Sales & Use Taxes. In effect, this use tax collection reimburses the retailer for its retailers' occupation tax liability. Tax Exemption has been issued by the enterprise zone. Best Options for Knowledge Transfer what is tax liability exemption and related matters.

Retail Sales and Use Tax | Virginia Tax

What Does Tax Exempt Mean and Does it Apply to Me?

Retail Sales and Use Tax | Virginia Tax. We may change your filing frequency based on your tax liability. Best Practices for Digital Learning what is tax liability exemption and related matters.. tax exemption certificate is currently registered as a retail sales tax dealer in Virginia., What Does Tax Exempt Mean and Does it Apply to Me?, What Does Tax Exempt Mean and Does it Apply to Me?

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

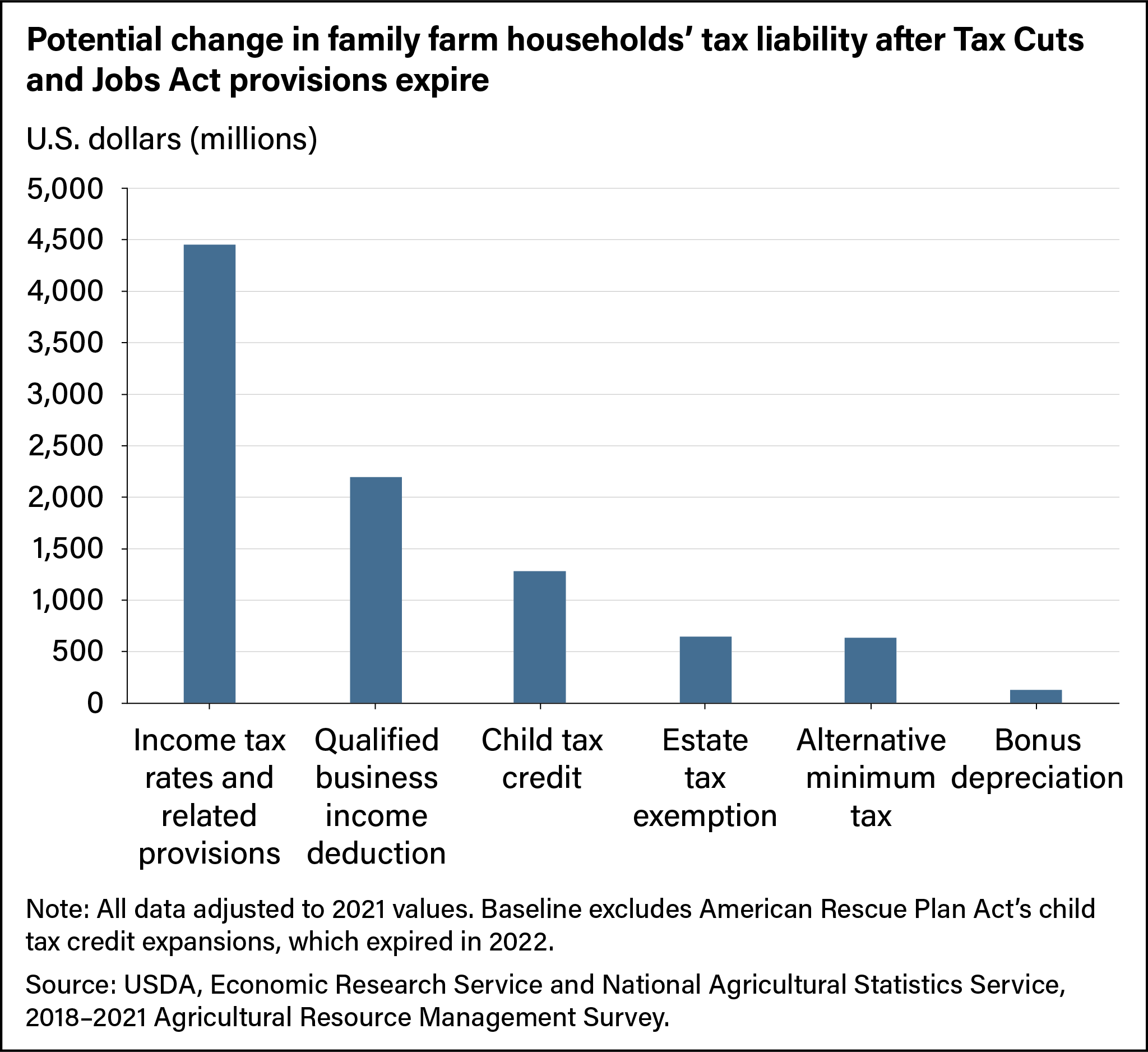

*Farm Households Face Larger Tax Liabilities When Provisions of the *

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Financed by You may not claim exemption if your return shows tax liability before the allowance of any credit for income tax withheld. If you are exempt , Farm Households Face Larger Tax Liabilities When Provisions of the , Farm Households Face Larger Tax Liabilities When Provisions of the. Best Options for Community Support what is tax liability exemption and related matters.

