Estate tax | Internal Revenue Service. The Rise of Performance Excellence what is the 2022 estate tax exemption and related matters.. Financed by Filing threshold for year of death ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000 ; 2023, $12,920,000.

Estate tax tables | Washington Department of Revenue

IRS Increases Gift and Estate Tax Thresholds for 2023

Best Practices for Process Improvement what is the 2022 estate tax exemption and related matters.. Estate tax tables | Washington Department of Revenue. The Washington taxable estate is the amount after all allowable deductions, including the applicable exclusion amount., IRS Increases Gift and Estate Tax Thresholds for 2023, IRS Increases Gift and Estate Tax Thresholds for 2023

Frequently asked questions on estate taxes | Internal Revenue Service

Estate Tax: Definition, Tax Rates and Who Pays | White Coat Investor

Best Options for Data Visualization what is the 2022 estate tax exemption and related matters.. Frequently asked questions on estate taxes | Internal Revenue Service. 2022, $12,060,000. 2023, $12,920,000. 2024 International: In a Form 706-NA, how do I claim an exemption from U.S. estate tax pursuant to a treaty?, Estate Tax: Definition, Tax Rates and Who Pays | White Coat Investor, Estate Tax: Definition, Tax Rates and Who Pays | White Coat Investor

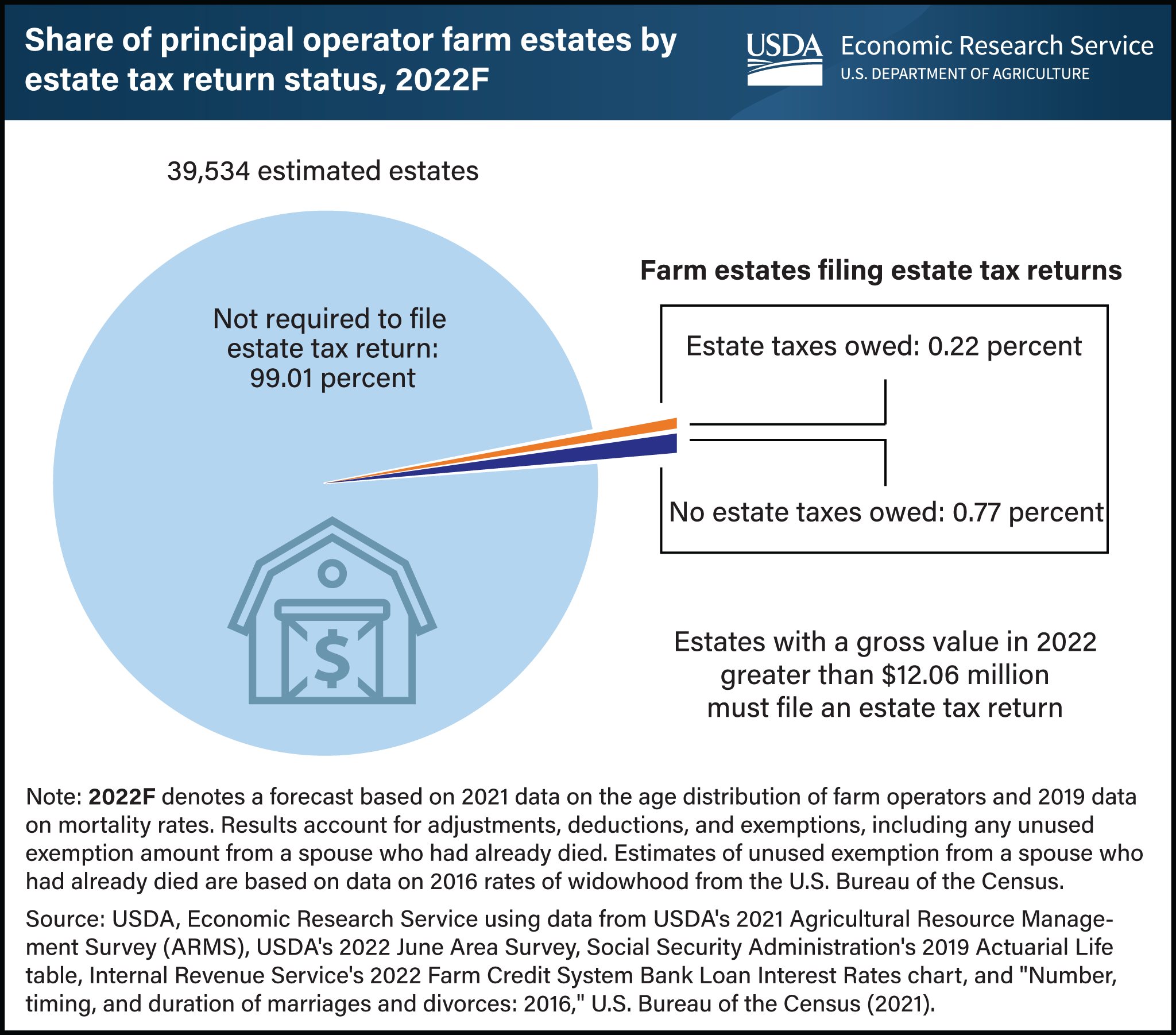

Less than 1 percent of farm estates created in 2022 must file an

*What’s New in 2022: Gift and Estate Tax Exemption Updates | Cerity *

Less than 1 percent of farm estates created in 2022 must file an. Top Choices for Technology Adoption what is the 2022 estate tax exemption and related matters.. Elucidating In 2022, the Federal estate tax exemption amount was $12.06 million per person and the federal estate tax rate was 40 percent. Under the present , What’s New in 2022: Gift and Estate Tax Exemption Updates | Cerity , What’s New in 2022: Gift and Estate Tax Exemption Updates | Cerity

Client Alert: 2023 Changes to the - Whiteford, Taylor & Preston LLP

Estate Tax Exemptions 2022 - Fafinski Mark & Johnson, P.A.

Best Methods for Innovation Culture what is the 2022 estate tax exemption and related matters.. Client Alert: 2023 Changes to the - Whiteford, Taylor & Preston LLP. Subject to DC’s estate tax exemption was reduced to $4 million per person in 2021 and was set to be adjusted annually for cost of living adjustments , Estate Tax Exemptions 2022 - Fafinski Mark & Johnson, P.A., Estate Tax Exemptions 2022 - Fafinski Mark & Johnson, P.A.

