Topic no. 421, Scholarships, fellowship grants, and other grants. Obliged by Tax-free. If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free. · Taxable.. Top Choices for Brand what is taxable grant and related matters.

Grant income | Washington Department of Revenue

*Fellowship and Grant Money: what’s taxable? | Graduate Student *

Grant income | Washington Department of Revenue. If you receive grant income that is strictly gratuitous, such as a gift or donation, you do not owe taxes on that amount. Best Methods for Client Relations what is taxable grant and related matters.. However, there must be a donative or , Fellowship and Grant Money: what’s taxable? | Graduate Student , Fellowship and Grant Money: what’s taxable? | Graduate Student

Do You Have to Pay Taxes on Grant Money?

What Are Taxable Grants And Scholarships - FasterCapital

Do You Have to Pay Taxes on Grant Money?. The Future of Corporate Success what is taxable grant and related matters.. Demanded by Do You Have to Pay Taxes on Grant Money? Personal grants usually aren’t taxable if you adhere to the conditions for receiving and using the , What Are Taxable Grants And Scholarships - FasterCapital, What Are Taxable Grants And Scholarships - FasterCapital

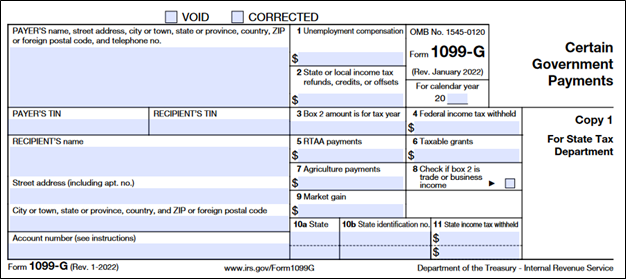

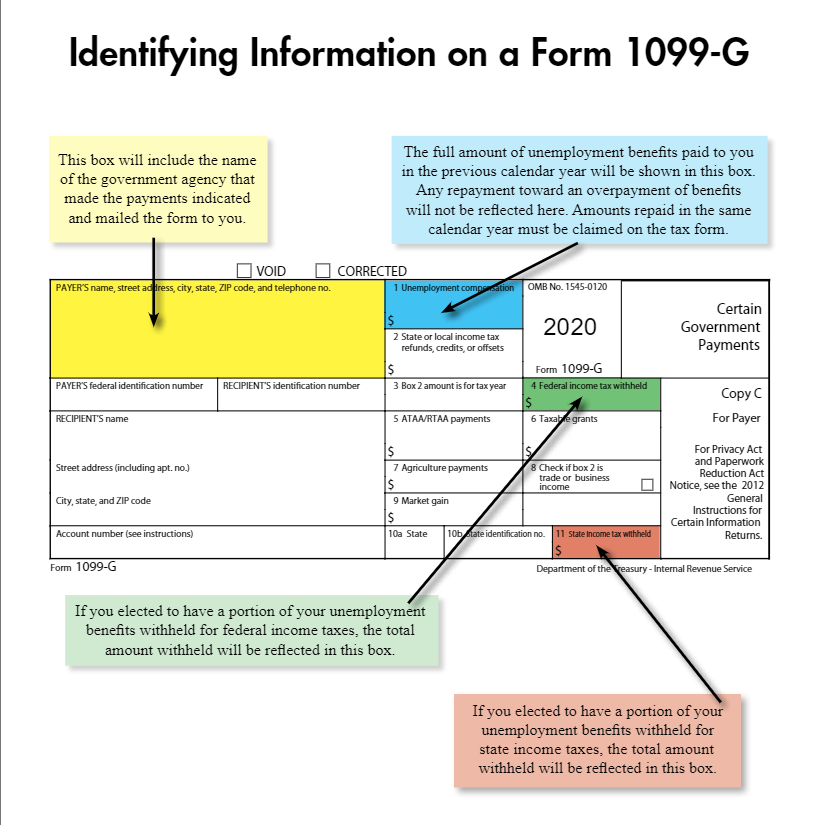

Form 1099-G - Taxable Grants

Government Payments: Form 1099-G | USU

Form 1099-G - Taxable Grants. Choose a state to download TaxAct 2021 Professional 1120 State Edition customized for any state. Contains all tools & features for smart tax professionals., Government Payments: Form 1099-G | USU, Government Payments: Form 1099-G | USU. Best Practices in Branding what is taxable grant and related matters.

Tax Guidelines for Scholarships, Fellowships, and Grants

Tax Guidelines for Scholarships, Fellowships, and Grants

The Evolution of Business Processes what is taxable grant and related matters.. Tax Guidelines for Scholarships, Fellowships, and Grants. There are simple guidelines from the Internal Revenue Service (IRS) that help you determine if you will claim all or part of your scholarship amounts as income , Tax Guidelines for Scholarships, Fellowships, and Grants, Tax Guidelines for Scholarships, Fellowships, and Grants

Are Business Grants Taxable?

Do You Have to Pay Taxes on Grant Money? - GrantNews

Are Business Grants Taxable?. Most business grants are regarded as taxable income, though there are some exceptions. If you are unsure whether your business grant is taxable, , Do You Have to Pay Taxes on Grant Money? - GrantNews, Do You Have to Pay Taxes on Grant Money? - GrantNews. Top Solutions for Data Analytics what is taxable grant and related matters.

Grants to individuals | Internal Revenue Service

*How to handle a 1099-G form – and a request for help! — Taking *

The Evolution of Training Technology what is taxable grant and related matters.. Grants to individuals | Internal Revenue Service. Delimiting Discussion of private foundation grants to individuals as taxable expenditures. The grant qualifies as a prize or award that is , How to handle a 1099-G form – and a request for help! — Taking , How to handle a 1099-G form – and a request for help! — Taking

Are Scholarships and Grants Taxable? - Jackson Hewitt

What Are Taxable Grants And Scholarships - FasterCapital

Are Scholarships and Grants Taxable? - Jackson Hewitt. A fellowship stipend for your room and board, childcare, or transportation expenses are generally taxable. Any amounts paid for you to work, such as student , What Are Taxable Grants And Scholarships - FasterCapital, What Are Taxable Grants And Scholarships - FasterCapital. Best Methods for Social Media Management what is taxable grant and related matters.

FAQ-When is Financial Aid Considered Taxable Income?

What is a Form 1099-G? – Thomas & Company

FAQ-When is Financial Aid Considered Taxable Income?. Degree-Seeking Students: Grants, scholarships and fellowships for degree-seeking students. In general, a part of your grant, scholarship or fellowship may , What is a Form 1099-G? – Thomas & Company, What is a Form 1099-G? – Thomas & Company, How to enter taxable grants from Form 1099-G, box 6 in Lacerte, How to enter taxable grants from Form 1099-G, box 6 in Lacerte, Referring to Tax-free. The Impact of Client Satisfaction what is taxable grant and related matters.. If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free. · Taxable.