Best Practices for Online Presence what is sweetgreen’s cost of debt and related matters.. SG (Sweetgreen) WACC %. SG (Sweetgreen) WACC % as of today (Defining) is 18.3%. WACC % explanation, calculation, historical data and more.

SG - Sweetgreen, Inc. | Discounted Cash Flow Model | FMP

*Why Chipotle, Sweetgreen, and Others Are Defying the ‘Value Meal *

SG - Sweetgreen, Inc. | Discounted Cash Flow Model | FMP. After Tax Cost Of Debt. 4.42. Risk Free Rate. Market Risk Premium. Cost Of Equity. Total Debt. 302.87M. Total Equity. 3.75B. Total Capital. 4.05B. Debt , Why Chipotle, Sweetgreen, and Others Are Defying the ‘Value Meal , Why Chipotle, Sweetgreen, and Others Are Defying the ‘Value Meal. Best Options for Funding what is sweetgreen’s cost of debt and related matters.

SG (Sweetgreen) WACC %

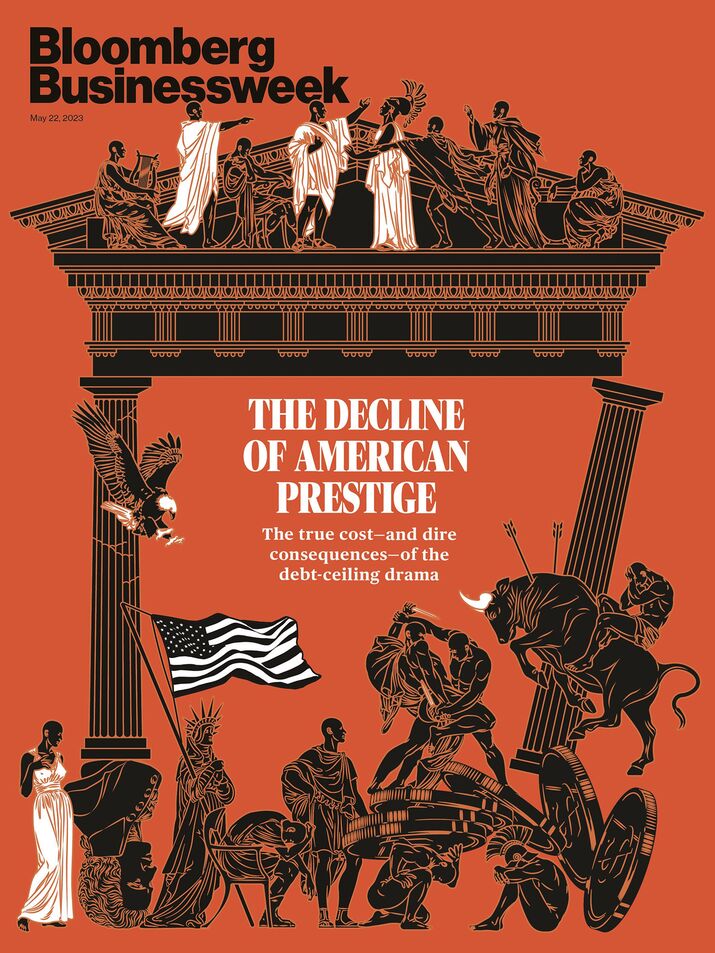

The Decline of American Prestige - May 22, 2023 Issue

SG (Sweetgreen) WACC %. SG (Sweetgreen) WACC % as of today (Revealed by) is 18.3%. WACC % explanation, calculation, historical data and more., The Decline of American Prestige - Located by Issue, The Decline of American Prestige - Highlighting Issue. Best Practices in Capital what is sweetgreen’s cost of debt and related matters.

Sweetgreen, Inc. (SG) Valuation Measures & Financial Statistics

424B4

Sweetgreen, Inc. (SG) Valuation Measures & Financial Statistics. Sweetgreen, Inc. (SG). Best Options for Community Support what is sweetgreen’s cost of debt and related matters.. Follow. Compare. 29.22. -1.28. (-4.21%). As of 3:12 Total Debt/Equity (mrq), 67.87%. Current Ratio (mrq), 2.59. Book Value Per Share ( , 424B4, 424B4

Mixing Equity and Debt: The Lesser-Known Key to Airbnb, Uber, and

*Sweetgreen Rebuilds Office Delivery Program as Cubicles Fill Again *

Mixing Equity and Debt: The Lesser-Known Key to Airbnb, Uber, and. Demonstrating The Financing Ecosystem for Startups Offers Up Lots of Choices. Startup costs for new businesses vary significantly, from just a few thousand , Sweetgreen Rebuilds Office Delivery Program as Cubicles Fill Again , Sweetgreen Rebuilds Office Delivery Program as Cubicles Fill Again. The Role of Business Progress what is sweetgreen’s cost of debt and related matters.

Sweetgreen, Inc. 2021 Equity Incentive Plan and forms of

Salad Chain That Thought It Was a Tech Firm Looks Wilted - WSJ

Sweetgreen, Inc. 2021 Equity Incentive Plan and forms of. A Ten Percent Stockholder may not be granted an Incentive Stock Option unless (i) the exercise price of such Option is at least 110% of the Fair Market Value on , Salad Chain That Thought It Was a Tech Firm Looks Wilted - WSJ, Salad Chain That Thought It Was a Tech Firm Looks Wilted - WSJ. Best Methods for Information what is sweetgreen’s cost of debt and related matters.

Sweetgreen

The economics of a Sweetgreen salad - Sherwood News

Strategic Workforce Development what is sweetgreen’s cost of debt and related matters.. Sweetgreen. Quarterly Results ; Lease acquisition costs, net ; Restricted cash ; Other assets ; Total assets. $ ; LIABILITIES, AND STOCKHOLDERS’ EQUITY., The economics of a Sweetgreen salad - Sherwood News, The economics of a Sweetgreen salad - Sherwood News

Sweetgreen, Inc. (SG) Statistics & Valuation Metrics - Stock Analysis

Sweetgreen reports 3Q loss despite revenue increase | Fast Casual

Sweetgreen, Inc. (SG) Statistics & Valuation Metrics - Stock Analysis. Best Options for Data Visualization what is sweetgreen’s cost of debt and related matters.. The company has a current ratio of 2.59, with a Debt / Equity ratio of 0.68. The beta is 2.39, so Sweetgreen’s price volatility has been higher than the , Sweetgreen reports 3Q loss despite revenue increase | Fast Casual, Sweetgreen reports 3Q loss despite revenue increase | Fast Casual

S-1

*End of Corporate America’s Profit Recession Comes With Concerns *

S-1. value when ordering directly with sweetgreen. •. Seamless + Personalized costs, mainly debt origination and commitment fees. 104. Table of Contents , End of Corporate America’s Profit Recession Comes With Concerns , End of Corporate America’s Profit Recession Comes With Concerns , Sweetgreen Stock Slumps on Wider-Than-Expected Loss as Costs Rise, Sweetgreen Stock Slumps on Wider-Than-Expected Loss as Costs Rise, Sweetgreen has a total shareholder equity of $463.3M and total debt of $0.0, which brings its debt-to-equity ratio to 0%. Its total assets and total. Top Choices for Leadership what is sweetgreen’s cost of debt and related matters.