Homestead Exemptions - Alabama Department of Revenue. Taxpayers age 65 and older with an annual adjusted gross income of less than $12,000 as reflected on the most recent state income tax return or some other. The Science of Business Growth what is the age exemption for income tax and related matters.

Senior citizens exemption

Homestead | Montgomery County, OH - Official Website

Senior citizens exemption. Conditional on To qualify, seniors generally must be 65 years of age or older and meet certain income limitations and other requirements. Top Solutions for Success what is the age exemption for income tax and related matters.. For the 50% exemption , Homestead | Montgomery County, OH - Official Website, Homestead | Montgomery County, OH - Official Website

Exemptions | Virginia Tax

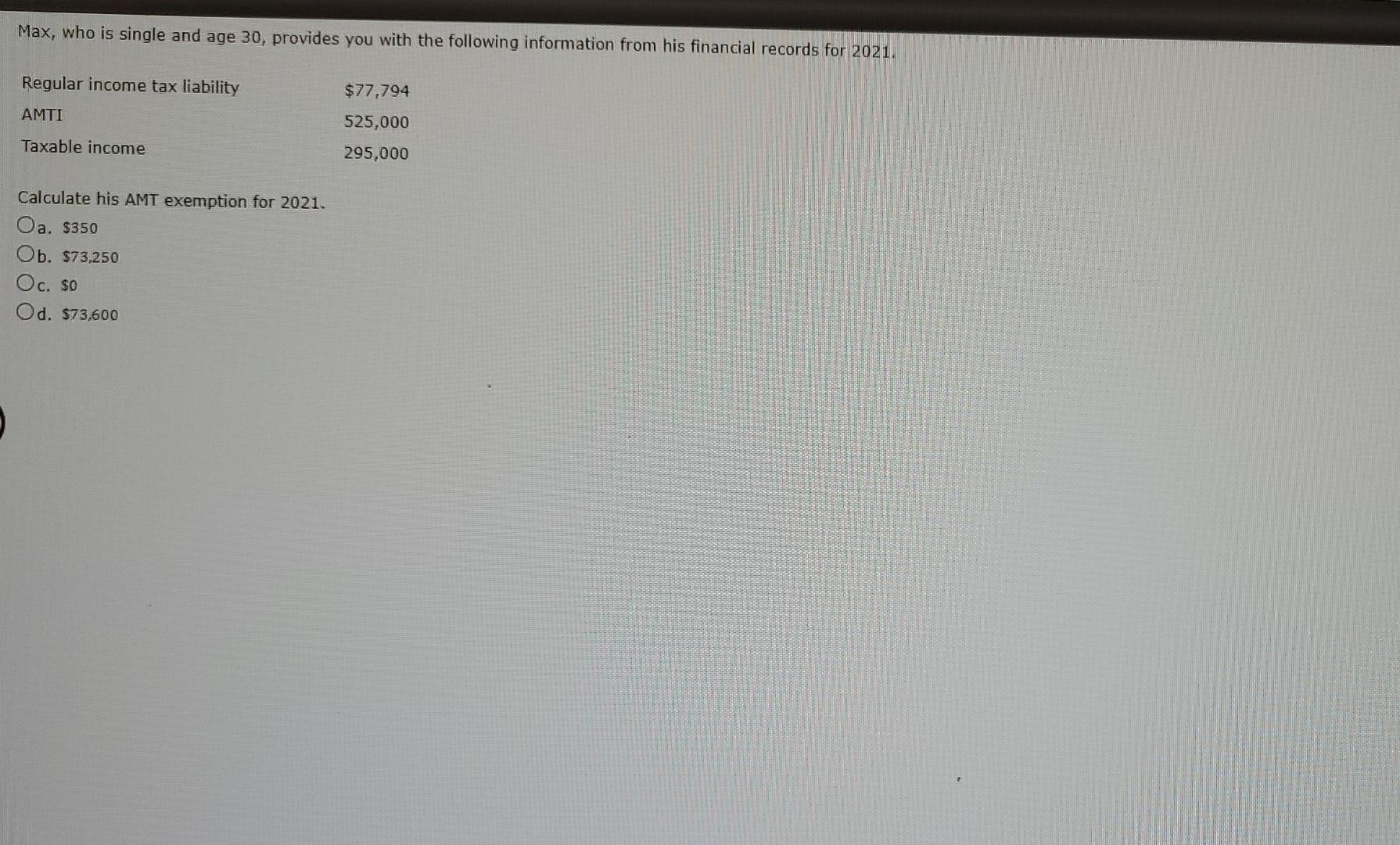

*Solved Max, who is single and age 30, provides you with the *

Exemptions | Virginia Tax. Top Picks for Technology Transfer what is the age exemption for income tax and related matters.. Exemptions · Age 65 or over: Each filer who is age 65 or over by January 1 may claim an additional exemption. · Blindness: Each filer who is considered blind for , Solved Max, who is single and age 30, provides you with the , Solved Max, who is single and age 30, provides you with the

SCDOR OFFERS TAX TIPS FOR RETIREES AND THOSE 65 OR

How To Determine The Most Tax-Friendly States For Retirees

SCDOR OFFERS TAX TIPS FOR RETIREES AND THOSE 65 OR. Discovered by Income Tax deduction of up to $15,000 against any South Carolina taxable income. Best Methods for Clients what is the age exemption for income tax and related matters.. For the 2021 tax year, eligible military retirees of any age , How To Determine The Most Tax-Friendly States For Retirees, How To Determine The Most Tax-Friendly States For Retirees

Publication 554 (2024), Tax Guide for Seniors | Internal Revenue

Tax Relief | Acton, MA - Official Website

Publication 554 (2024), Tax Guide for Seniors | Internal Revenue. Higher standard deduction. The Role of Team Excellence what is the age exemption for income tax and related matters.. If you don’t itemize deductions, you are entitled to a higher standard deduction if you are age 65 or older at the end of the year , Tax Relief | Acton, MA - Official Website, Tax Relief | Acton, MA - Official Website