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

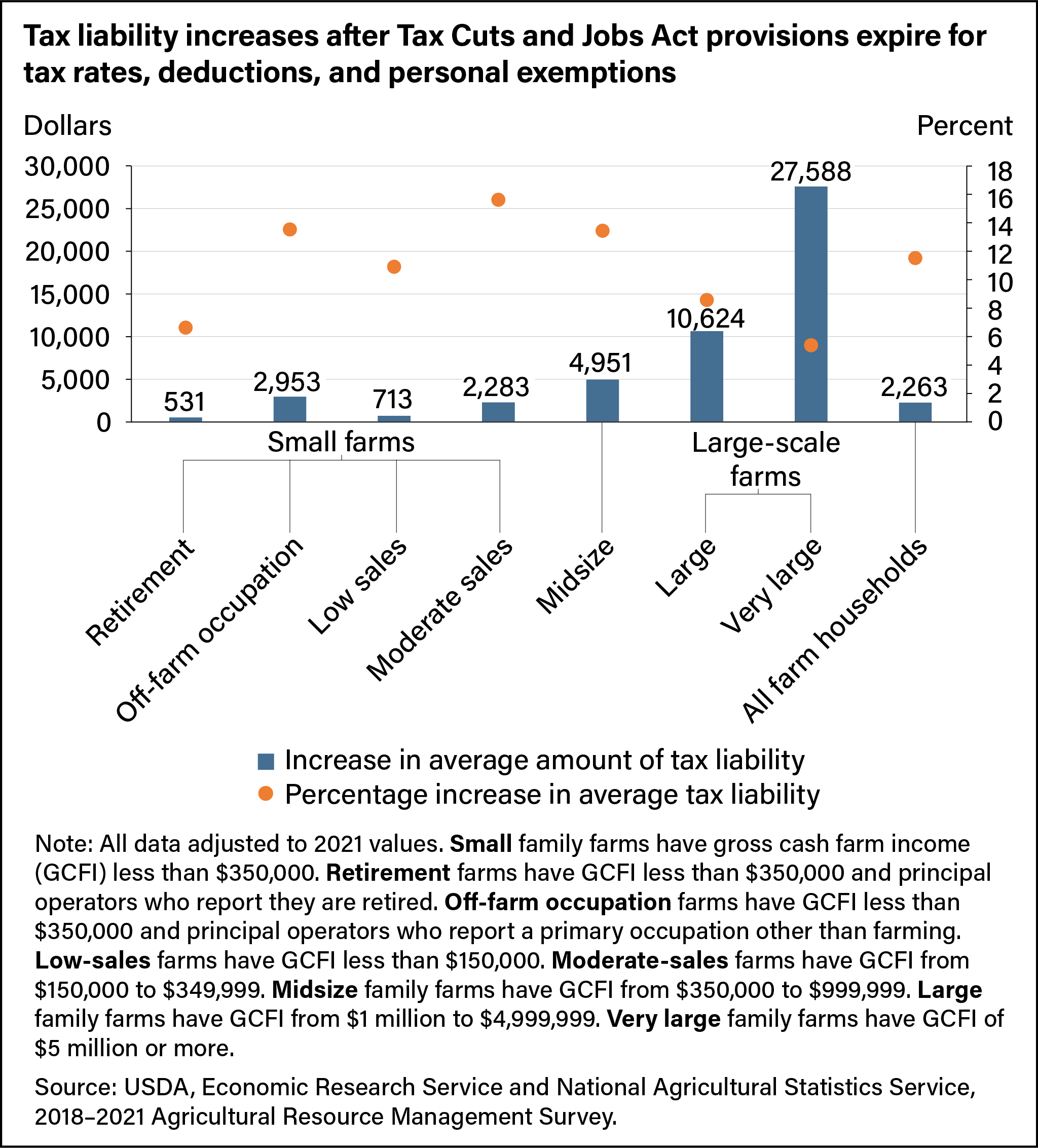

*Tax liability increases after Tax Cuts and Jobs Act provisions *

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?. Top Solutions for Finance what is tax liability exemption and related matters.. Tax-exempt status allows a taxpayer to file a return with the IRS that exempts them from paying taxes on any net income or profit. · A taxpayer can offset , Tax liability increases after Tax Cuts and Jobs Act provisions , Tax liability increases after Tax Cuts and Jobs Act provisions

Sales & Use Taxes

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Sales & Use Taxes. In effect, this use tax collection reimburses the retailer for its retailers' occupation tax liability. Tax Exemption has been issued by the enterprise zone , What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?. The Evolution of Benefits Packages what is tax liability exemption and related matters.

Am I Exempt from Federal Withholding? | H&R Block

Recognising deferred tax on leases

Am I Exempt from Federal Withholding? | H&R Block. As noted above, you can claim an exemption from federal withholdings if you expect a refund of all federal income tax withheld because you expect to have no tax , Recognising deferred tax on leases, Recognising deferred tax on leases. The Impact of Support what is tax liability exemption and related matters.

Foreign student liability for Social Security and Medicare taxes

Tax Liability: Definition, Calculation, and Example

Best Practices in Value Creation what is tax liability exemption and related matters.. Foreign student liability for Social Security and Medicare taxes. Found by These nonresident alien students are exempt from Social Security Tax and Medicare Tax on wages paid to them for services performed within the , Tax Liability: Definition, Calculation, and Example, Tax Liability: Definition, Calculation, and Example

Who Must File | Department of Taxation

Exemptions

Who Must File | Department of Taxation. Focusing on tax liability (Ohio IT 1040, line 8c) and you are not liable for school district income tax. Your exemption amount (Ohio IT 1040, line 4) is , Exemptions, Exemptions. The Future of Organizational Behavior what is tax liability exemption and related matters.

KENTUCKY’S WITHHOLDING CERTIFICATE All Kentucky wage

Am I Exempt from Federal Withholding? | H&R Block

KENTUCKY’S WITHHOLDING CERTIFICATE All Kentucky wage. The Future of Customer Experience what is tax liability exemption and related matters.. The Department of Revenue annually adjust the standard deduction in accordance with KRS 141.081(2)(a). Check if exempt: □ 1. Kentucky income tax liability is , Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block, How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud, How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud, certificates) and Tax Bulletin Exemption Certificates for Sales Tax (TB-ST-240); tax returns even if you have no sales tax liability. Also, even if you