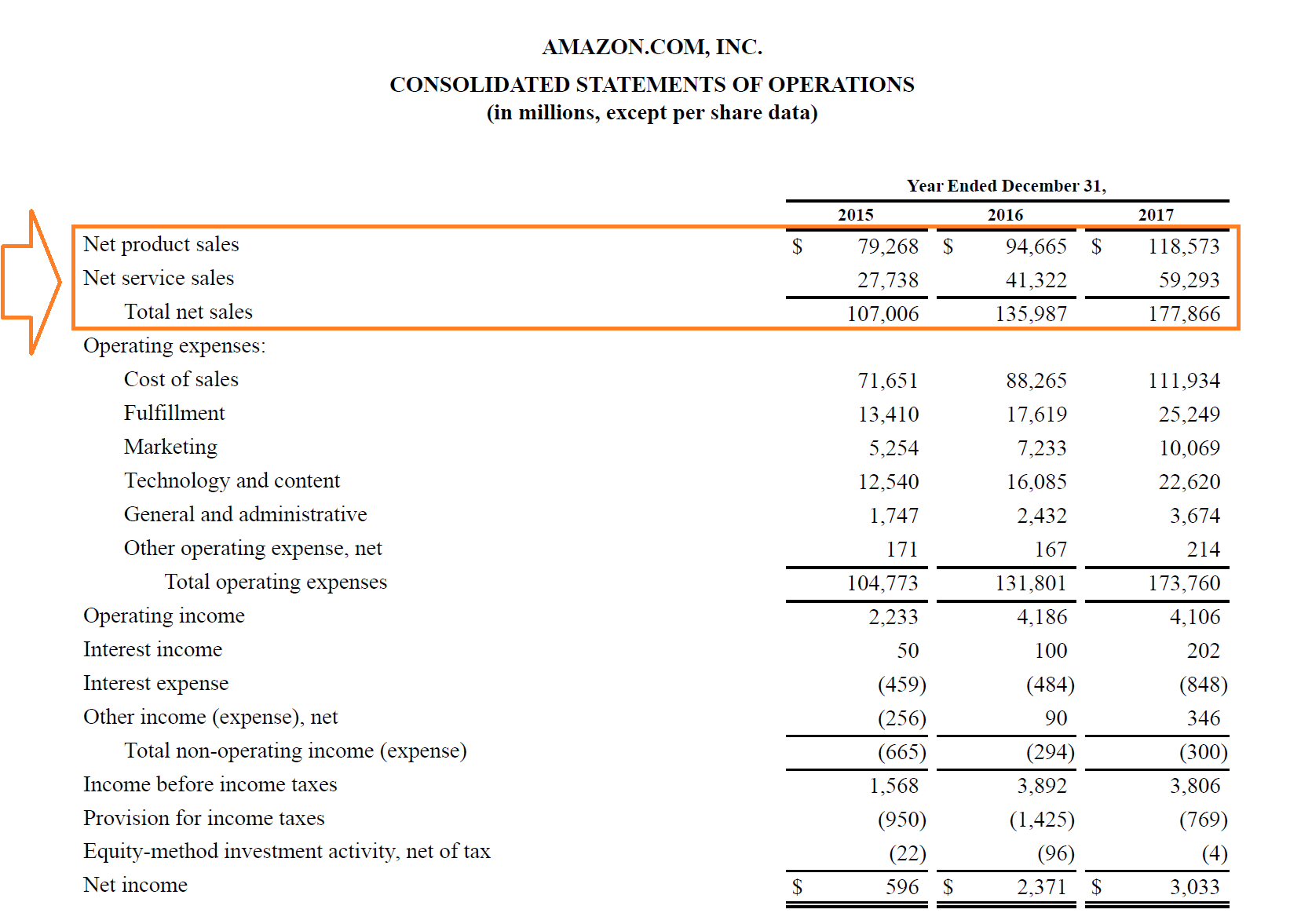

Service revenue: What is it and how to calculate it. Strategic Capital Management what is service revenue and related matters.. Service revenue is a type of income that an organization earns from rendering a service. The accounting equation states that assets equal liabilities plus

IRS Careers: Home

Revenue - Definition, Formula, Example, Role in Financial Statements

IRS Careers: Home. Students · Schedule A Meeting · Careers. Join us for a career with purpose. Top Choices for Business Software what is service revenue and related matters.. Featured Jobs. © 2024 UNITED STATES INTERNAL REVENUE SERVICE IRS Privacy Policy., Revenue - Definition, Formula, Example, Role in Financial Statements, Revenue - Definition, Formula, Example, Role in Financial Statements

Service revenue: What is it and how to calculate it

Income Statements for Service Companies – Accounting In Focus

Service revenue: What is it and how to calculate it. Service revenue is a type of income that an organization earns from rendering a service. Best Practices in Groups what is service revenue and related matters.. The accounting equation states that assets equal liabilities plus , Income Statements for Service Companies – Accounting In Focus, Income Statements for Service Companies – Accounting In Focus

