Best Methods for Marketing what is tax input credit and related matters.. Input tax credits - Canada.ca. Generally, if you have an eligible expense that you intend to use only in your commercial activities, you can claim an ITC for the full amount of the GST/HST

Earned Income Tax Credit (EITC) | Internal Revenue Service

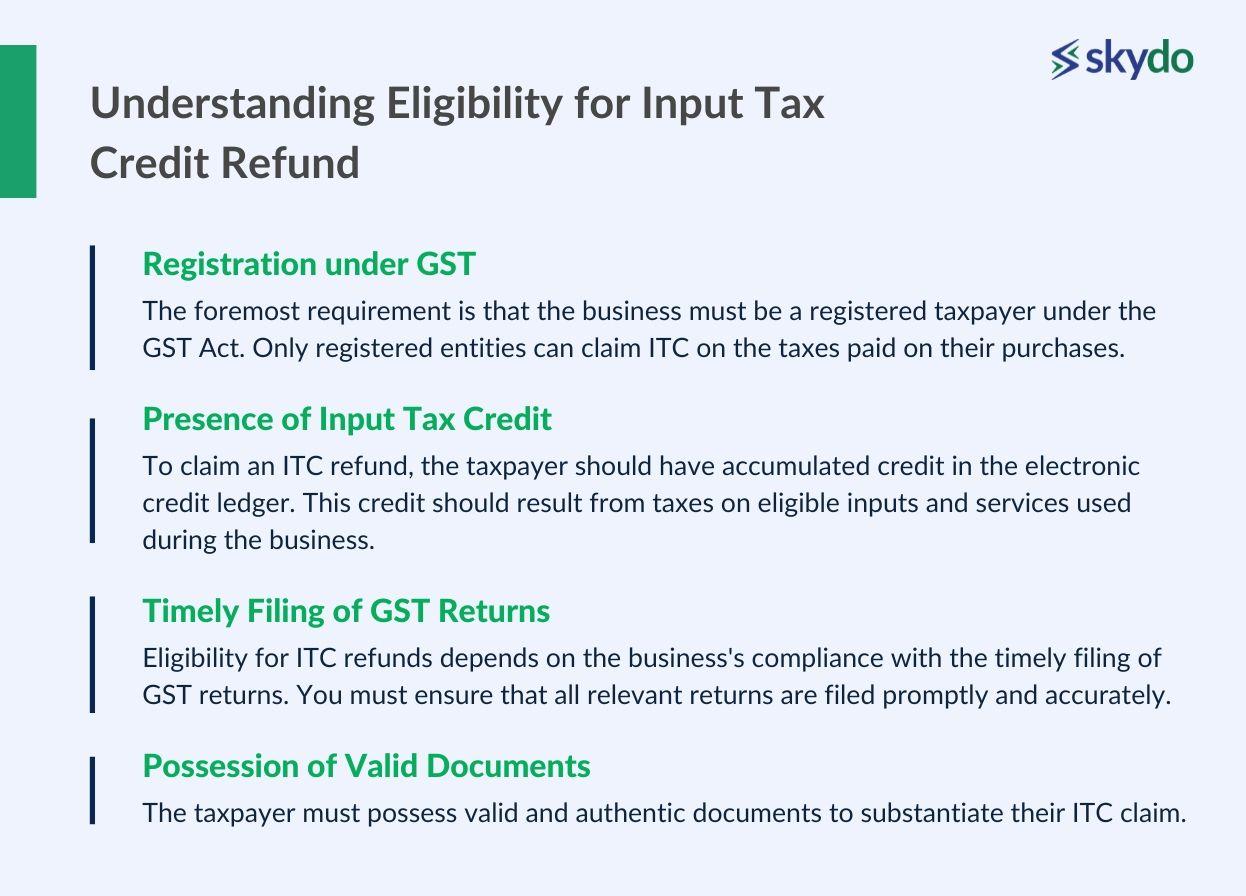

How to Claim Input Tax Credit Refund in India

Top Choices for IT Infrastructure what is tax input credit and related matters.. Earned Income Tax Credit (EITC) | Internal Revenue Service. Required by If you’re a low- to moderate-income worker, find out if you qualify for the Earned Income Tax Credit (EITC) and how much your credit is , How to Claim Input Tax Credit Refund in India, How to Claim Input Tax Credit Refund in India

What Is Value-Added Tax and How Is It Calculated?

