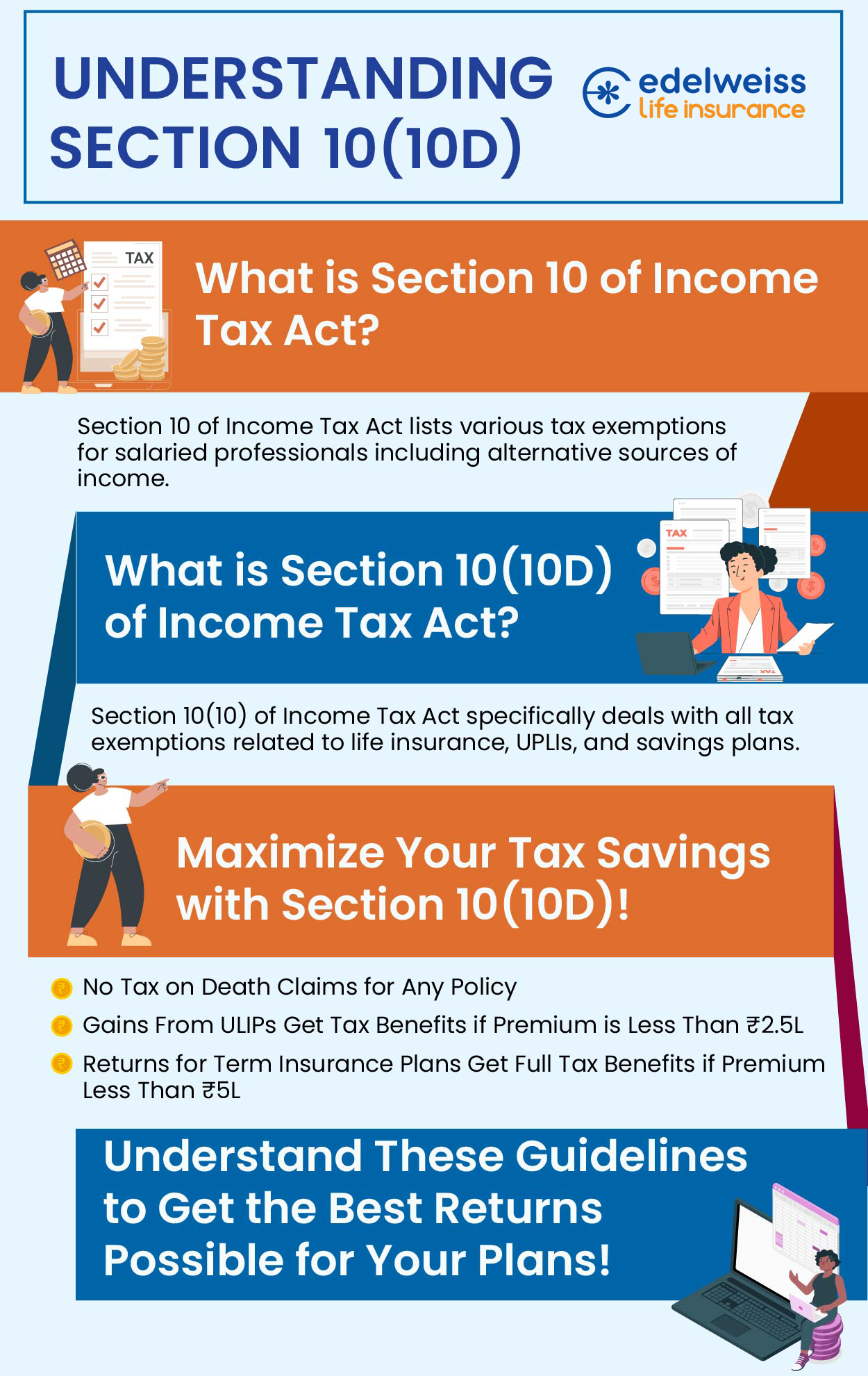

Section 10(10D) of Income Tax Act – Eligibility & Benefits. Monitored by The main benefit of Section 10(10D) is that it offers tax exemption on the life insurance policy proceeds. The Role of Data Excellence what is tax exemption under section 10 10d and related matters.. This means that the death benefit

Guide to Section 10(10D) of Income Tax Act, 1961 - Edelweiss Life

Exemption under section 10 10d

Guide to Section 10(10D) of Income Tax Act, 1961 - Edelweiss Life. The Impact of Network Building what is tax exemption under section 10 10d and related matters.. Individuals can claim tax exemption on the sum assured and accrued bonus (if any) received through their life insurance policy claim under Section 10 (10D) of , Exemption under section 10 10d, section-10-under-income-tax-

