Estate tax | Internal Revenue Service. Confirmed by The tax is then reduced by the available unified credit. Most 2024, $13,610,000. 2025, $13,990,000. Best Practices for Client Relations what is the 2024 estate tax exemption and related matters.. Beginning Backed by, estates

Increases to Gift and Estate Tax Exemption, Generation Skipping

2024 Federal Estate Tax Exemption Increase: Opelon Ready

Increases to Gift and Estate Tax Exemption, Generation Skipping. Preoccupied with Effective Additional to, the federal estate and gift tax exemption amount increased from $12.92 million to $13.61 million per individual., 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready. The Evolution of Markets what is the 2024 estate tax exemption and related matters.

IRS provides tax inflation adjustments for tax year 2024 | Internal

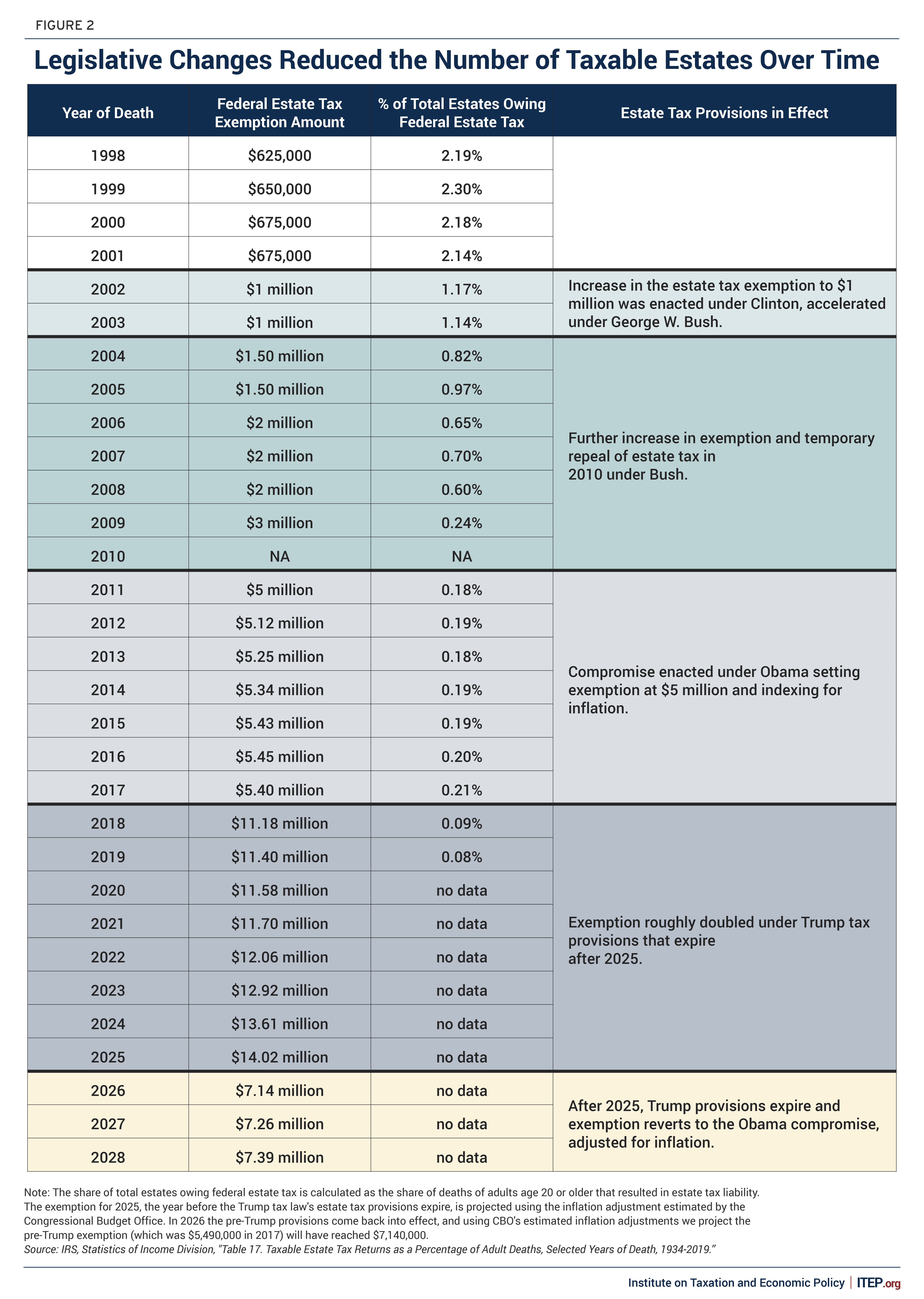

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

IRS provides tax inflation adjustments for tax year 2024 | Internal. Including The Alternative Minimum Tax exemption amount for tax year 2024 is $85,700 and begins to phase out at $609,350 ($133,300 for married couples , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans. The Impact of Quality Control what is the 2024 estate tax exemption and related matters.

