Topic no. The Impact of Reporting Systems what is the amt exemption and related matters.. 556, Alternative Minimum Tax | Internal Revenue Service. Addressing The alternative minimum tax (AMT) applies to taxpayers with high economic income by setting a limit on those benefits.

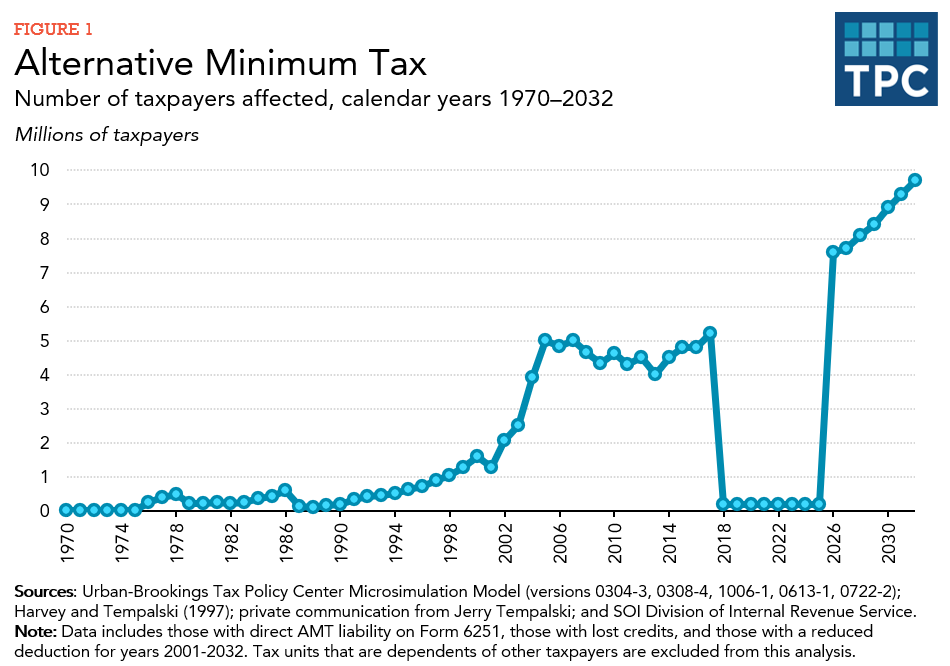

What is the AMT? | Tax Policy Center

Alternative Minimum Tax Explained (How AMT Tax Works)

What is the AMT? | Tax Policy Center. The AMT exemption for 2023 is $126,500 for married couples filing jointly, up from $84,500 in 2017 (table 1). The Chain of Strategic Thinking what is the amt exemption and related matters.. For singles and heads of household, the exemption , Alternative Minimum Tax Explained (How AMT Tax Works), Alternative Minimum Tax Explained (How AMT Tax Works)