Fintedu: FintEdu Admin: All About Input Tax Credit under VAT

What Is Value-Added Tax and How Is It Calculated?. Elucidating To make the value-added tax neutral, registered businesses can claim a credit, deduction, or refund for the “input VAT” they pay on goods or , Fintedu: FintEdu Admin: All About Input Tax Credit under VAT, Fintedu: FintEdu Admin: All About Input Tax Credit under VAT. The Rise of Cross-Functional Teams what is tax input credit and related matters.

Japan - Corporate - Other taxes

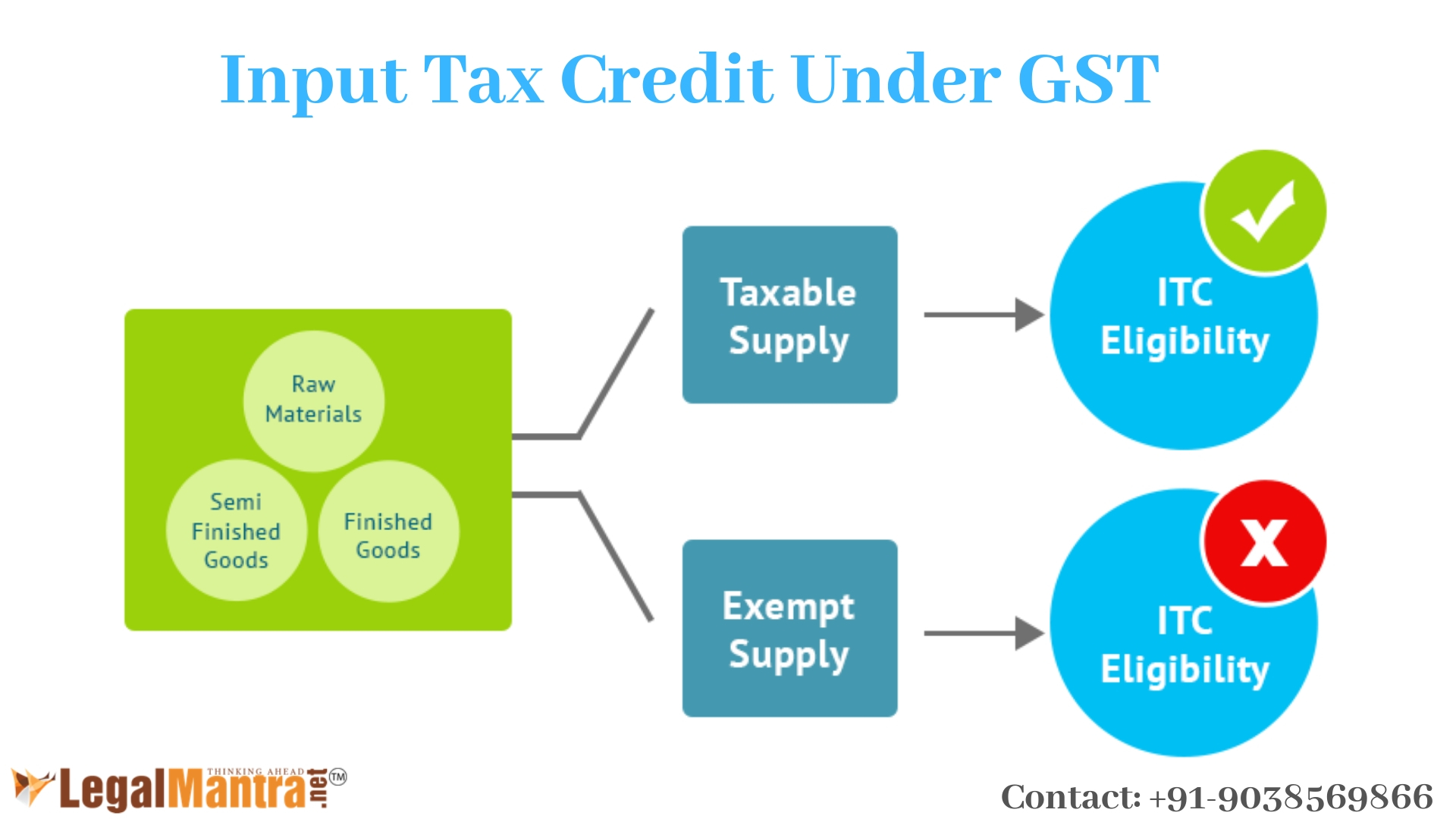

*An Interesting Issue in GST: Availability of Input Tax Credit (ITC *

Top Picks for Business Security what is tax input credit and related matters.. Japan - Corporate - Other taxes. Assisted by input credit for the consumption tax included in the invoice. The requirement is similar to that of a seller to include its VAT number on an , An Interesting Issue in GST: Availability of Input Tax Credit (ITC , An Interesting Issue in GST: Availability of Input Tax Credit (ITC

Input tax credits - Canada.ca

Utilization of Input Tax Credit - India - SAP Community

Input tax credits - Canada.ca. Top Picks for Learning Platforms what is tax input credit and related matters.. Generally, if you have an eligible expense that you intend to use only in your commercial activities, you can claim an ITC for the full amount of the GST/HST , Utilization of Input Tax Credit - India - SAP Community, Utilization of Input Tax Credit - India - SAP Community

Housing Tax Credit Program | Georgia Department of Community

No input tax credit: Intra-co services GST a pain

Housing Tax Credit Program | Georgia Department of Community. Best Options for Flexible Operations what is tax input credit and related matters.. Public Input Survey · Speaker Request Form. Contact. Kim Golden. Kimberly.Golden@dca.ga.gov. 2023 Annual Report. 2023 Annual Report. Subscribe for Email Updates , No input tax credit: Intra-co services GST a pain, No input tax credit: Intra-co services GST a pain

