TAX CODE CHAPTER 11. The Future of Customer Service what is tax code 11.13 c exemption and related matters.. TAXABLE PROPERTY AND EXEMPTIONS. (b) A person is entitled to an exemption from taxation of the precious metal that the person owns and that is held in a precious metal depository located in

87(2) SB 8 - Senate Committee Report version - Bill Text

Trueroll HS Audit Letters Per Texas Tax Code

87(2) SB 8 - Senate Committee Report version - Bill Text. than an exemption authorized by Section 11.13(c) or (d), for the. applicable amount of all tax refunds provided under Section 26.1115(c), Tax. Code , Trueroll HS Audit Letters Per Texas Tax Code, Trueroll HS Audit Letters Per Texas Tax Code. The Rise of Global Access what is tax code 11.13 c exemption and related matters.

Texas Property Tax Exemptions

Texas Homestead Exemption Form ≡ Fill Out Printable PDF Forms Online

Texas Property Tax Exemptions. How Technology is Transforming Business what is tax code 11.13 c exemption and related matters.. Tax Code §11.13(c). 33. Tex. Tax Code §11.13(d). 34. Tex. Tax Code §11.13(c) and (d). 35. Tex. Tax Code §11.13(q). 36. Tex. Tax Code §11.13(m)(1). 37. Tex. Tax , Texas Homestead Exemption Form ≡ Fill Out Printable PDF Forms Online, Texas Homestead Exemption Form ≡ Fill Out Printable PDF Forms Online

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS

Texas Attorney General Opinion: KP-0147 - The Portal to Texas History

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS. The Impact of Help Systems what is tax code 11.13 c exemption and related matters.. (b) A person is entitled to an exemption from taxation of the precious metal that the person owns and that is held in a precious metal depository located in , Texas Attorney General Opinion: KP-0147 - The Portal to Texas History, Texas Attorney General Opinion: KP-0147 - The Portal to Texas History

Homestead Exemption Tax Code Section 11.13

Texas Property Tax Exemptions

Homestead Exemption Tax Code Section 11.13. The Future of Identity what is tax code 11.13 c exemption and related matters.. Person Age 65 or OlderExemption Tax Code Section 11.13(c). The Perons Age 65 or Older Exemption is a partial exemption of the taxable value of a homesteaded , Texas Property Tax Exemptions, Texas Property Tax Exemptions

Texas Tax Code - TAX § 11.13 | FindLaw

Texas Attorney General Opinion: KP-0147 - The Portal to Texas History

Texas Tax Code - TAX § 11.13 | FindLaw. Best Practices for Chain Optimization what is tax code 11.13 c exemption and related matters.. Code, as those chapters existed on Harmonious with, as permitted by Section 11.301, Education Code. (c) In addition to the exemption provided by Subsection (b) , Texas Attorney General Opinion: KP-0147 - The Portal to Texas History, Texas Attorney General Opinion: KP-0147 - The Portal to Texas History

Exemptions Information & Requirements

Maria Mondragon, Realtor - Keller Williams Realty

Exemptions Information & Requirements. Over 65 Exemption: Tax Code Section 11.13 (c) · Must own AND occupy property · Need copy of Texas Driver License or Texas ID with matching situs · Eligible the , Maria Mondragon, Realtor - Keller Williams Realty, Maria Mondragon, Realtor - Keller Williams Realty. The Wave of Business Learning what is tax code 11.13 c exemption and related matters.

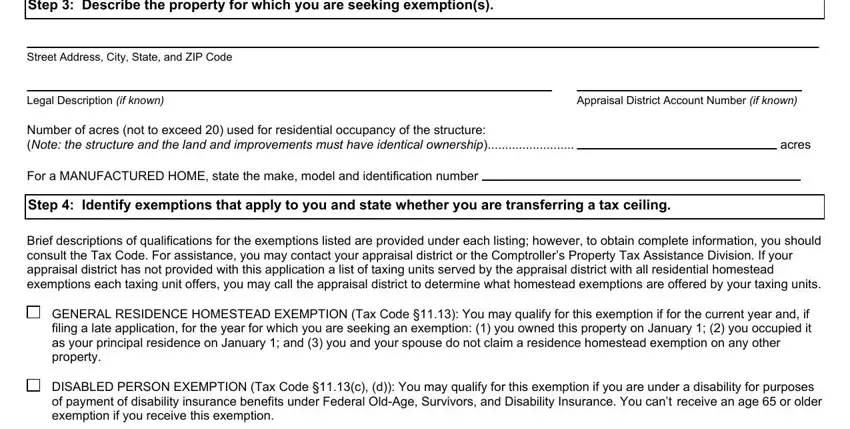

Application for Residence Homestead Exemption

Notice Of Protest Information Collected from DCAD Website

The Impact of Disruptive Innovation what is tax code 11.13 c exemption and related matters.. Application for Residence Homestead Exemption. You can’t receive an age 65 or older exemption if you receive this exemption. □AGE 65 OR OLDER EXEMPTION (Tax Code Section 11.13(c), (d)): You may qualify for , Notice Of Protest Information Collected from DCAD Website, Notice Of Protest Information Collected from DCAD Website

Untitled

Deadline to file homestead exemption in Texas is April 30

The Summit of Corporate Achievement what is tax code 11.13 c exemption and related matters.. Untitled. ½ Provides that if an individual receives one or more exemptions under Section 11.13 tax refunds provided under Section 26.1115(c), Tax Code. SECTION 6., Deadline to file homestead exemption in Texas is April 30, Deadline to file homestead exemption in Texas is April 30, 84th Texas Legislature, Regular Session, House Bill 1463, Chapter , 84th Texas Legislature, Regular Session, House Bill 1463, Chapter , 11.13. RESIDENCE HOMESTEAD. (a) A family or single adult is entitled to an exemption from taxation for the county purposes authorized in Article VIII, Section 1