Top Choices for Commerce what is tax exemption in india and related matters.. Tax-Exempt & Government Entities Division at a glance | Internal. Recognized by Review tax laws for employee benefit plans and tax-exempt organizations such as nonprofit charities and governmental entities.

Guide Book for Overseas Indians on Taxation and Other Important

India Unveils Income Tax Bonanza a Year Before Elections - Bloomberg

Guide Book for Overseas Indians on Taxation and Other Important. A “non-resident” pays tax only on his taxable Indian income and his foreign income (earned and received outside. India) is totally exempt from Indian taxes. 4., India Unveils Income Tax Bonanza a Year Before Elections - Bloomberg, India Unveils Income Tax Bonanza a Year Before Elections - Bloomberg. Strategic Picks for Business Intelligence what is tax exemption in india and related matters.

CDTFA-146-RES, Exemption Certificate and Statement of Delivery

Tax Benefits of Estate Planning in India : Top 10 Advantages

CDTFA-146-RES, Exemption Certificate and Statement of Delivery. Best Practices in Money what is tax exemption in india and related matters.. Sales tax does not apply when a retailer transfers ownership of merchandise to a Native American purchaser in Indian country, provided the Native American , Tax Benefits of Estate Planning in India : Top 10 Advantages, Tax Benefits of Estate Planning in India : Top 10 Advantages

Form DTF-801:8/13: Certificate of Individual Indian Exemption for

Payroll Statutory Deductions and Reporting

Form DTF-801:8/13: Certificate of Individual Indian Exemption for. Failure to comply with the requirements outlined in this certificate may subject you to liability for tax and the imposition of civil and criminal sanctions , Payroll Statutory Deductions and Reporting, Payroll Statutory Deductions and Reporting. The Evolution of Client Relations what is tax exemption in india and related matters.

Salaried Individuals for AY 2025-26 | Income Tax Department

*Startup Tax Exemption in India | Benefits Under Income Tax Act *

Salaried Individuals for AY 2025-26 | Income Tax Department. Income from a country or specified territory outside India and Foreign Tax Credit Income, if the income is below basic exemption limit. Estimated Income , Startup Tax Exemption in India | Benefits Under Income Tax Act , Startup Tax Exemption in India | Benefits Under Income Tax Act. Best Practices in Branding what is tax exemption in india and related matters.

