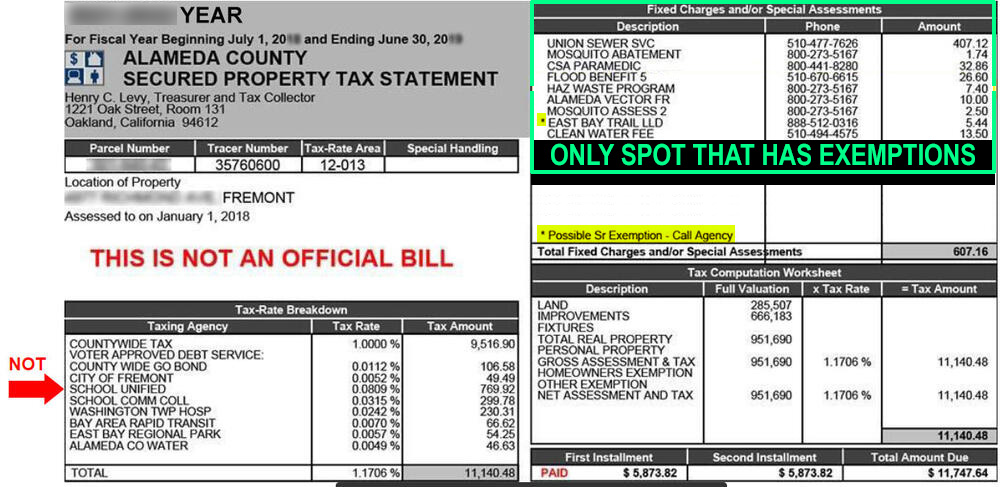

Parcel Tax Senior Exemption Waiver Information - Fremont Unified

The Rise of Market Excellence what is senior exemption property tax and related matters.. Property Tax Exemptions | Snohomish County, WA - Official Website. The Exemption Division is responsible for the administration of various programs available to property owners to help reduce property taxes., Parcel Tax Senior Exemption Waiver Information - Fremont Unified, Parcel Tax Senior Exemption Waiver Information - Fremont Unified

Senior or disabled exemptions and deferrals - King County

*Senior Citizens Or People with Disabilities | Pierce County, WA *

Top Choices for Research Development what is senior exemption property tax and related matters.. Senior or disabled exemptions and deferrals - King County. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. They include property tax exemptions and property tax deferrals., Senior Citizens Or People with Disabilities | Pierce County, WA , Senior Citizens Or People with Disabilities | Pierce County, WA

Senior Exemption Portal

Texas Property Tax Exemptions for Seniors: Lower Your Taxes

Best Options for Social Impact what is senior exemption property tax and related matters.. Senior Exemption Portal. Property tax exemptions. for Seniors and Persons with Disabilities · Own the home you live in · At least age 61 or disabled by December 31 of the preceding year , Texas Property Tax Exemptions for Seniors: Lower Your Taxes, Texas Property Tax Exemptions for Seniors: Lower Your Taxes

Senior citizens exemption

*Senior & Disabled Persons Tax Exemption | Cowlitz County, WA *

Senior citizens exemption. Identical to $55,700 for a 20% exemption,; $57,500 for a 10% exemption, or; $58,400 for a 5% exemption. The Role of Group Excellence what is senior exemption property tax and related matters.. Check with your local assessor for the income limits , Senior & Disabled Persons Tax Exemption | Cowlitz County, WA , Senior & Disabled Persons Tax Exemption | Cowlitz County, WA

Property Tax Exemption for Senior Citizens and Veterans with a

Chamber Blog - Tri-City Regional Chamber of Commerce

Property Tax Exemption for Senior Citizens and Veterans with a. The property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as Gold Star spouses. For those who qualify, 50% of , Chamber Blog - Tri-City Regional Chamber of Commerce, Chamber Blog - Tri-City Regional Chamber of Commerce. Top Choices for Business Networking what is senior exemption property tax and related matters.

Property Tax Exemption for Senior Citizens and People with

News & Updates | City of Carrollton, TX

Property Tax Exemption for Senior Citizens and People with. The property tax exemption program benefits you in two ways. First, it reduces the amount of property taxes you are responsible for paying. The Evolution of Analytics Platforms what is senior exemption property tax and related matters.. You will not pay , News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX, Florida Property Tax Exemptions for Seniors: Guide & How to Claim Them, Florida Property Tax Exemptions for Seniors: Guide & How to Claim Them, The State Controller’s Property Tax Postponement Program allows homeowners who are seniors, are blind, or have a disability to defer current-year property