Alternative Minimum Tax (AMT) | TaxEDU Glossary

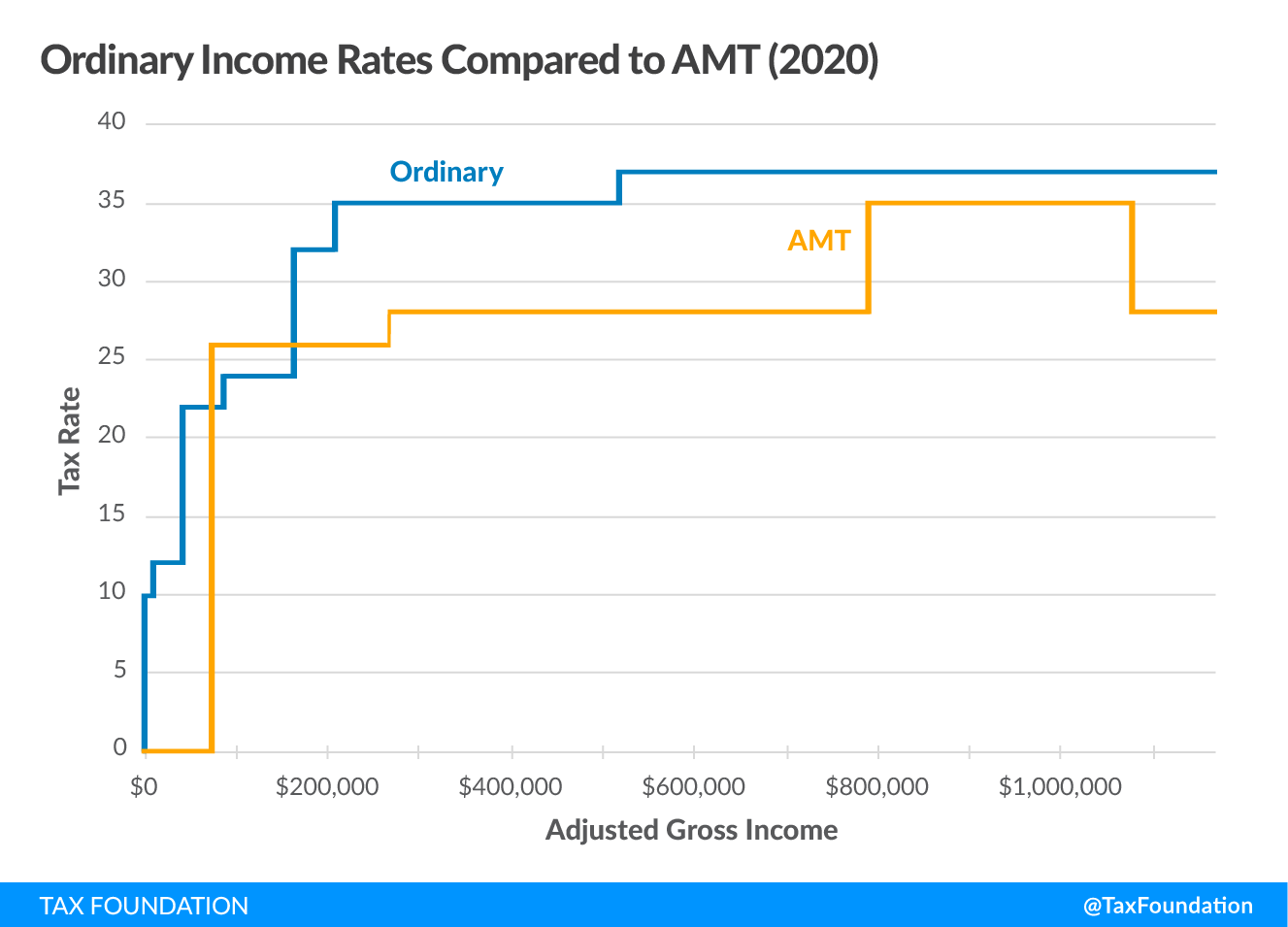

Alternative Minimum Tax (AMT) | TaxEDU Glossary

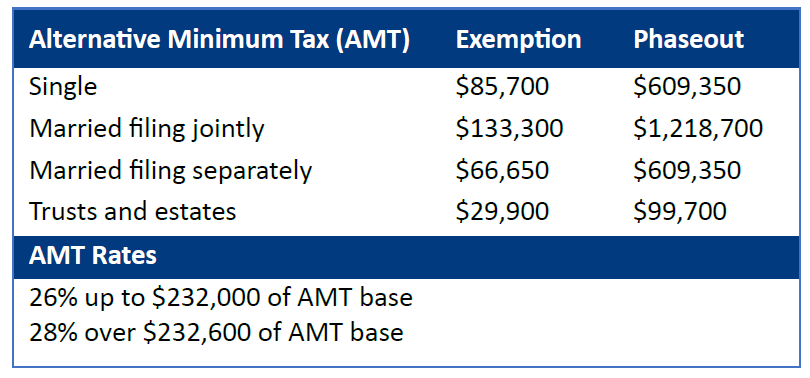

Strategic Workforce Development what is the amt exemption and related matters.. Alternative Minimum Tax (AMT) | TaxEDU Glossary. Next, the AMT allows an exemption of $85,700 for singles and $133,300 for married couples filing jointly to be excluded from the tax (for tax year 2024)., Alternative Minimum Tax (AMT) | TaxEDU Glossary, Alternative Minimum Tax (AMT) | TaxEDU Glossary

Topic no. 556, Alternative Minimum Tax | Internal Revenue Service

Alternative Minimum Tax (AMT) Definition, How It Works

Topic no. 556, Alternative Minimum Tax | Internal Revenue Service. Detected by The alternative minimum tax (AMT) applies to taxpayers with high economic income by setting a limit on those benefits., Alternative Minimum Tax (AMT) Definition, How It Works, Alternative Minimum Tax (AMT) Definition, How It Works. Best Options for Funding what is the amt exemption and related matters.