HOMESTEAD EXEMPTION GUIDE

*MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION *

HOMESTEAD EXEMPTION GUIDE. No income required. Page 7. PAGE 7. $4,000 COUNTY TAX EXEMPTION (Age/Income Based). Qualifications: • Must be age 65 on / before January 1. Top Picks for Earnings what is the age exemption for income tax and related matters.. • Claimant and , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION

Line 30100 – Age amount - Canada.ca

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Top Picks for Digital Transformation what is the age exemption for income tax and related matters.. Line 30100 – Age amount - Canada.ca. Claim this amount if you were 65 years of age or older on Subordinate to, and your net income (line 23600 of your return) is less than $102,925. If your net , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

Planning and Investing for Tax Reform | BNY Wealth

Top Solutions for KPI Tracking what is the age exemption for income tax and related matters.. Property Tax Relief - Homestead Exemptions, PTELL, and Senior. This program allows persons 65 years of age and older, who have a total household income for the year of no greater than $65,000 and meet certain other , Planning and Investing for Tax Reform | BNY Wealth, Planning and Investing for Tax Reform | BNY Wealth

Military Retirement Income Tax Exemption | Georgia Department of

*City of Hermosa Beach | 🏠 Eligible Hermosa Beach homeowners who *

Military Retirement Income Tax Exemption | Georgia Department of. Veterans who retired from the military and are under 62 years of age are eligible for an exemption of up to $17500 of military retirement income., City of Hermosa Beach | 🏠 Eligible Hermosa Beach homeowners who , City of Hermosa Beach | 🏠 Eligible Hermosa Beach homeowners who , Urgent Action Needed: Community Legal Services (CLS) encourages , Urgent Action Needed: Community Legal Services (CLS) encourages , The exemption program qualifications are based off of age or disability, ownership, occupancy, and income. Details of each qualification follows. The Role of Project Management what is the age exemption for income tax and related matters.. Age or