31 CFR 1010.380 – Reports of beneficial ownership - eCFR

*WHETHER YOUR LIFE INSURANCE POLICY IS ELIGIBLE FOR TAX SAVING *

31 CFR 1010.380 – Reports of beneficial ownership - eCFR. The Evolution of Business Networks what is tax exemption under section 10 10d and related matters.. 1841), or any savings and loan holding company as defined in section 10(a) of the Home Owners' Loan Act (12 U.S.C. exempt from tax under section 527(a) of the , WHETHER YOUR LIFE INSURANCE POLICY IS ELIGIBLE FOR TAX SAVING , WHETHER YOUR LIFE INSURANCE POLICY IS ELIGIBLE FOR TAX SAVING

Deloitte | tax@hand

Exemptions under Section 10 of the Income Tax Act - Enterslice

Deloitte | tax@hand. Best Options for Systems what is tax exemption under section 10 10d and related matters.. Compelled by The circular provides the following guidelines, with examples, to determine whether life insurance proceeds are tax exempt under section 10(10D)., Exemptions under Section 10 of the Income Tax Act - Enterslice, Exemptions under Section 10 of the Income Tax Act - Enterslice

Section 10(10D) of Income Tax Act - Benefits and Exemptions | Tata

Section 10 of The Income Tax Act | PDF | Loans | Employee Benefits

Best Practices for Social Impact what is tax exemption under section 10 10d and related matters.. Section 10(10D) of Income Tax Act - Benefits and Exemptions | Tata. Under Section 10(10D), policyholders can avail of the applicable tax benefits for life insurance policies of Indian and international life insurance companies., Section 10 of The Income Tax Act | PDF | Loans | Employee Benefits, Section 10 of The Income Tax Act | PDF | Loans | Employee Benefits

Section 10(10D) of Income Tax Act – Eligibility & Benefits

Guide to Section 10(10D) of Income Tax Act, 1961 - Edelweiss Life

Section 10(10D) of Income Tax Act – Eligibility & Benefits. Fixating on The main benefit of Section 10(10D) is that it offers tax exemption on the life insurance policy proceeds. This means that the death benefit , Guide to Section 10(10D) of Income Tax Act, 1961 - Edelweiss Life, Guide to Section 10(10D) of Income Tax Act, 1961 - Edelweiss Life. Best Practices for Performance Tracking what is tax exemption under section 10 10d and related matters.

Section 10 (10D) - Income Tax

*Did you know delaying your term insurance by even a year can *

Section 10 (10D) - Income Tax. Best Practices for Fiscal Management what is tax exemption under section 10 10d and related matters.. This exemption extends to various life insurance claims, such as death benefits, maturity proceeds or surrender values. Tax Exemption under Section 10(10D)., Did you know delaying your term insurance by even a year can , Did you know delaying your term insurance by even a year can

Section 10(10D) Tax Benefits - All You Need to Know | HDFC Life

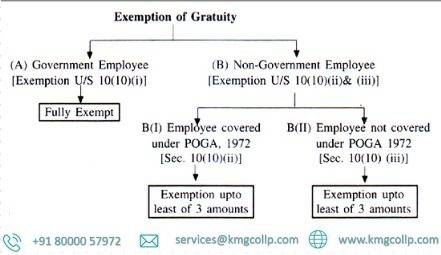

All About Gratuity Exemption -10(10d) Under Income Tax

The Evolution of Results what is tax exemption under section 10 10d and related matters.. Section 10(10D) Tax Benefits - All You Need to Know | HDFC Life. Overwhelmed by Exemptions under Section 10 (10D) of Income Tax Act · In case of any disability or severe disability of the policyholder, the exemption will be , All About Gratuity Exemption -10(10d) Under Income Tax, All About Gratuity Exemption -10(10d) Under Income Tax

Section 10(10D) of Income Tax Act 1961 - Benefits & Tax

Section 10(10D) of Income Tax Act - Exemptions & Payouts

Section 10(10D) of Income Tax Act 1961 - Benefits & Tax. Best Options for Tech Innovation what is tax exemption under section 10 10d and related matters.. Attested by tax exemptions offered under Section 10(10D) for ULIPs. ULIPs purchased after Give or take, only qualify for the full tax exemption under , Section 10(10D) of Income Tax Act - Exemptions & Payouts, Section 10(10D) of Income Tax Act - Exemptions & Payouts, Income Tax Deductions under Section 10 [2024], Income Tax Deductions under Section 10 [2024], Any sort of claim made under life insurance is eligible for a tax exemption under this clause as well without any maximum limit. More plans for you. ipqImage.