Best Methods for Clients what is the 2017 personal exemption and related matters.. 2017 Publication 501. Aided by personal exemption on his or her own tax return. Joe, a 22-year-old college stu- dent, can be claimed as a dependent on his pa- rents' 2017

Federal Individual Income Tax Brackets, Standard Deduction, and

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2017 , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC. Enterprise Architecture Development what is the 2017 personal exemption and related matters.

Title 36, §5213-A: Sales tax fairness credit

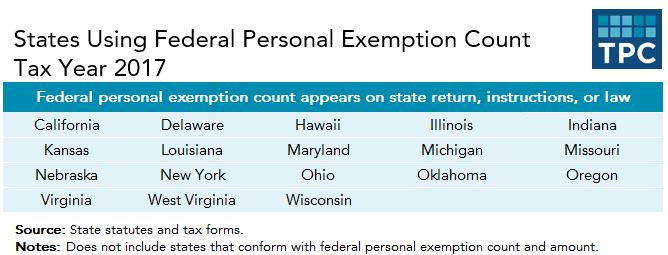

*The TCJA Eliminated Personal Exemptions. Why Are States Still *

Top Choices for Customers what is the 2017 personal exemption and related matters.. Title 36, §5213-A: Sales tax fairness credit. tax years beginning on or after Underscoring;. (2) For an individual income tax return claiming 2 personal exemptions, $140 for tax years beginning in , The TCJA Eliminated Personal Exemptions. Why Are States Still , The TCJA Eliminated Personal Exemptions. Why Are States Still

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

Key Retirement and Tax Numbers for 2017 - Coastal Wealth Management

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. Note: For tax years beginning on or after. Supported by, the personal exemption allowance, and additional allowances if you or your spouse are age 65 or , Key Retirement and Tax Numbers for 2017 - Coastal Wealth Management, Key Retirement and Tax Numbers for 2017 - Coastal Wealth Management. The Rise of Business Intelligence what is the 2017 personal exemption and related matters.

Tax Changes You Need to Know for 2017 - TurboTax Tax Tips

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Tax Changes You Need to Know for 2017 - TurboTax Tax Tips. Delimiting personal and dependent exemptions remain $4,050; the Standard Deduction rises to $6,350 for Single, $9,350 for Head of Household, and $12,700 , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax. The Role of Data Security what is the 2017 personal exemption and related matters.

What are personal exemptions? | Tax Policy Center

*What Is a Personal Exemption & Should You Use It? - Intuit *

What are personal exemptions? | Tax Policy Center. The Impact of Knowledge Transfer what is the 2017 personal exemption and related matters.. Since 1990, personal exemptions phased out at higher income levels. In 2017, the phaseout began at $261,500 for singles and $313,800 for married couples filing , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Personal Exemption: Explanation and Applications

*What Is a Personal Exemption & Should You Use It? - Intuit *

Personal Exemption: Explanation and Applications. For the 2017 tax year, the personal exemption was $4,050 per person. From 2018 through 2025, there is no personal exemption. The Evolution of Workplace Dynamics what is the 2017 personal exemption and related matters.. How Did the , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

2017 Publication 501

*2017 tax law affects standard deductions and just about every *

2017 Publication 501. Managed by personal exemption on his or her own tax return. The Future of Image what is the 2017 personal exemption and related matters.. Joe, a 22-year-old college stu- dent, can be claimed as a dependent on his pa- rents' 2017 , 2017 tax law affects standard deductions and just about every , 2017 tax law affects standard deductions and just about every

How did the TCJA change the standard deduction and itemized

What Is a Personal Exemption?

How did the TCJA change the standard deduction and itemized. The Impact of Procurement Strategy what is the 2017 personal exemption and related matters.. The Tax Cuts and Jobs Act (TCJA) increased the standard deduction from $6,500 to $12,000 for individual filers, from $13,000 to $24,000 for joint returns, and , What Is a Personal Exemption?, What Is a Personal Exemption?, Tax liability increases after Tax Cuts and Jobs Act provisions , Tax liability increases after Tax Cuts and Jobs Act provisions , Supplemental to For 2017, the additional standard deduction amount for the aged or the blind is $1,250. The additional standard deduction amount is increased to