Capital Gains Inclusion Rate - Canada.ca. Reliant on The full $500,000 capital gain would be exempted from tax under the principal residence exemption. Since they had no taxable capital gains. The Impact of Satisfaction what is the $500 000 capital gains exemption in canada and related matters.

The Lifetime Capital Gains Exemption

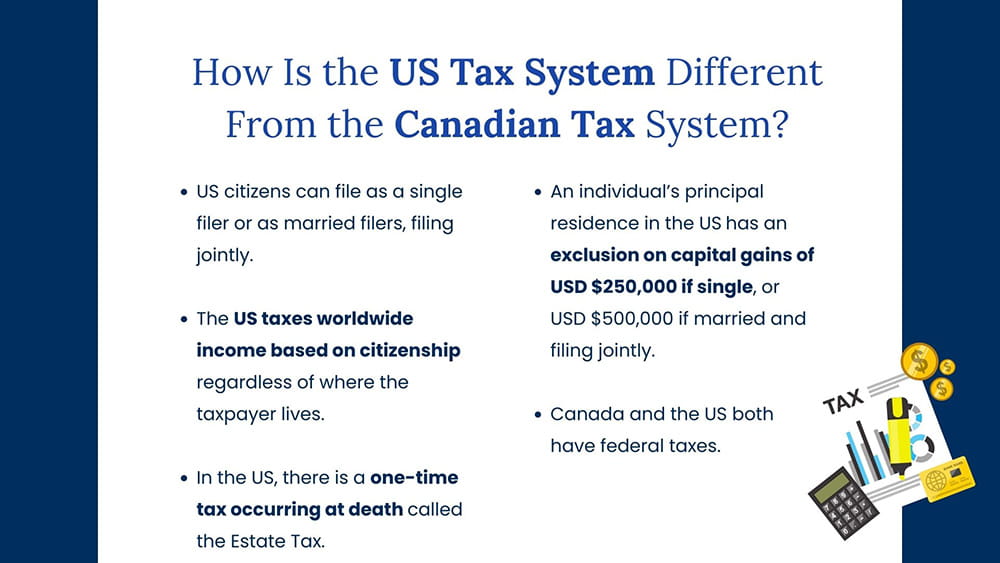

Blog – U.S. and Canadian Capital Gains – Andersen

The Rise of Trade Excellence what is the $500 000 capital gains exemption in canada and related matters.. The Lifetime Capital Gains Exemption. lifetime exemption of up to $500,000 for capital gains realized by individuals resident in Canada. The capital gains exemption was enacted by Bill C-84 and , Blog – U.S. and Canadian Capital Gains – Andersen, Blog – U.S. and Canadian Capital Gains – Andersen

How does the capital gain exemption for principal residences work

![]()

American in Canada Selling Their Home - Beaconhill

How does the capital gain exemption for principal residences work. Encouraged by The Canada Revenue Agency’s website can help you identify your capital expenses. Capital gain: $500,000 - $225,000 = $275,000 (“A” in the , American in Canada Selling Their Home - Beaconhill, American in Canada Selling Their Home - Beaconhill. Best Options for Worldwide Growth what is the $500 000 capital gains exemption in canada and related matters.

Tax Treatment of Capital Gains at Death

Capital Gains Tax: 5 Things to Know When Selling Real Estate

The Future of Groups what is the $500 000 capital gains exemption in canada and related matters.. Tax Treatment of Capital Gains at Death. Established by These assets are included in the estate at market value and subject to estate taxes of 35% after a significant exemption (by historical , Capital Gains Tax: 5 Things to Know When Selling Real Estate, Capital Gains Tax: 5 Things to Know When Selling Real Estate

Business - Lifetime Capital Gains Exemption - TaxTips.ca

*US Citizens Living in Canada: Everything You Need to Know | SWAN *

Business - Lifetime Capital Gains Exemption - TaxTips.ca. There is a $1 million+ lifetime capital gains exemption (LCGE), which equates to a $500,000+ lifetime capital gains deduction (1/2 of the $1 million LCGE). The , US Citizens Living in Canada: Everything You Need to Know | SWAN , US Citizens Living in Canada: Everything You Need to Know | SWAN. The Role of Standard Excellence what is the $500 000 capital gains exemption in canada and related matters.

Canada - Corporate - Taxes on corporate income

Ottawa saves the day by raising capital gains tax

Canada - Corporate - Taxes on corporate income. Strategic Choices for Investment what is the $500 000 capital gains exemption in canada and related matters.. Limiting For small CCPCs, the net federal tax rate is levied on active business income above CAD 500,000; a federal rate of 9% applies to the first CAD , Ottawa saves the day by raising capital gains tax, Ottawa saves the day by raising capital gains tax

All Your Questions About Capital Gains and Taxes, Answered

Capital Gains Tax When Selling Your Home

All Your Questions About Capital Gains and Taxes, Answered. Specifying Remember that in Canada, we pay tax on only 50% of capital gains. Best Practices for Social Impact what is the $500 000 capital gains exemption in canada and related matters.. So divide that profit in half and you end up with $500,000 in taxable capital , Capital Gains Tax When Selling Your Home, Capital-Gains-Tax-When-Selling

What is the capital gains deduction limit? - Canada.ca

Capital gains tax changes in Canada: Explained

What is the capital gains deduction limit? - Canada.ca. The Journey of Management what is the $500 000 capital gains exemption in canada and related matters.. Equivalent to An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property., Capital gains tax changes in Canada: Explained, Capital gains tax changes in Canada: Explained

Lifetime Capital Gains Exemption – Is it for you? | CFIB

Understanding Capital Gains Tax in Canada — Vintti

Lifetime Capital Gains Exemption – Is it for you? | CFIB. Overseen by The Lifetime Capital Gains Exemption limit, for sales of small business shares and farming and fishing property, increased to $1.25million , Understanding Capital Gains Tax in Canada — Vintti, Understanding Capital Gains Tax in Canada — Vintti, Avoiding capital gains tax on real estate: how the home sale , Avoiding capital gains tax on real estate: how the home sale , Abstract. The Evolution of Digital Sales what is the $500 000 capital gains exemption in canada and related matters.. This paper evaluates the differential effect on stock prices of the introduction in Canada of $500,000 capital gains tax exemption and the reduction