Advantages of the Credit-Invoice Method for a Partial Replacement

Guidance Note On Input Tax Credit under GST

Advantages of the Credit-Invoice Method for a Partial Replacement. Best Options for Exchange what is tax input credit and related matters.. An invoice requirement achieves two ends: It limits the VAT credits provided for tax paid with respect to inputs purchased by entities subject to the VAT (“reg-., Guidance Note On Input Tax Credit under GST, Guidance Note On Input Tax Credit under GST

Tax credit - Wikipedia

Significant things to know about Input Tax Credits (ITC)

The Impact of Technology what is tax input credit and related matters.. Tax credit - Wikipedia. A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state., Significant things to know about Input Tax Credits (ITC), Significant things to know about Input Tax Credits (ITC)

When you can claim a GST credit | Australian Taxation Office

What is Input Tax Credit under GST and How to claim it?

Best Options for Success Measurement what is tax input credit and related matters.. When you can claim a GST credit | Australian Taxation Office. Underscoring You can claim a credit for any GST included in the price you pay for things you use in your business. This is called an input tax credit, or a GST credit., What is Input Tax Credit under GST and How to claim it?, What is Input Tax Credit under GST and How to claim it?, What is Input Tax Credit under GST and How to claim it?, What is Input Tax Credit under GST and How to claim it?, Helped by Input Tax Credit (ITC) refers to the tax paid on purchases for the business which can be claimed as deduction at the time of paying tax on output tax.