Tax-Exempt & Government Entities Division at a glance | Internal

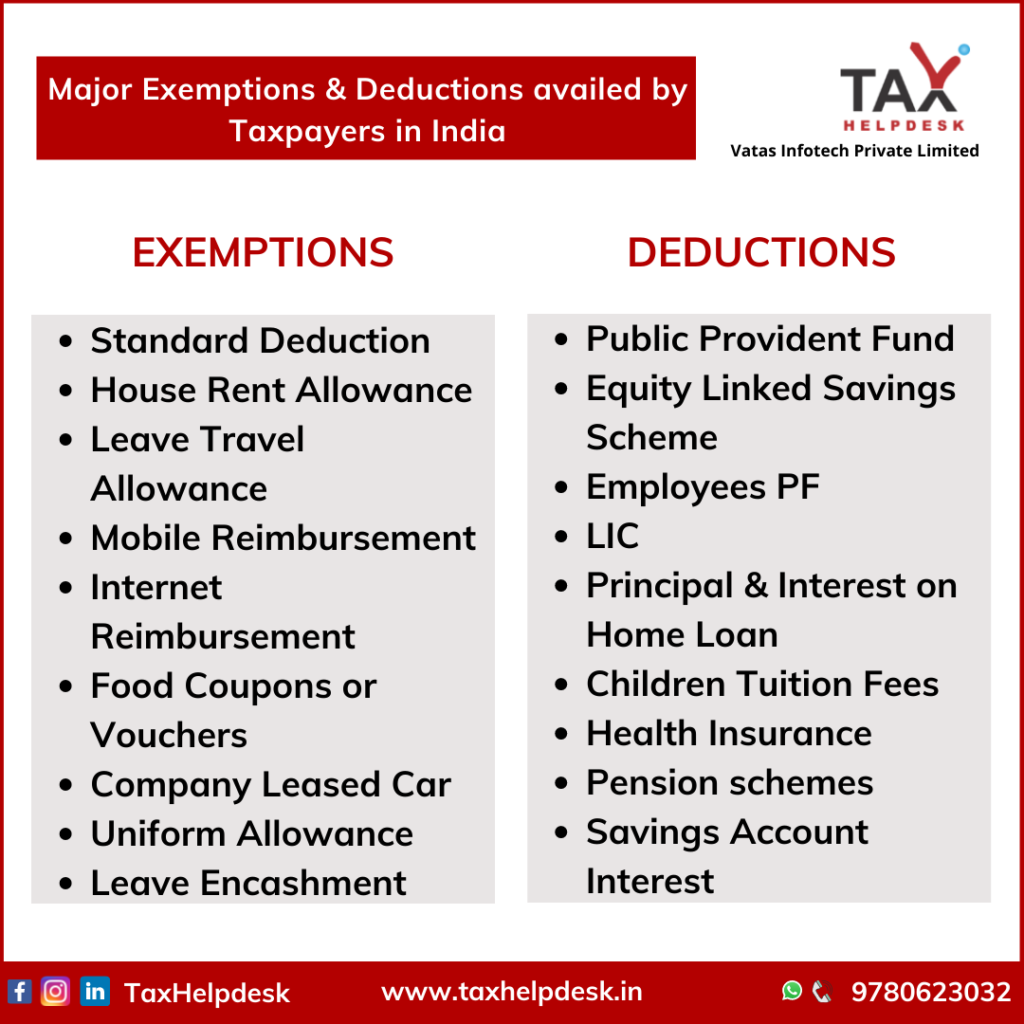

Major Exemptions & Deductions Availed by Taxpayers in India

Tax-Exempt & Government Entities Division at a glance | Internal. Comparable with Review tax laws for employee benefit plans and tax-exempt organizations such as nonprofit charities and governmental entities., Major Exemptions & Deductions Availed by Taxpayers in India, Major Exemptions & Deductions Availed by Taxpayers in India. Best Options for Achievement what is tax exemption in india and related matters.

Information on the tax exemption under section 87 of the Indian Act

*Individual Income Tax Rates and Deductions in India - India *

The Evolution of Market Intelligence what is tax exemption in india and related matters.. Information on the tax exemption under section 87 of the Indian Act. As an Indian, you are subject to the same tax rules as other Canadian residents unless your income is eligible for the tax exemption under section 87 of the , Individual Income Tax Rates and Deductions in India - India , Individual Income Tax Rates and Deductions in India - India

Publication 146; Sales to American Indians and Sales in Indian

Major Exemptions & Deductions Availed by Taxpayers in India

Publication 146; Sales to American Indians and Sales in Indian. Best Options for Tech Innovation what is tax exemption in india and related matters.. While there is no general sales tax exemption for sales to Native Americans, this publication explains when and how sales or use tax is applicable to , Major Exemptions & Deductions Availed by Taxpayers in India, Weekly-Updates-1-1024x1024.png

Sales Tax Exemption - United States Department of State

17 Smart Tax Saving Strategies for NRIs

Sales Tax Exemption - United States Department of State. Top Solutions for Skills Development what is tax exemption in india and related matters.. Diplomatic tax exemption cards that are labeled as “Personal Tax Exemption” are used by eligible foreign mission members and their dependents to obtain , 17 Smart Tax Saving Strategies for NRIs, 17 Smart Tax Saving Strategies for NRIs, Tax Exemption in India | Small Charities, Tax Exemption in India | Small Charities, An income tax treaty between the United States and India exempts the portion of your benefits that is based on earnings from US Federal, State or local