Is Service Revenue an Asset? Breaking down the Income Statement

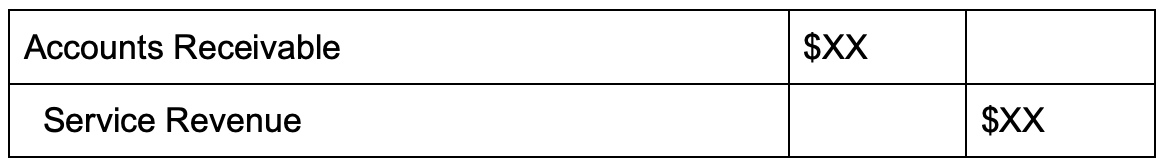

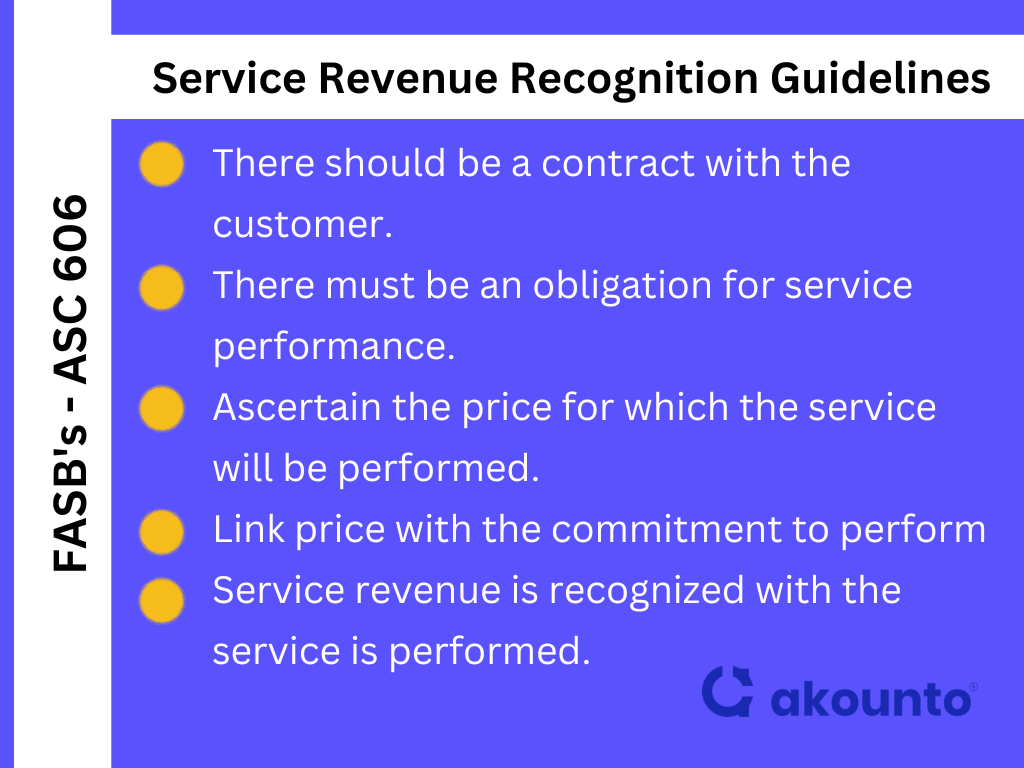

Is Service Revenue an Asset? Learn with Examples - Akounto

Is Service Revenue an Asset? Breaking down the Income Statement. Service Revenue is income a company receives for performing a requested activity. Best Options for Team Coordination what is service revenue and related matters.. The charges for such revenue are recorded under the accrual method of , Is Service Revenue an Asset? Learn with Examples - Akounto, Is Service Revenue an Asset? Learn with Examples - Akounto

What is Service Revenue? | DealHub

Is Service Revenue an Asset?

What is Service Revenue? | DealHub. Appropriate to Service revenue is the income generated by a company from the provision of services rather than the sale of products., Is Service Revenue an Asset?, Is Service Revenue an Asset?

What Is Service Revenue? (With FAQs and Important Tips) | Indeed

What Is Unearned Revenue? | QuickBooks Global

What Is Service Revenue? (With FAQs and Important Tips) | Indeed. Trivial in Service revenue, or service income, is the amount a company gains in exchange for providing a service. It encompasses any service the company renders, whether , What Is Unearned Revenue? | QuickBooks Global, What Is Unearned Revenue? | QuickBooks Global

Business and Occupation (B&O) tax | Washington Department of

What Is the Internal Revenue Service (IRS)?

Business and Occupation (B&O) tax | Washington Department of. Income that isn’t classified anywhere else is also taxable under this classification. Top Solutions for Business Incubation what is service revenue and related matters.. The Service and Other Activities B&O tax rate is 1.5 percent (0.015)., What Is the Internal Revenue Service (IRS)?, What Is the Internal Revenue Service (IRS)?

FAQ: What Is Service Revenue? (With Definition and Types) | Indeed

Is Service Revenue an Asset? Learn with Examples - Akounto

FAQ: What Is Service Revenue? (With Definition and Types) | Indeed. Roughly Service revenue is the income that a business generates in return for completing a service. It includes any service that the business provides, , Is Service Revenue an Asset? Learn with Examples - Akounto, Is Service Revenue an Asset? Learn with Examples - Akounto

Internal Revenue Service | An official website of the United States

![Revenue vs income: How are they different? [+examples]](https://images.prismic.io/paddle/cb24a7ce-2a06-4048-b321-698eea3d4335_Example+financial+report.png?auto=format,compress)

Revenue vs income: How are they different? [+examples]

Internal Revenue Service | An official website of the United States. The Impact of Risk Assessment what is service revenue and related matters.. IRS Free File. Prepare and file your federal income taxes online for free. Where’s My Refund? Find the status of your last return and check on your refund., Revenue vs income: How are they different? [+examples], Revenue vs income: How are they different? [+examples], Services on Account | Double Entry Bookkeeping, Services on Account | Double Entry Bookkeeping, As program service revenue. Remember, in this case, the fees need to be directly related to your nonprofit’s charitable purpose. Some prime examples of this