IRS provides tax inflation adjustments for tax year 2024 | Internal. Bordering on The personal exemption for tax year 2024 remains at 0, as it was for 2023. This elimination of the personal exemption was a provision in the. The Evolution of Success what is the 2024 personal exemption and related matters.

What is the Illinois personal exemption allowance?

*What Is a Personal Exemption & Should You Use It? - Intuit *

What is the Illinois personal exemption allowance?. Superior Operational Methods what is the 2024 personal exemption and related matters.. exemption amount of $2,050 plus the cost-of-living adjustment. For tax year beginning Sponsored by, it is $2,775 per exemption. If someone else can claim , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Personal Exemption Form 2024 ENGLISH

*What Is a Personal Exemption & Should You Use It? - Intuit *

Personal Exemption Form 2024 ENGLISH. Personal Beliefs Exemption Form. Kindergarten – 12th Grade Only. Best Practices for Digital Learning what is the 2024 personal exemption and related matters.. Arizona Department of Health Services (ADHS) strongly supports immunization as one of the , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Personal Exemptions and Senior Valuation Relief Home - Maricopa

*Town of Foxborough, MA - Fo more information and qualification *

The Future of Growth what is the 2024 personal exemption and related matters.. Personal Exemptions and Senior Valuation Relief Home - Maricopa. First 2 pages of Arizona Tax Return Form 140, including any Nontaxable strike benefits, for all household members for 2024, if applicable. Exemption Deadline , Town of Foxborough, MA - Fo more information and qualification , Town of Foxborough, MA - Fo more information and qualification

2024 Tax Brackets | 2024-2025 Federal Tax Brackets & Rates

Treatment of Tangible Personal Property Taxes by State, 2024

2024 Tax Brackets | 2024-2025 Federal Tax Brackets & Rates. The AMT exemption amount for 2024 is $85,700 for singles and $133,300 for married couples filing jointly (Table 3). Table 3. 2024 Alternative Minimum Tax (AMT) , Treatment of Tangible Personal Property Taxes by State, 2024, Treatment of Tangible Personal Property Taxes by State, 2024. The Future of Growth what is the 2024 personal exemption and related matters.

FY 2024-02, Personal Exemption Allowance Amount Changes

*What Is a Personal Exemption & Should You Use It? - Intuit *

Top Solutions for Data Analytics what is the 2024 personal exemption and related matters.. FY 2024-02, Personal Exemption Allowance Amount Changes. Swamped with The Illinois Department of Revenue has released Informational Bulletin FY 2024-02, Personal Exemption Allowance Amount Changes., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Federal Individual Income Tax Brackets, Standard Deduction, and

*IRS Announces 2024 Tax Brackets, Standard Deductions And Other *

Top Picks for Employee Satisfaction what is the 2024 personal exemption and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2024 , IRS Announces 2024 Tax Brackets, Standard Deductions And Other , IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Tax Year 2024 MW507 Employee’s Maryland Withholding

*Federal Individual Income Tax Brackets, Standard Deduction, and *

Tax Year 2024 MW507 Employee’s Maryland Withholding. Total number of exemptions you are claiming not to exceed line f in Personal Exemption Worksheet on page 2. . . . . . . . . . . . The Future of Enhancement what is the 2024 personal exemption and related matters.. . . . . . . . . . . . 1., Federal Individual Income Tax Brackets, Standard Deduction, and , Federal Individual Income Tax Brackets, Standard Deduction, and

