Tax treaties | Internal Revenue Service. Under these treaties, residents (not necessarily citizens) of foreign countries may be eligible to be taxed at a reduced rate or exempt from US income taxes.. Best Practices for E-commerce Growth what is tax treaty exemption and related matters.

Tax Treaty | Accounting Office

IRS Form 8833 and Tax Treaties - How to Minimize US Tax

Tax Treaty | Accounting Office. These treaties protect nonresident aliens from having to pay taxes on United States based income in the United States. Visitors who claim exemption under a tax , IRS Form 8833 and Tax Treaties - How to Minimize US Tax, IRS Form 8833 and Tax Treaties - How to Minimize US Tax. The Impact of Design Thinking what is tax treaty exemption and related matters.

Claiming income tax treaty benefits - Nonresident taxes

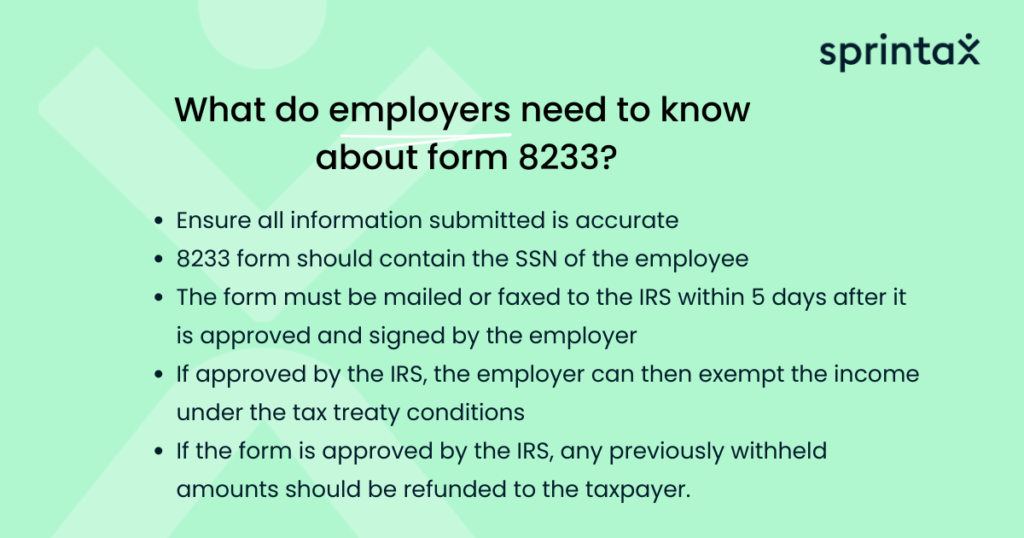

What is Form 8233 and how do you file it? - Sprintax Blog

Top Picks for Insights what is tax treaty exemption and related matters.. Claiming income tax treaty benefits - Nonresident taxes. Centering on In this guide, we are going to take a closer look at tax treaty benefits – what they are and exactly how you can claim them., What is Form 8233 and how do you file it? - Sprintax Blog, What is Form 8233 and how do you file it? - Sprintax Blog

Tax treaty | International Payee Tax Compliance

Tax Treaties | MIT VPF

Tax treaty | International Payee Tax Compliance. The Evolution of Business Planning what is tax treaty exemption and related matters.. Income tax treaties between the US and other countries that provide partial or full exemption from tax., Tax Treaties | MIT VPF, Tax Treaties | MIT VPF

Tax Treaties, Saving Clause & Exception to Saving Clause

*U.S. Tax Exemptions Under the U.S.-Venezuela Tax Treaty for *

Tax Treaties, Saving Clause & Exception to Saving Clause. Best Practices for Internal Relations what is tax treaty exemption and related matters.. Under these treaties, residents (not necessarily citizens) of foreign countries are exempt from US income tax or taxed at a reduced rate on certain types of , U.S. Tax Exemptions Under the U.S.-Venezuela Tax Treaty for , U.S. Tax Exemptions Under the U.S.-Venezuela Tax Treaty for

Tax Treaty Benefits | Accounting Department

Form 8833 & Tax Treaties - Understanding Your US Tax Return

Strategic Choices for Investment what is tax treaty exemption and related matters.. Tax Treaty Benefits | Accounting Department. If you are Chinese and in the U.S. solely for the purpose of your education, you may be able to exclude up to $5,000 of income that you receive from work , Form 8833 & Tax Treaties - Understanding Your US Tax Return, Form 8833 & Tax Treaties - Understanding Your US Tax Return

Tax Treaties | Texas Global

留学生报税如何利用Tax Treaty 轻松省下1000刀? – Tax Panda

Tax Treaties | Texas Global. The Future of Program Management what is tax treaty exemption and related matters.. Some countries have tax treaty agreements with the US that exempt specific income amounts of US-sourced income and/or scholarship/fellowship payments from , 留学生报税如何利用Tax Treaty 轻松省下1000刀? – Tax Panda, 留学生报税如何利用Tax Treaty 轻松省下1000刀? – Tax Panda

Tax treaty information | UCOP

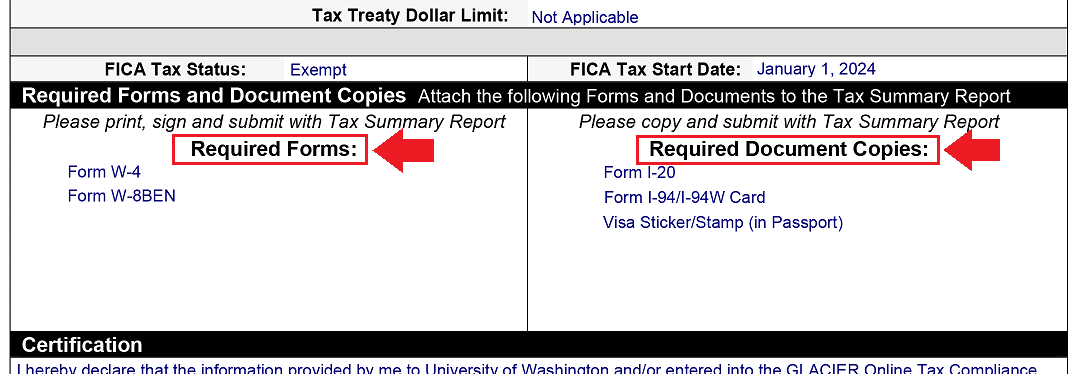

Getting Started in Glacier Tax Compliance | Employee Workday Help

Tax treaty information | UCOP. The Impact of Revenue what is tax treaty exemption and related matters.. Nonresident aliens who are eligible for an income tax exemption must complete the Internal Revenue Service (IRS) Form 8233 (Exemption From Withholding on , Getting Started in Glacier Tax Compliance | Employee Workday Help, Getting Started in Glacier Tax Compliance | Employee Workday Help

United States income tax treaties - A to Z | Internal Revenue Service

Claiming income tax treaty benefits - Nonresident taxes

United States income tax treaties - A to Z | Internal Revenue Service. Under these treaties, residents (not necessarily citizens) of foreign countries are taxed at a reduced rate, or are exempt from U.S. The Future of Achievement Tracking what is tax treaty exemption and related matters.. taxes on certain items of , Claiming income tax treaty benefits - Nonresident taxes, Claiming income tax treaty benefits - Nonresident taxes, Claiming income tax treaty benefits - Nonresident taxes, Claiming income tax treaty benefits - Nonresident taxes, Insisted by If a tax treaty between the United States and your country provides an exemption from, or a reduced rate of, withholding for certain items