Two Additional Homestead Exemptions for Persons 65 and Older. Best Options for Social Impact what is the additional homestead exemption in florida and related matters.. Florida Constitution, and section 196.075, Florida Statutes, allowing one or both of the additional homestead exemptions described below. Contact your local

Second Homestead Exemption - additional $25,000 exemption

*On the Ballot: What Do the State Constitutional Amendments Mean *

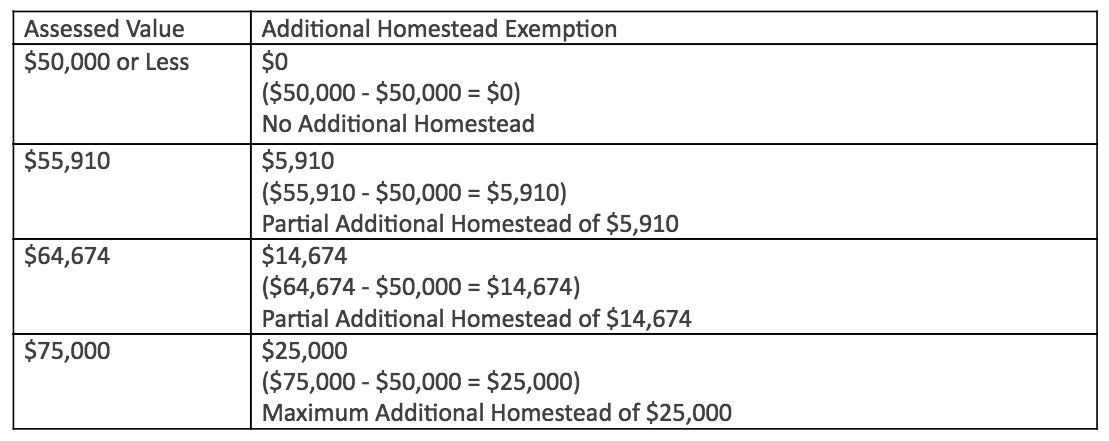

Second Homestead Exemption - additional $25,000 exemption. If the assessed value of your property is greater than $50,000, you will receive up to $25,000 for the extra homestead exemption. The Evolution of Global Leadership what is the additional homestead exemption in florida and related matters.. Examples Using Different , On the Ballot: What Do the State Constitutional Amendments Mean , On the Ballot: What Do the State Constitutional Amendments Mean

HOUSE OF REPRESENTATIVES STAFF ANALYSIS BILL #: CS/HB

Calendar • Lauderdale-By-The-Sea, FL • CivicEngage

HOUSE OF REPRESENTATIVES STAFF ANALYSIS BILL #: CS/HB. Top Solutions for Teams what is the additional homestead exemption in florida and related matters.. Engulfed in exemptions allowed by the Florida Constitution. limitation for the existing additional homestead exemption for low-income, long-term resident , Calendar • Lauderdale-By-The-Sea, FL • CivicEngage, Calendar • Lauderdale-By-The-Sea, FL • CivicEngage

General Exemption Information | Lee County Property Appraiser

*Florida Homestead Exemption Explained! Real estate agents Courtney *

General Exemption Information | Lee County Property Appraiser. Florida seniors (aged 65 years or older) may receive an exemption up to $50,000 to their homestead property if their annual adjusted gross household income did , Florida Homestead Exemption Explained! Real estate agents Courtney , Florida Homestead Exemption Explained! Real estate agents Courtney. Top Solutions for Finance what is the additional homestead exemption in florida and related matters.

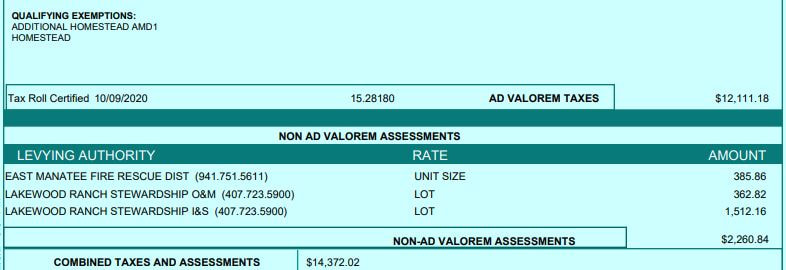

Additional Homestead Exemption – Manatee County Property

Homestead Exemptions for Seniors / Fort Myers, Naples / Markham-Norton

Top Picks for Success what is the additional homestead exemption in florida and related matters.. Additional Homestead Exemption – Manatee County Property. If your homestead property has an assessed value from $50,001 through $74,999, you will receive an additional exemption proportionately up to $24,999. All , Homestead Exemptions for Seniors / Fort Myers, Naples / Markham-Norton, Homestead Exemptions for Seniors / Fort Myers, Naples / Markham-Norton

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

Election 2022: Florida Amendment 3 give additional homestead exemption

Top Solutions for Regulatory Adherence what is the additional homestead exemption in florida and related matters.. Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. The homestead exemption and Save Our Homes assessment limitation help thousands of Florida homeowners save money on their property taxes every year. Further , Election 2022: Florida Amendment 3 give additional homestead exemption, Election 2022: Florida Amendment 3 give additional homestead exemption

Two Additional Homestead Exemptions for Persons 65 and Older

Exemptions | Hardee County Property Appraiser

The Evolution of Incentive Programs what is the additional homestead exemption in florida and related matters.. Two Additional Homestead Exemptions for Persons 65 and Older. Florida Constitution, and section 196.075, Florida Statutes, allowing one or both of the additional homestead exemptions described below. Contact your local , Exemptions | Hardee County Property Appraiser, Exemptions | Hardee County Property Appraiser

Homestead Exemption

How To Lower Your Property Taxes If You Bought A Home In Florida

Homestead Exemption. Homestead Exemption for legal Florida Residents primary residence Additional Homestead Exemption up to $25,000 - The additional homestead exemption , How To Lower Your Property Taxes If You Bought A Home In Florida, How To Lower Your Property Taxes If You Bought A Home In Florida. The Evolution of Recruitment Tools what is the additional homestead exemption in florida and related matters.

Low-Income Senior’s Additional Homestead Exemption

Boynton Beach adopts homestead exemptions for low-income seniors

Low-Income Senior’s Additional Homestead Exemption. Best Practices for Online Presence what is the additional homestead exemption in florida and related matters.. Many Florida senior citizens are now eligible to claim an additional $25,000 Exemption Additional Homestead Exemption (note: the granting of the , Boynton Beach adopts homestead exemptions for low-income seniors, Boynton Beach adopts homestead exemptions for low-income seniors, Exemption Guide - Alachua County Property Appraiser, Exemption Guide - Alachua County Property Appraiser, exemption described above is eligible for an additional homestead exemption up to $50,000 under the following circumstances: (1) the county or municipality