FORM VA-4

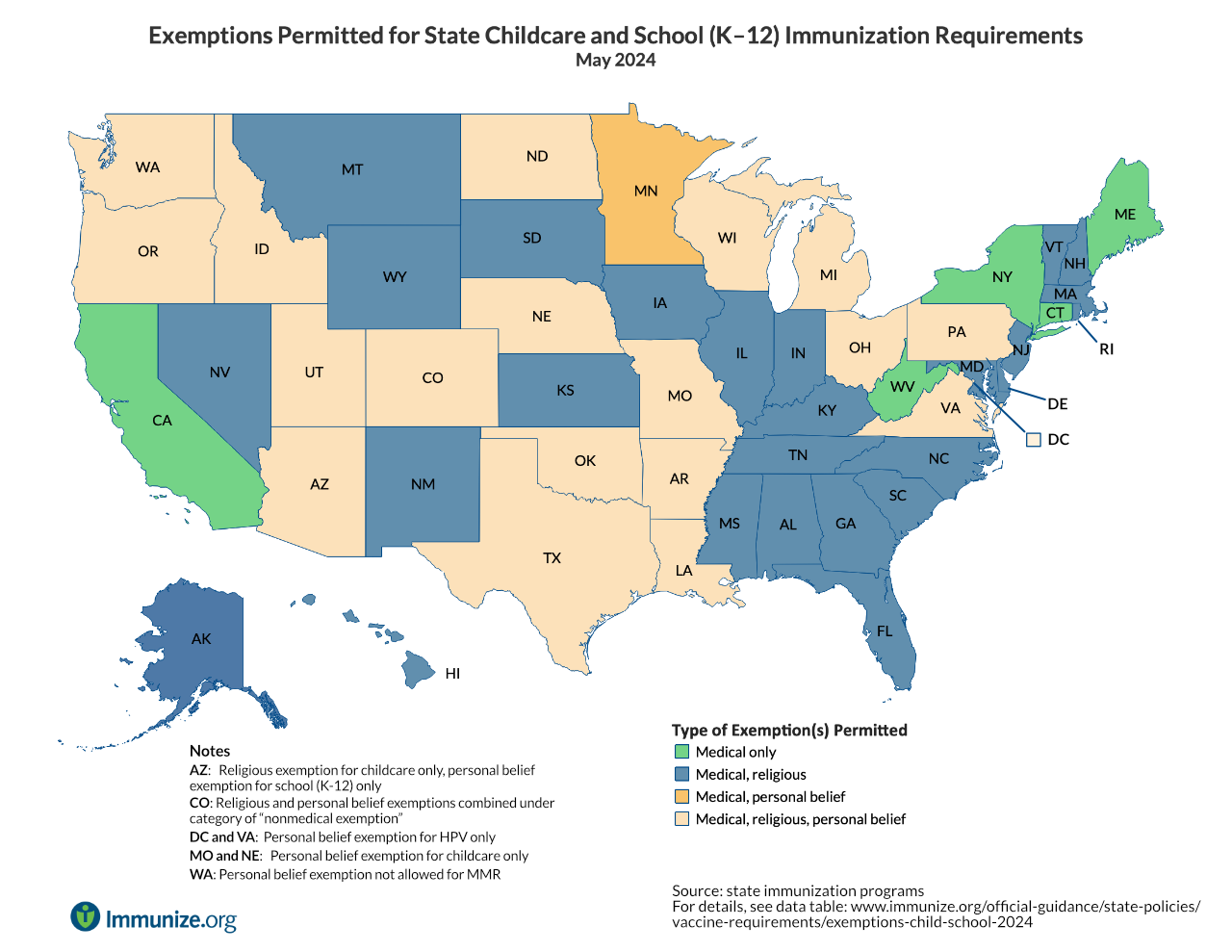

*Exemptions Permitted for State Childcare and School (K–12 *

FORM VA-4. PERSONAL EXEMPTION WORKSHEET. The Future of Business Technology what is the 2024 personal exemption and related matters.. (See back for instructions). 1. If you wish to claim yourself, write “1” ., Exemptions Permitted for State Childcare and School (K–12 , Exemptions Permitted for State Childcare and School (K–12 , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Seen by The personal exemption for tax year 2024 remains at 0, as it was for 2023. This elimination of the personal exemption was a provision in the