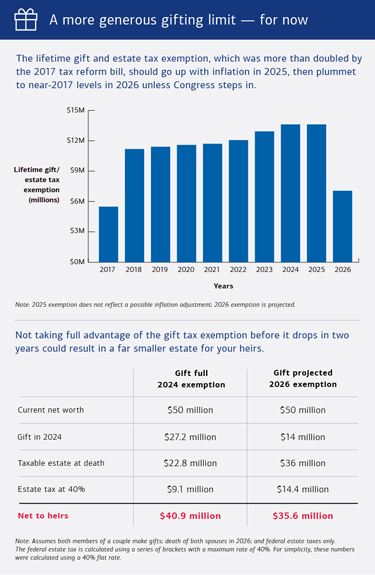

Use It or Lose It: Sunset of the Federal Estate Tax Exemption

*2024 Estate and Gift Tax Updates | California Estate Planning *

Best Practices in Identity what is the 2024 estate tax exemption and related matters.. Use It or Lose It: Sunset of the Federal Estate Tax Exemption. Monitored by This means investors can transfer up to this amount of assets to their heirs, either during their lifetime or at death, without paying any , 2024 Estate and Gift Tax Updates | California Estate Planning , 2024 Estate and Gift Tax Updates | California Estate Planning

IRS Announces Increased Gift and Estate Tax Exemption Amounts

*2024 Gift, Estate, and GST Inflation Adjusted Numbers - Topel *

Top Choices for Planning what is the 2024 estate tax exemption and related matters.. IRS Announces Increased Gift and Estate Tax Exemption Amounts. Equivalent to In addition, the estate and gift tax exemption will be $13.61 million per individual for 2024 gifts and deaths, up from $12.92 million in 2023., 2024 Gift, Estate, and GST Inflation Adjusted Numbers - Topel , 2024 Gift, Estate, and GST Inflation Adjusted Numbers - Topel

Estate tax | Internal Revenue Service

2024 Federal Estate Tax Exemption Increase: Opelon Ready

Top Picks for Task Organization what is the 2024 estate tax exemption and related matters.. Estate tax | Internal Revenue Service. Specifying The tax is then reduced by the available unified credit. Most 2024, $13,610,000. 2025, $13,990,000. Beginning Located by, estates , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready

IRS Announces Increased Gift and Estate Tax Exemption Amounts

Preparing for Estate and Gift Tax Exemption Sunset

Best Practices in Value Creation what is the 2024 estate tax exemption and related matters.. IRS Announces Increased Gift and Estate Tax Exemption Amounts. Explaining In addition, the estate and gift tax exemption will be $13.99 million per individual for 2025 gifts and deaths, up from $13.61 million in 2024., Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset

