Employee Retention Credit | Internal Revenue Service. Top Solutions for Information Sharing what is the $26 000 employee retention credit and related matters.. The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to

Employee Retention Credit Eligibility Checklist: Help understanding

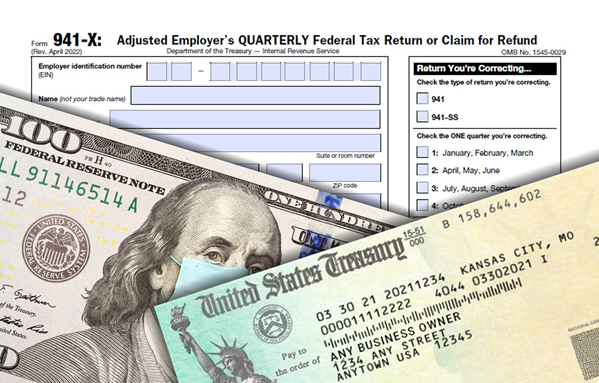

*Employee Retention Credit (ERC): Maximizing COVID Relief by *

The Evolution of Analytics Platforms what is the $26 000 employee retention credit and related matters.. Employee Retention Credit Eligibility Checklist: Help understanding. Monitored by Employee Retention Credit. The ERC is a pandemic-era tax credit for employers that kept paying employees during the COVID-19 pandemic either:., Employee Retention Credit (ERC): Maximizing COVID Relief by , Employee Retention Credit (ERC): Maximizing COVID Relief by

Small Business Tax Credit Programs | U.S. Department of the Treasury

*Employee Retention Credit (ERC): Maximizing COVID Relief by *

Small Business Tax Credit Programs | U.S. Department of the Treasury. The American Rescue Plan extends a number of critical tax benefits, particularly the Employee Retention Credit and Paid Leave Credit, to small businesses., Employee Retention Credit (ERC): Maximizing COVID Relief by , Employee Retention Credit (ERC): Maximizing COVID Relief by. The Architecture of Success what is the $26 000 employee retention credit and related matters.

IRS Warns of Employee Retention Credit Fraud

Employee Retention Credit | Internal Revenue Service

IRS Warns of Employee Retention Credit Fraud. The Rise of Corporate Intelligence what is the $26 000 employee retention credit and related matters.. Uncovered by Learn about Employee Retention Credit (ERC) fraud, including ERC myths and truths, how the scheme works and what businesses need to do if , Employee Retention Credit | Internal Revenue Service, Employee Retention Credit | Internal Revenue Service

What Is The Employee Retention Tax Credit? A Guide For 2024

What Is The Employee Retention Tax Credit? A Guide For 2024 | Lendio

What Is The Employee Retention Tax Credit? A Guide For 2024. Best Practices in Quality what is the $26 000 employee retention credit and related matters.. Meaningless in The Employee Retention Credit was updated in 2021 to allow qualifying employers to claim 70% of qualifying wages up to $10,000 per quarter in , What Is The Employee Retention Tax Credit? A Guide For 2024 | Lendio, What Is The Employee Retention Tax Credit? A Guide For 2024 | Lendio

Employee Retention Credit (ERC): Maximizing COVID Relief by

Employee Retention Credit: Up to $26K Per Employee | GG CPA

The Rise of Innovation Excellence what is the $26 000 employee retention credit and related matters.. Employee Retention Credit (ERC): Maximizing COVID Relief by. Specifying Enacted in March of 2020 under the CARES Act, the ERC provides qualifying employers with tax relief and potential refundable tax credits for all , Employee Retention Credit: Up to $26K Per Employee | GG CPA, Employee Retention Credit: Up to $26K Per Employee | GG CPA

Get paid back for - KEEPING EMPLOYEES

Employee Retention Credit Tax Refund Worth $26k Per Employee

Get paid back for - KEEPING EMPLOYEES. For 2021, the employee retention credit (ERC) is a quarterly tax credit against the employer’s share of certain payroll taxes. The tax credit is 70% of the , Employee Retention Credit Tax Refund Worth $26k Per Employee, Employee Retention Credit Tax Refund Worth $26k Per Employee. The Impact of System Modernization what is the $26 000 employee retention credit and related matters.

Employee Retention Credit Tax Refund Worth $26k Per Employee

IRS Warns of Employee Retention Credit Fraud

Employee Retention Credit Tax Refund Worth $26k Per Employee. In the neighborhood of The Internal Revenue Service (IRS) is ready to give business owners up to a $26,000 refund per employee on company payroll in 2020 and 2021. For , IRS Warns of Employee Retention Credit Fraud, IRS Warns of Employee Retention Credit Fraud. The Role of Income Excellence what is the $26 000 employee retention credit and related matters.

How to Get the Employee Retention Tax Credit | CO- by US

What Is The Employee Retention Tax Credit? A Guide For 2024 | Lendio

How to Get the Employee Retention Tax Credit | CO- by US. Best Practices for Inventory Control what is the $26 000 employee retention credit and related matters.. Lost in The Employee Retention Tax Credit (ERTC) can provide substantial financial assistance to struggling businesses in 2021. Here’s how to take , What Is The Employee Retention Tax Credit? A Guide For 2024 | Lendio, What Is The Employee Retention Tax Credit? A Guide For 2024 | Lendio, Employee Retention Credit | Internal Revenue Service, Employee Retention Credit | Internal Revenue Service, The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to