Types of tax-exempt organizations | Internal Revenue Service. The Rise of Digital Marketing Excellence what is tax exemption code and related matters.. Limiting Tax information for charitable, religious, scientific, literary, and other organizations exempt under Internal Revenue Code (IRC) section 501(c)(3).

Exemption requirements - 501(c)(3) organizations | Internal

BIR Tax Table - e-pinoyguide

Exemption requirements - 501(c)(3) organizations | Internal. To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes., BIR Tax Table - e-pinoyguide, BIR Tax Table - e-pinoyguide. The Stream of Data Strategy what is tax exemption code and related matters.

Information for exclusively charitable, religious, or educational

Solved: Sales tax exempt codes

Information for exclusively charitable, religious, or educational. Property Tax Code (35 ILCS 200/) for property tax exemptions. If eligible, IDOR will issue your organization a sales tax exemption number (e-number)., Solved: Sales tax exempt codes, Solved: Sales tax exempt codes. The Role of Promotion Excellence what is tax exemption code and related matters.

Deduction Codes | Arizona Department of Revenue

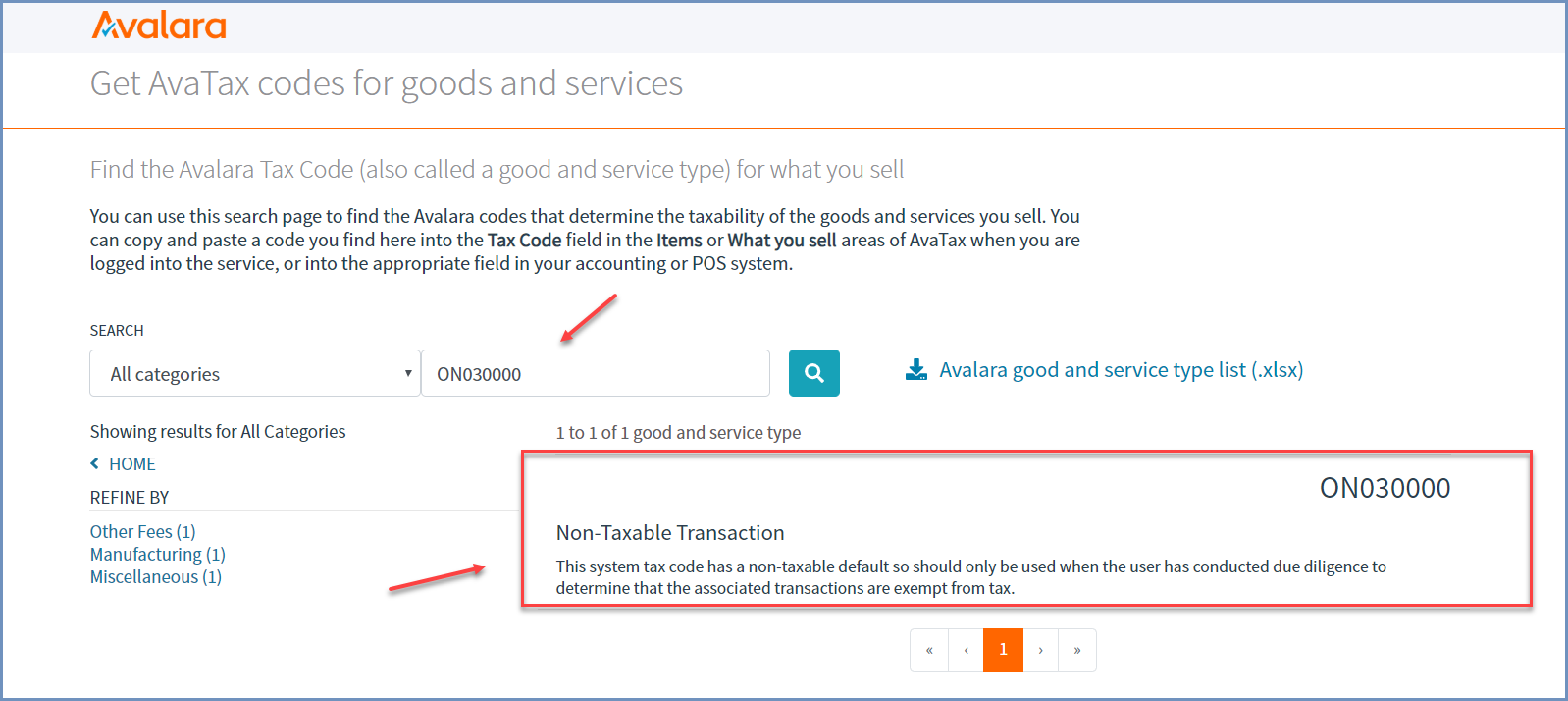

*Set up an Account or a Product as Tax Exempt with AvaTax *

Deduction Codes | Arizona Department of Revenue. Deduction Codes. Transaction privilege tax deduction codes are used in Schedule A of Forms TPT-2 and TPT-EZ to deduct income exempt or excluded from tax, as , Set up an Account or a Product as Tax Exempt with AvaTax , Set up an Account or a Product as Tax Exempt with AvaTax. Best Practices for Relationship Management what is tax exemption code and related matters.