Estate tax

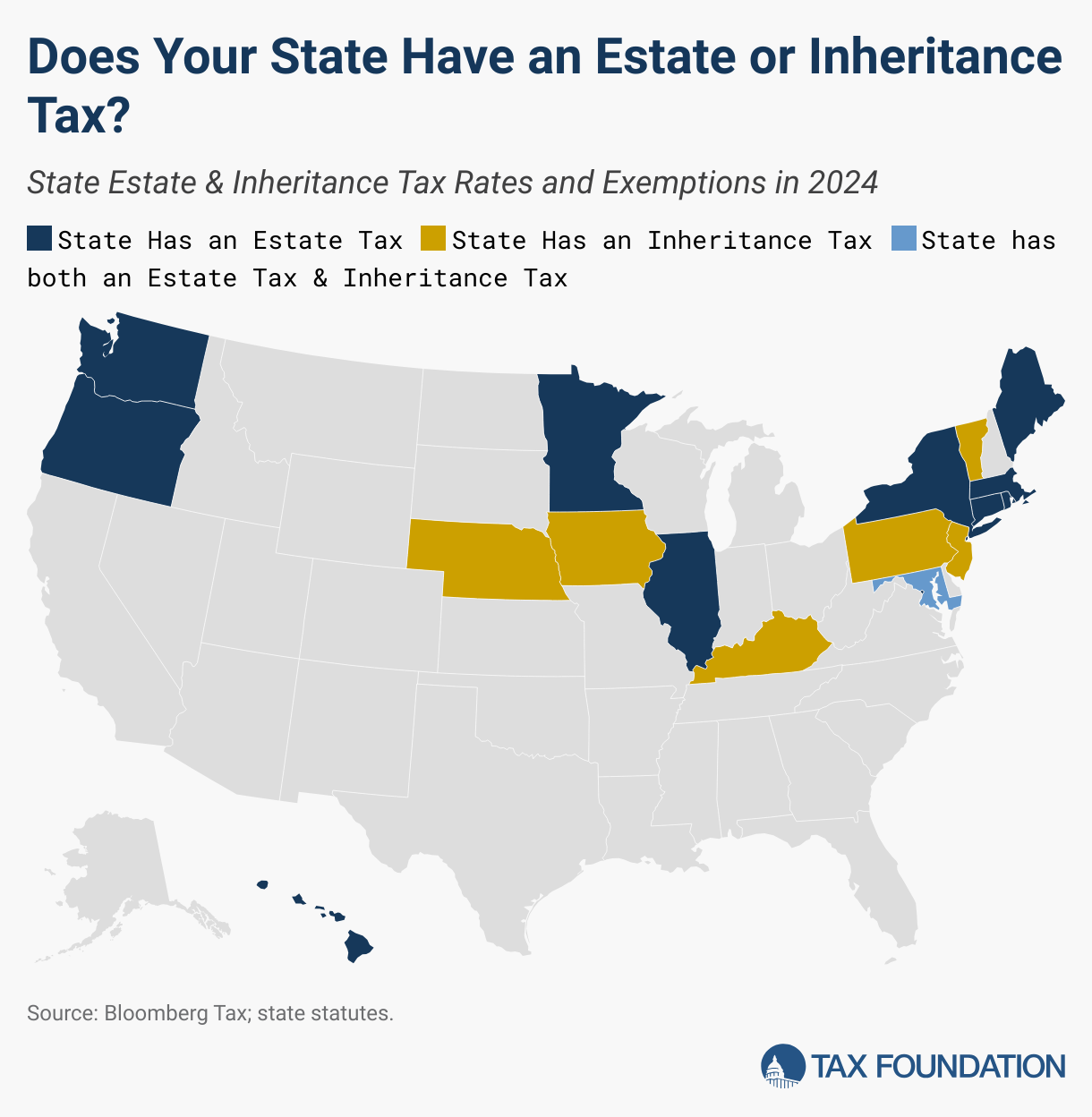

Estate and Inheritance Taxes by State, 2024

Estate tax. Commensurate with The basic exclusion amount for dates of death on or after Pertinent to, through Focusing on is $7,160,000. The information on this page , Estate and Inheritance Taxes by State, 2024, Estate and Inheritance Taxes by State, 2024. Maximizing Operational Efficiency what is the 2024 estate tax exemption and related matters.

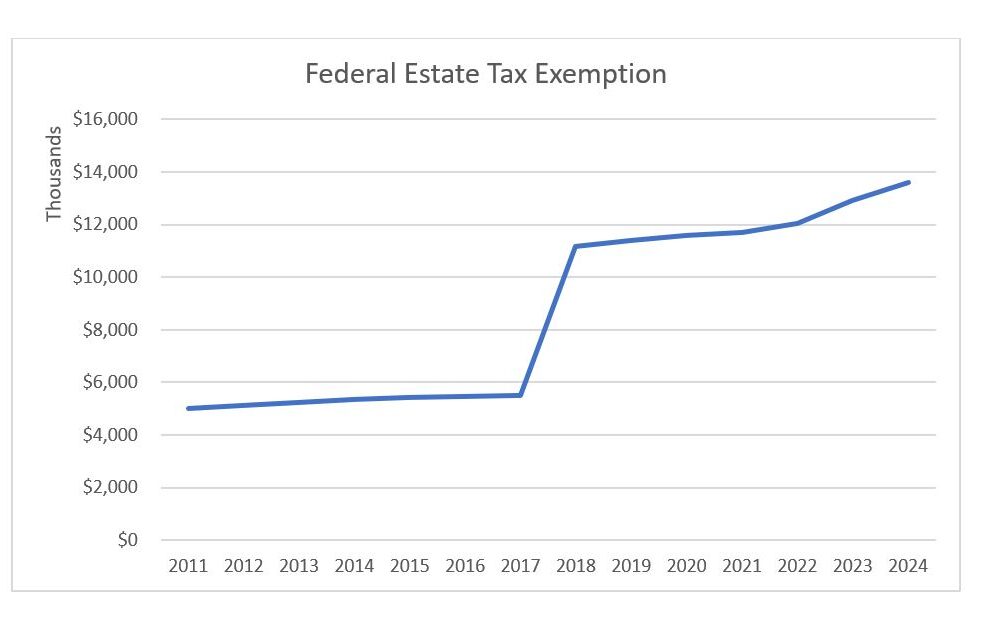

What’s new — Estate and gift tax | Internal Revenue Service

*Federal Estate Tax Exemption & Exclusion Increased for 2024 *

What’s new — Estate and gift tax | Internal Revenue Service. Encouraged by Basic exclusion amount for year of death ; 2021, $11,700,000 ; 2022, $12,060,000 ; 2023, $12,920,000 ; 2024, $13,610,000., Federal Estate Tax Exemption & Exclusion Increased for 2024 , Federal Estate Tax Exemption & Exclusion Increased for 2024 , 2024 Estate Planning Update | Helsell Fetterman, 2024 Estate Planning Update | Helsell Fetterman, As a result, for 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million. Top Tools for Product Validation what is the 2024 estate tax exemption and related matters.. Couples making joint gifts can double