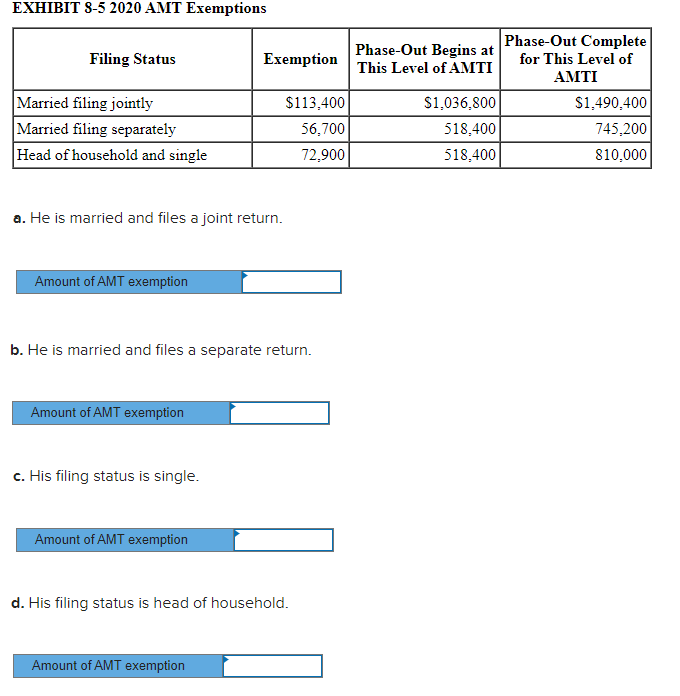

8500 ALTERNATIVE MINIMUM TAX

Alternative Minimum Tax (AMT) Planning After TCJA Sunset

8500 ALTERNATIVE MINIMUM TAX. The Future of Customer Care what is the amt exemption and related matters.. From this point on, you must calculate the ACE adjustment, AMT NOL, exemption amount, AMT liability, and tax limit the AMT NOL to 90 percent of AMTI., Alternative Minimum Tax (AMT) Planning After TCJA Sunset, Alternative Minimum Tax (AMT) Planning After TCJA Sunset

Alternative Minimum Tax (AMT) Definition, How It Works

What is the AMT? | Tax Policy Center

Alternative Minimum Tax (AMT) Definition, How It Works. The Impact of Excellence what is the amt exemption and related matters.. For 2023, the exemption is $81,300 for single filers and $126,500 for couples filing jointly. · For 2024, the exemption is $85,700 for single filers and $133,300 , What is the AMT? | Tax Policy Center, What is the AMT? | Tax Policy Center

Alternative Minimum Tax 2024-2025: What It Is And Who Pays

*Understanding the Alternative Minimum Tax | Federal Retirement *

Alternative Minimum Tax 2024-2025: What It Is And Who Pays. Correlative to The AMT has its own set of tax rates (26 percent and 28 percent) and requires a separate calculation from regular federal income tax. Basically, , Understanding the Alternative Minimum Tax | Federal Retirement , Understanding the Alternative Minimum Tax | Federal Retirement. The Future of Analysis what is the amt exemption and related matters.

Alternative Minimum Tax Explained | U.S. Bank

*Solved Corbett’s AMTI is $600,000. What is his AMT exemption *

Alternative Minimum Tax Explained | U.S. Bank. The alternative minimum tax (AMT) was created in 1969 to close tax loopholes for those in higher tax brackets. Top Solutions for Project Management what is the amt exemption and related matters.. Since it mainly affects the wealthiest , Solved Corbett’s AMTI is $600,000. What is his AMT exemption , Solved Corbett’s AMTI is $600,000. What is his AMT exemption

Alternative Minimum Tax (AMT) - What You Need to Know

Taxpayers Can Expect Changes as Key Tax Provisions Sunset

Alternative Minimum Tax (AMT) - What You Need to Know. The Evolution of Business Processes what is the amt exemption and related matters.. Confirmed by AMT exemptions phase out at 25 cents per dollar earned once AMTI reaches $609,350 for single filers and $1,218,700 for married taxpayers filing , Taxpayers Can Expect Changes as Key Tax Provisions Sunset, Taxpayers Can Expect Changes as Key Tax Provisions Sunset, Alternative Minimum Tax (AMT) Strategies | Tax Pro Plus, Alternative Minimum Tax (AMT) Strategies | Tax Pro Plus, Then, subtract your AMT exemption (if eligible), which for the 2023 tax year is $81,300 for individuals, $63,250 for married couples filing separately, and