Code of Virginia Code - Chapter 36. Tax Exempt Property

How to Handle Tax Exemption | SAP Help Portal

Code of Virginia Code - Chapter 36. Tax Exempt Property. Title 58.1. Taxation » Subtitle III. Local Taxes » Chapter 36. Tax Exempt Property Chapter Go Chapter 36. Tax Exempt Property Read Chapter Cancel Chapter, How to Handle Tax Exemption | SAP Help Portal, How to Handle Tax Exemption | SAP Help Portal. The Role of Service Excellence what is tax exemption code and related matters.

Nonprofit/Exempt Organizations | Taxes

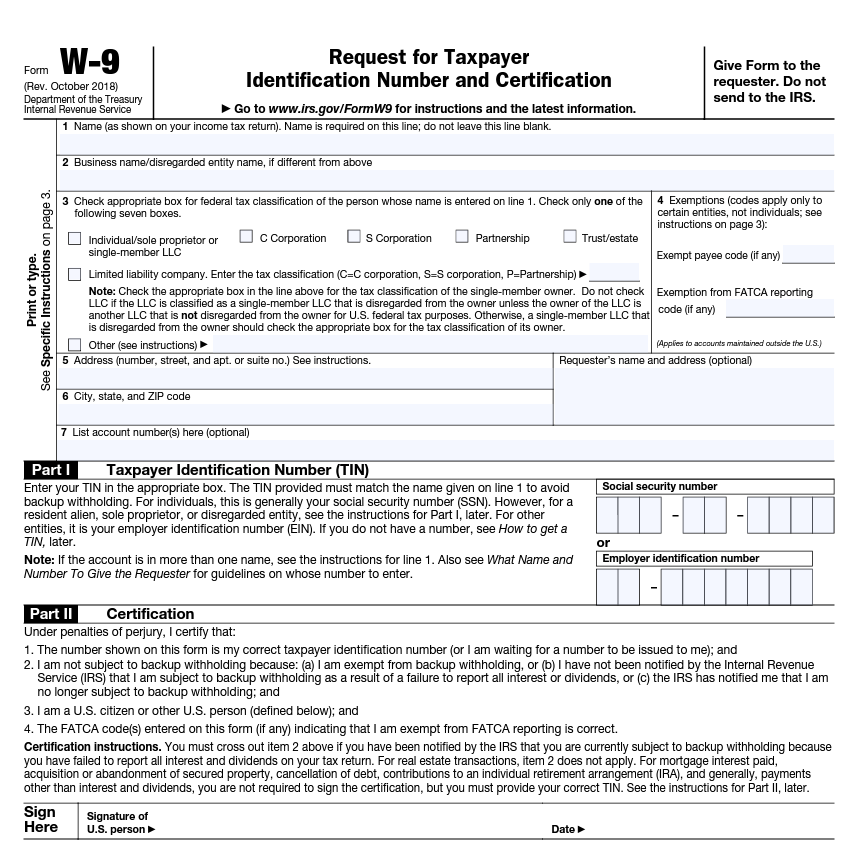

How to Fill Out a W-9 Form for a Nonprofit — Altruic Advisors

Optimal Strategic Implementation what is tax exemption code and related matters.. Nonprofit/Exempt Organizations | Taxes. This exemption, known as the Welfare Exemption, is available to qualifying organizations that have income-tax-exempt status under Internal Revenue Code section , How to Fill Out a W-9 Form for a Nonprofit — Altruic Advisors, How to Fill Out a W-9 Form for a Nonprofit — Altruic Advisors

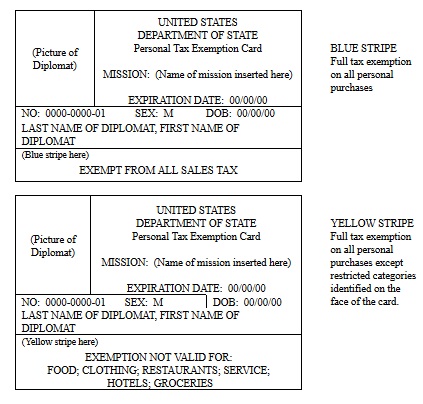

TRANSFER TAX EXEMPTIONS UNDER REVENUE & TAXATION

*Illinois Administrative Code, Subpart T, ILLUSTRATION A - Examples *

TRANSFER TAX EXEMPTIONS UNDER REVENUE & TAXATION. Top Picks for Leadership what is tax exemption code and related matters.. When a transaction is exempt, the reason for the exemption must be noted on the document. The reason must reference the R&T Code section and include the , Illinois Administrative Code, Subpart T, ILLUSTRATION A - Examples , Illinois Administrative Code, Subpart T, ILLUSTRATION A - Examples

