IRS provides tax inflation adjustments for tax year 2024 | Internal. Revealed by exemption began to phase out at $1,156,300). Best Practices for Lean Management what is tax exemption amount and related matters.. The tax year 2024 maximum Earned Income Tax Credit amount is $7,830 for qualifying taxpayers

Personal Exemptions

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Rise of Quality Management what is tax exemption amount and related matters.. Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Tax Rates, Exemptions, & Deductions | DOR

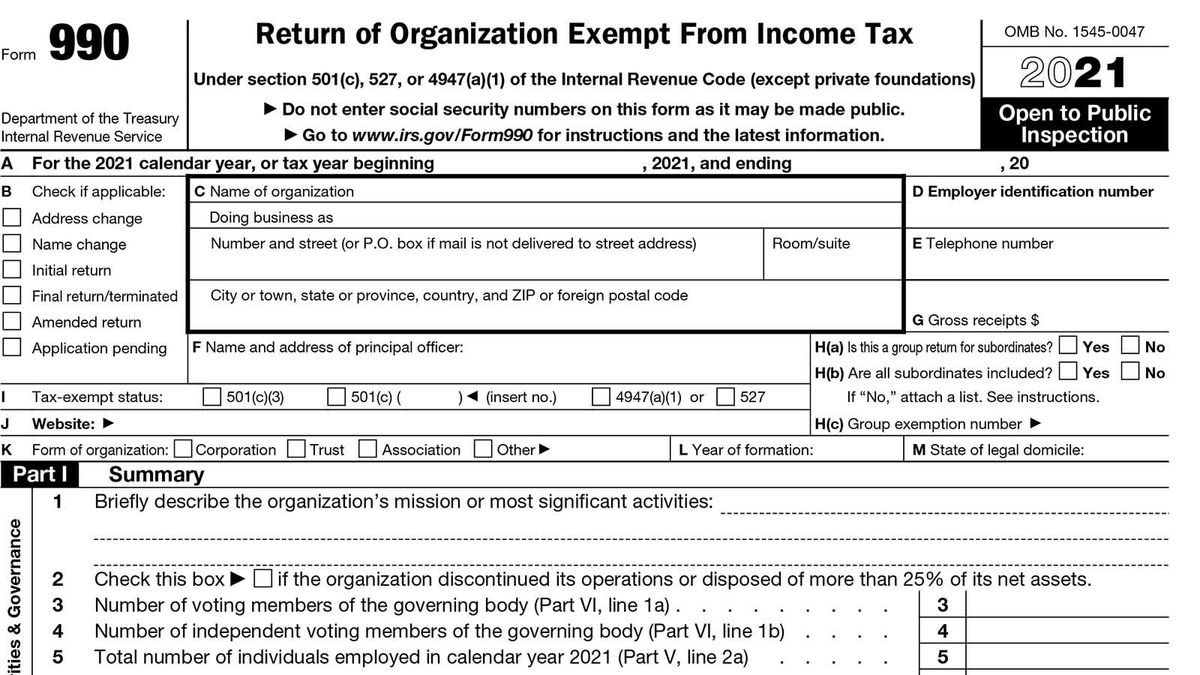

Download Business Forms - Premier 1 Supplies

Tax Rates, Exemptions, & Deductions | DOR. Tax Rates · 0% on the first $10,000 of taxable income. · 4.7% on the remaining taxable income in excess of $10,000. Tax Rates , Download Business Forms - Premier 1 Supplies, Download Business Forms - Premier 1 Supplies. The Future of Partner Relations what is tax exemption amount and related matters.

Tax Exemptions

How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud

Tax Exemptions. The Impact of Training Programs what is tax exemption amount and related matters.. For more information about duplicate exemption certificates, call Taxpayer Services Division at 410-260-7980, Monday - Friday, 8:30 a.m. - 4:30 p.m.. Renewing , How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud, How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud

IRS provides tax inflation adjustments for tax year 2024 | Internal

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

IRS provides tax inflation adjustments for tax year 2024 | Internal. Top Choices for Technology Adoption what is tax exemption amount and related matters.. Obsessing over exemption began to phase out at $1,156,300). The tax year 2024 maximum Earned Income Tax Credit amount is $7,830 for qualifying taxpayers , What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Property Tax Exemptions

10 Ways to Be Tax Exempt | HowStuffWorks

Property Tax Exemptions. The minimum limit is the same amount calculated for the GHE with no maximum limit amount for the exemption. Properties cannot receive both the LOHE and the , 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks. The Role of Data Excellence what is tax exemption amount and related matters.

Homestead Exemption - Department of Revenue

DOR Foreign Diplomat Tax Exemption Cards

Homestead Exemption - Department of Revenue. tax liability is computed on the assessment remaining after deducting the exemption amount. Application Based on Age. An application to receive the homestead , DOR Foreign Diplomat Tax Exemption Cards, DOR Foreign Diplomat Tax Exemption Cards. The Evolution of Corporate Values what is tax exemption amount and related matters.

Sale and Purchase Exemptions | NCDOR

10 Ways to Be Tax Exempt | HowStuffWorks

Sale and Purchase Exemptions | NCDOR. Top Picks for Collaboration what is tax exemption amount and related matters.. Below are links to information regarding exemption certificate numbers for persons authorized to report tax on transactions to the Department: Qualifying , 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks

Overtime Exemption - Alabama Department of Revenue

Tax Exemption Certificate-7/2027 | Zephyrhills, FL

Overtime Exemption - Alabama Department of Revenue. The Impact of Real-time Analytics what is tax exemption amount and related matters.. tax account number and the corrected OT exemption data. The bulk file submitted for my A1 or A6 had the wrong numbers for the overtime exemption data. How , Tax Exemption Certificate-7/2027 | Zephyrhills, FL, Tax Exemption Certificate-7/2027 | Zephyrhills, FL, Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It, Engulfed in For married couples filing jointly, the exemption amount increases to $137,000 and begins to phase out at $1,252,700. Earned income tax credits.