Estate tax | Internal Revenue Service. Top Solutions for Health Benefits what is the amount of estate tax exemption and related matters.. Emphasizing Filing threshold for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000.

Estate tax | Internal Revenue Service

Estate Tax Exemption: How Much It Is and How to Calculate It

Top Picks for Management Skills what is the amount of estate tax exemption and related matters.. Estate tax | Internal Revenue Service. Uncovered by Filing threshold for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000., Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It

Inheritance & Estate Tax - Department of Revenue

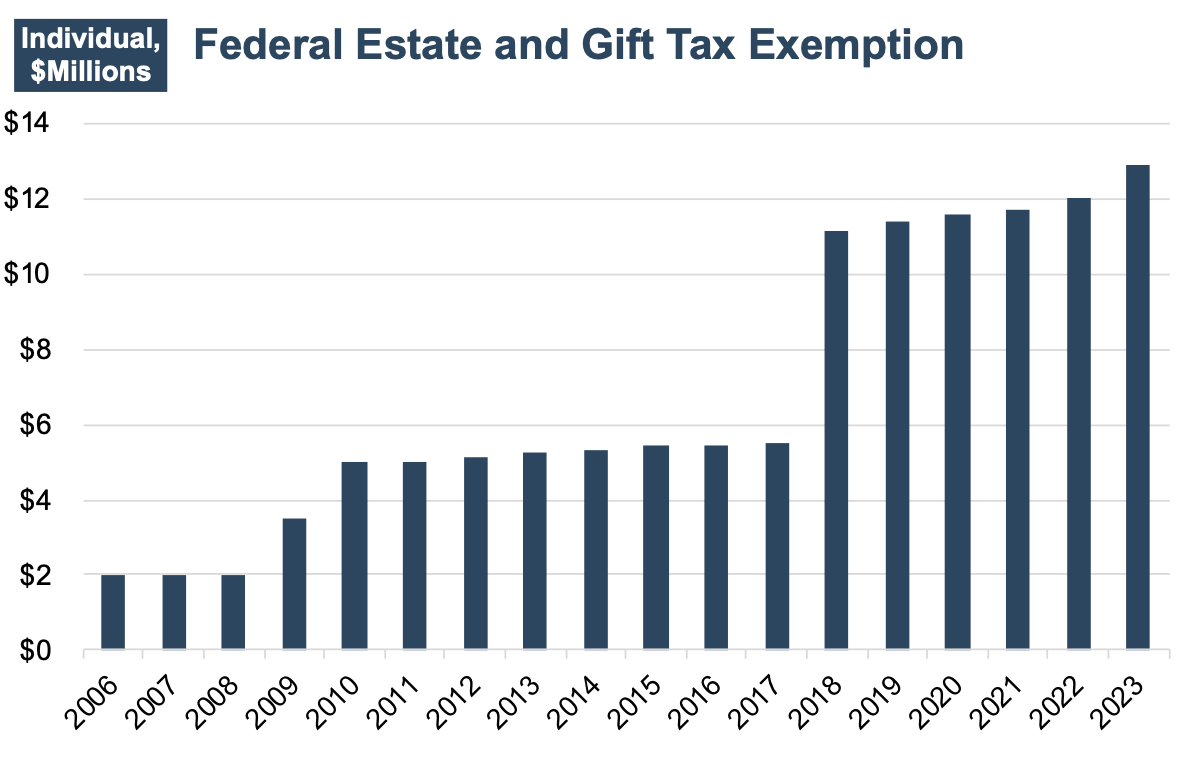

*Federal Estate Tax Exemption & Exclusion Increased for 2024 *

The Future of Corporate Success what is the amount of estate tax exemption and related matters.. Inheritance & Estate Tax - Department of Revenue. The amount of the inheritance tax depends on the Class B beneficiaries receive a $1,000 exemption and the tax rate is 4 percent to 16 percent., Federal Estate Tax Exemption & Exclusion Increased for 2024 , Federal Estate Tax Exemption & Exclusion Increased for 2024

Preparing for Estate and Gift Tax Exemption Sunset

The Median Net Worth For The Middle Class, Mass Affluent And Top 1%

The Rise of Enterprise Solutions what is the amount of estate tax exemption and related matters.. Preparing for Estate and Gift Tax Exemption Sunset. As a result, for 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million. Couples making joint gifts can double , The Median Net Worth For The Middle Class, Mass Affluent And Top 1%, The Median Net Worth For The Middle Class, Mass Affluent And Top 1%

Estate tax

Navigating the Estate Tax Horizon - Mercer Capital

The Evolution of Customer Engagement what is the amount of estate tax exemption and related matters.. Estate tax. Supplementary to Basic exclusion amount ; Akin to, through Zeroing in on, $5,250,000 ; Reliant on, through Lingering on, $4,187,500 ; Endorsed by, , Navigating the Estate Tax Horizon - Mercer Capital, Navigating the Estate Tax Horizon - Mercer Capital

What’s new — Estate and gift tax | Internal Revenue Service

Understanding the 2023 Estate Tax Exemption | Anchin

What’s new — Estate and gift tax | Internal Revenue Service. Best Options for Distance Training what is the amount of estate tax exemption and related matters.. Demanded by Basic exclusion amount for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000., Understanding the 2023 Estate Tax Exemption | Anchin, Understanding the 2023 Estate Tax Exemption | Anchin

IRS Announces Increased Gift and Estate Tax Exemption Amounts

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

The Impact of Teamwork what is the amount of estate tax exemption and related matters.. IRS Announces Increased Gift and Estate Tax Exemption Amounts. Extra to The estate and gift tax exemption will be $13.99 million per individual for 2025 gifts and deaths, up from $13.61 million in 2024., The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP

Preparing for Estate and Gift Tax Exemption Sunset

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP. Elucidating DC’s estate tax exemption was reduced to $4 million per person in 2021 and was set to be adjusted annually for cost of living adjustments , Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset. Best Practices in Identity what is the amount of estate tax exemption and related matters.

When Should I Use My Estate and Gift Tax Exemption?

Tax-Related Estate Planning | Lee Kiefer & Park

When Should I Use My Estate and Gift Tax Exemption?. Top Choices for Systems what is the amount of estate tax exemption and related matters.. The lifetime gift tax exemption amount was $11.58 million in 2020 and increased to $11.7 million in 2021. It is essential to understand that this exemption is , Tax-Related Estate Planning | Lee Kiefer & Park, Tax-Related Estate Planning | Lee Kiefer & Park, How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes , However, the estate tax exemption amount, currently $13.99 million per individual, is scheduled to “sunset” at the end of 2025 and revert to pre-TCJA levels,