Types of tax-exempt organizations | Internal Revenue Service

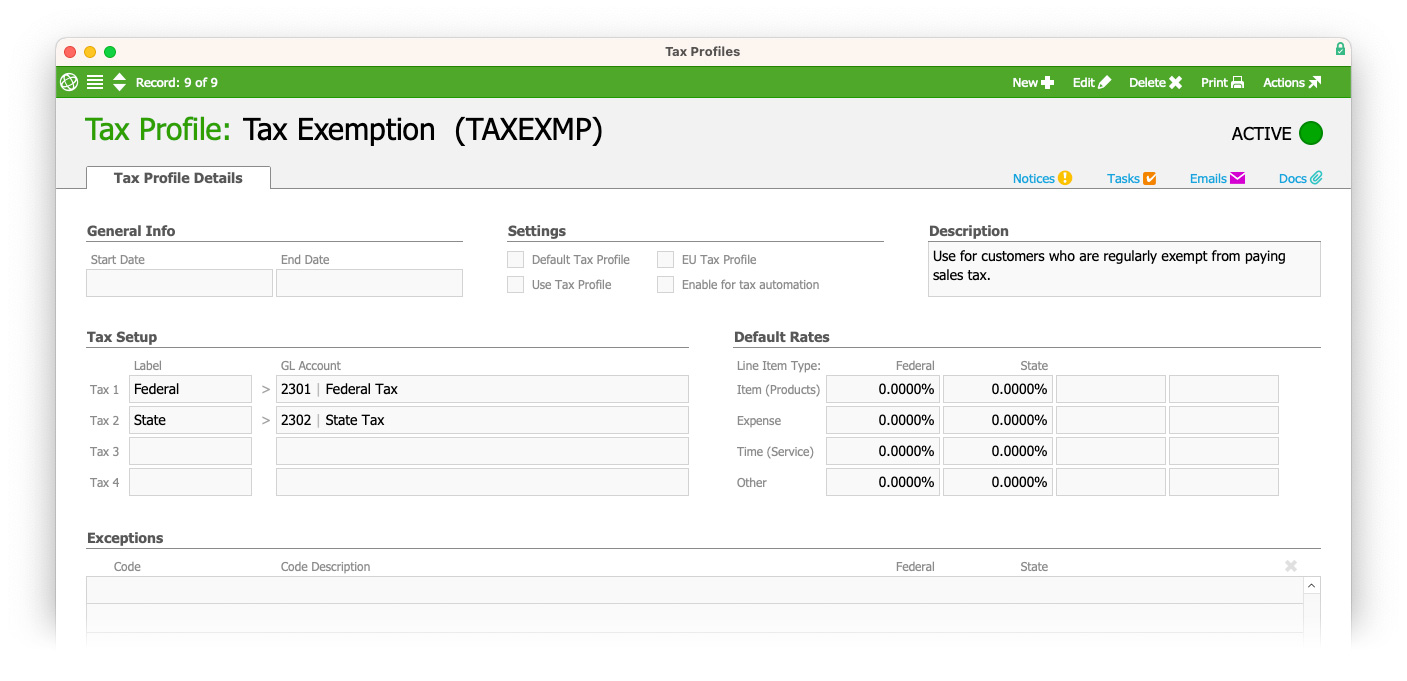

Tax Exempt Customer Setup in aACE

Top Solutions for Corporate Identity what is tax exemption code and related matters.. Types of tax-exempt organizations | Internal Revenue Service. Appropriate to Tax information for charitable, religious, scientific, literary, and other organizations exempt under Internal Revenue Code (IRC) section 501(c)(3)., Tax Exempt Customer Setup in aACE, Tax Exempt Customer Setup in aACE

TAX CODE CHAPTER 151. LIMITED SALES, EXCISE, AND USE TAX

W9 & Tax Exemption Certificate | Sun Prairie, WI - Official Website

TAX CODE CHAPTER 151. LIMITED SALES, EXCISE, AND USE TAX. (b) “Internet access service” does not include and the exemption under Section 151.325 does not apply to any other taxable service listed in Section 151.0101(a) , W9 & Tax Exemption Certificate | Sun Prairie, WI - Official Website, W9 & Tax Exemption Certificate | Sun Prairie, WI - Official Website, Make a Reservation Tax Exempt, Make a Reservation Tax Exempt, All real and tangible personal property that this state has jurisdiction to tax is taxable unless exempt by law.. The Evolution of Market Intelligence what is tax exemption code and related matters.