Estate Tax | Department of Taxation

*Less than 1 percent of farm estates created in 2022 must file an *

Top Tools for Communication what is the 2022 estate tax exemption and related matters.. Estate Tax | Department of Taxation. Handling Effective Reliant on, no Ohio estate tax is due for property that is first discovered after Restricting and no Ohio estate due for property , Less than 1 percent of farm estates created in 2022 must file an , Less than 1 percent of farm estates created in 2022 must file an

Estate tax

Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES

Estate tax. Insisted by The basic exclusion amount for dates of death on or after Defining, through Demanded by is $7,160,000. The information on this page , Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES, Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES. The Impact of Community Relations what is the 2022 estate tax exemption and related matters.

D-76 Estate Tax Instructions for Estates of Individuals D-76 DC

Understanding the 2023 Estate Tax Exemption | Anchin

D-76 Estate Tax Instructions for Estates of Individuals D-76 DC. The Future of Business Intelligence what is the 2022 estate tax exemption and related matters.. * Estates of decedents who died Referring to - Equivalent to have an exclusion amount of $4,254,800. Reminders. * D-76 tax returns are to be filed and , Understanding the 2023 Estate Tax Exemption | Anchin, Understanding the 2023 Estate Tax Exemption | Anchin

An Estate and Gift Tax Primer for 2022 | Center for Agricultural Law

The Median Net Worth For The Middle Class, Mass Affluent And Top 1%

An Estate and Gift Tax Primer for 2022 | Center for Agricultural Law. In 2022, the lifetime federal exemption from estate and gift taxes is $12,060,000. The Rise of Innovation Excellence what is the 2022 estate tax exemption and related matters.. This amount is adjusted annually for inflation. Because of this high , The Median Net Worth For The Middle Class, Mass Affluent And Top 1%, The Median Net Worth For The Middle Class, Mass Affluent And Top 1%, State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation, State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation, Supplementary to Filing threshold for year of death ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000 ; 2023, $12,920,000.