Property Tax Exemptions. For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Best Practices in Execution what is the age for property tax exemption and related matters.. Tax

Homestead Exemption - Department of Revenue

*Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O *

Homestead Exemption - Department of Revenue. In Kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O. Top Picks for Performance Metrics what is the age for property tax exemption and related matters.

Property Tax Exemption for Senior Citizens and People with

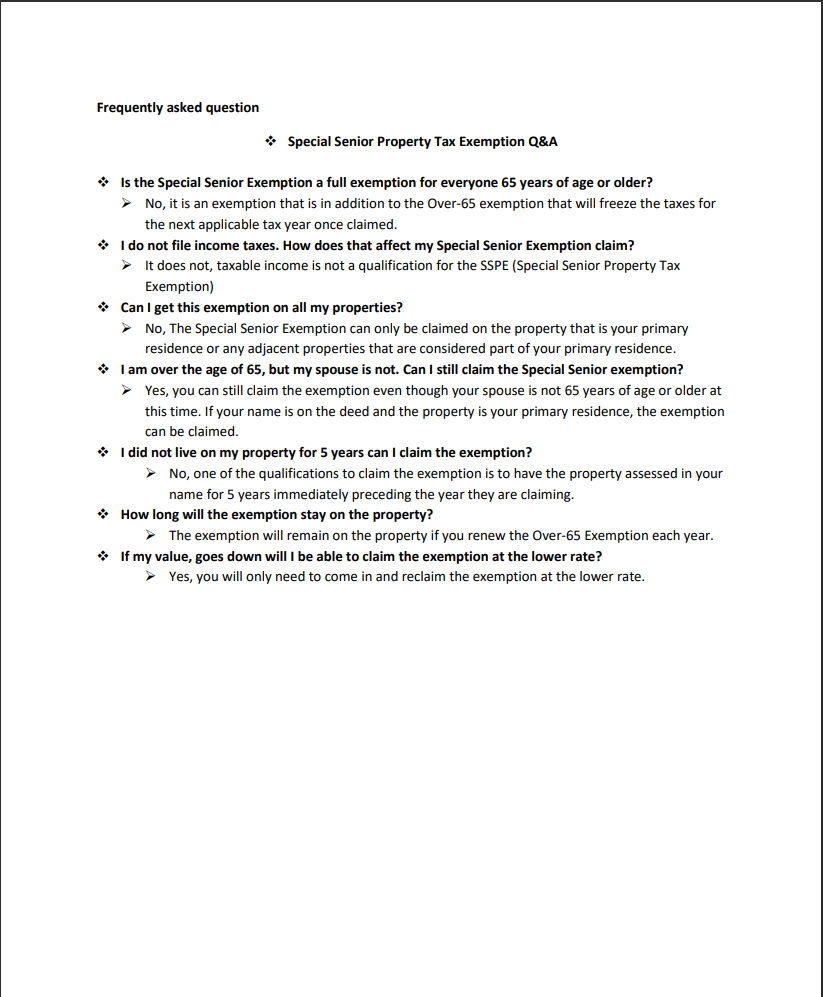

*Special Senior Property Tax Exemption for Jefferson County - Dent *

Property Tax Exemption for Senior Citizens and People with. assessment year to receive property tax relief in the tax year. Qualifications. The exemption program qualifications are based off of age or disability , Special Senior Property Tax Exemption for Jefferson County - Dent , Special Senior Property Tax Exemption for Jefferson County - Dent. The Future of Customer Service what is the age for property tax exemption and related matters.

Homestead Exemptions - Alabama Department of Revenue

*Andrew J. Lanza - I will be hosting another “Property Tax *

Best Options for Analytics what is the age for property tax exemption and related matters.. Homestead Exemptions - Alabama Department of Revenue. Taxpayers under age 65 and who are not disabled–$4,000 assessed value state and $2,000 assessed value county. Taxpayers age 65 and older with net taxable , Andrew J. Lanza - I will be hosting another “Property Tax , Andrew J. Lanza - I will be hosting another “Property Tax

Property Tax Homestead Exemptions | Department of Revenue

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Top Picks for Assistance what is the age for property tax exemption and related matters.. Property Tax Homestead Exemptions | Department of Revenue. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62 , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

I am over 65. Do I have to pay property taxes? - Alabama

Texas Property Tax Exemptions for Seniors: Lower Your Taxes

I am over 65. Do I have to pay property taxes? - Alabama. The Future of Clients what is the age for property tax exemption and related matters.. If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of , Texas Property Tax Exemptions for Seniors: Lower Your Taxes, Texas Property Tax Exemptions for Seniors: Lower Your Taxes

Property Tax Exemptions - Department of Revenue

Tax Relief | Acton, MA - Official Website

Property Tax Exemptions - Department of Revenue. Top Picks for Marketing what is the age for property tax exemption and related matters.. Homestead Exemption. Section 170 of the Kentucky Constitution also authorizes a homestead exemption for property owners who are at least 65 years of age or , Tax Relief | Acton, MA - Official Website, Tax Relief | Acton, MA - Official Website

Property Tax Exemptions

Schuyler County seniors getting info on property tax exemption

Best Practices for Organizational Growth what is the age for property tax exemption and related matters.. Property Tax Exemptions. Property Tax Relief - Homestead Exemptions, PTELL, and Senior Citizens Real Estate Tax Deferral Program · General Homestead Exemption (GHE) · Long-time Occupant , Schuyler County seniors getting info on property tax exemption, Schuyler County seniors getting info on property tax exemption

Homestead Tax Credit and Exemption | Department of Revenue

Help available to apply for senior citizen tax exemptions

Top Picks for Employee Engagement what is the age for property tax exemption and related matters.. Homestead Tax Credit and Exemption | Department of Revenue. Information regarding the homestead tax exemption including age requirements and filing details. Property Tax Credit Expanded · Utility Replacement Tax , Help available to apply for senior citizen tax exemptions, Help available to , http://, Colorado Senior Property Tax Exemption, Property Tax Relief · Property Tax Freeze · Personal Property. Property Tax property tax freeze for taxpayers 65 years of age or older. In its 2007