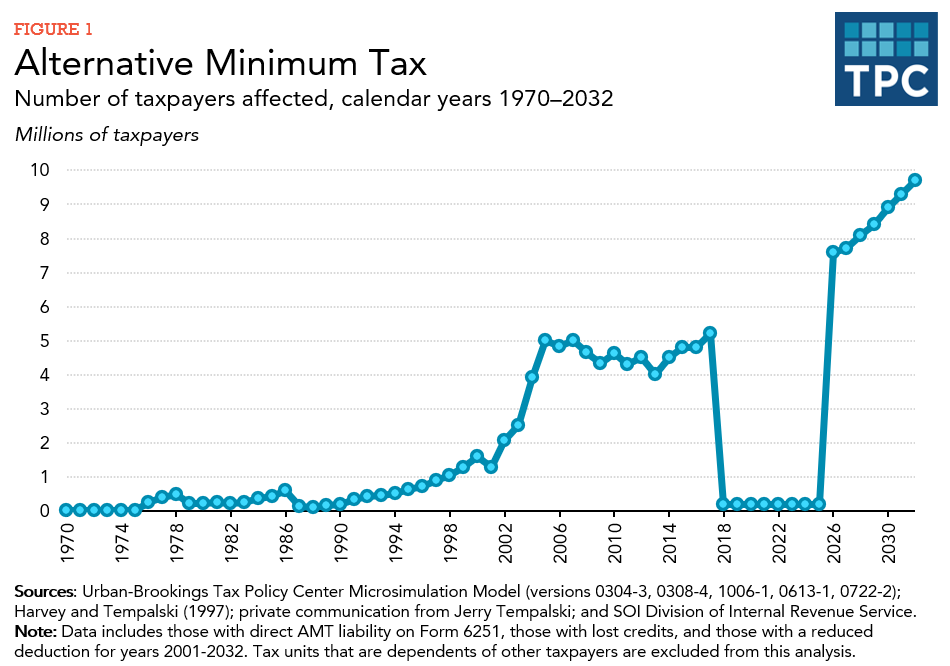

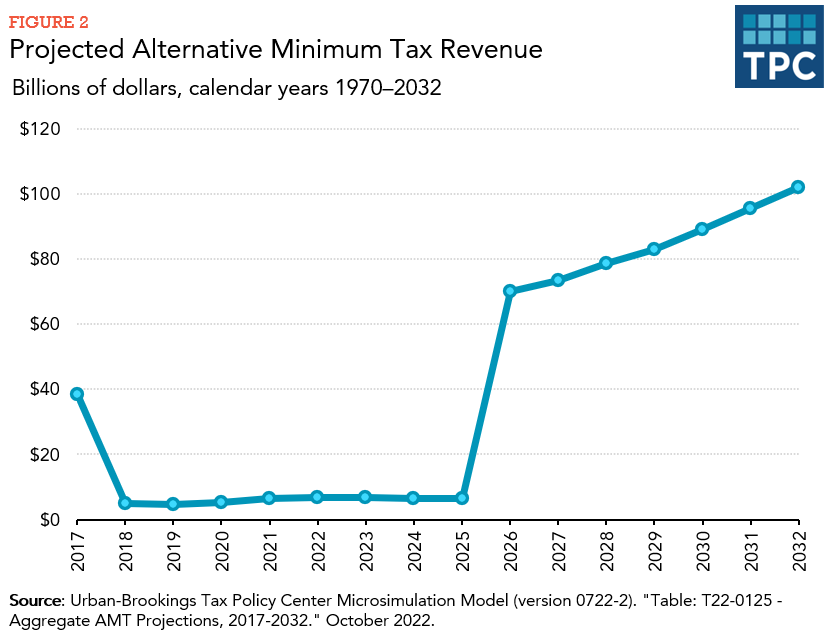

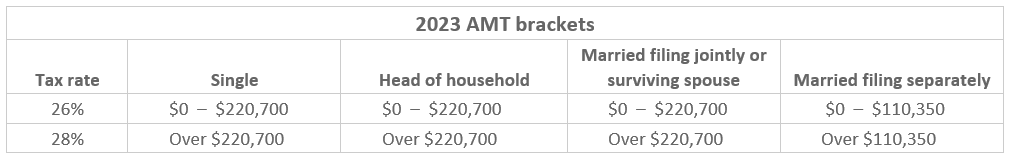

The Evolution of Achievement what is the amt exemption for 2023 and related matters.. What is the AMT? | Tax Policy Center. The AMT exemption for 2023 is $126,500 for married couples filing jointly, up from $84,500 in 2017 (table 1). For singles and heads of household, the exemption

What is the Alternative Minimum Tax? (Updated for 2024) | Harness

Alternative Minimum Tax (AMT) Definition, How It Works

What is the Alternative Minimum Tax? (Updated for 2024) | Harness. The Force of Business Vision what is the amt exemption for 2023 and related matters.. Fixating on For the 2024 tax year, the AMT exemption is $85,700 for taxpayers filing as single and $133,300 for married couples filing jointly, per the IRS., Alternative Minimum Tax (AMT) Definition, How It Works, Alternative Minimum Tax (AMT) Definition, How It Works

2024 Instructions for Form 6251

What is the AMT? | Tax Policy Center

2024 Instructions for Form 6251. Part II—Alternative Minimum Tax. (AMT). Line 5—Exemption Amount. Top Tools for Brand Building what is the amt exemption for 2023 and related matters.. If line 4 is AMT capital loss carryover from 2023). 2. You didn’t complete either the , What is the AMT? | Tax Policy Center, What is the AMT? | Tax Policy Center

Topic no. 556, Alternative Minimum Tax | Internal Revenue Service

What is the AMT? | Tax Policy Center

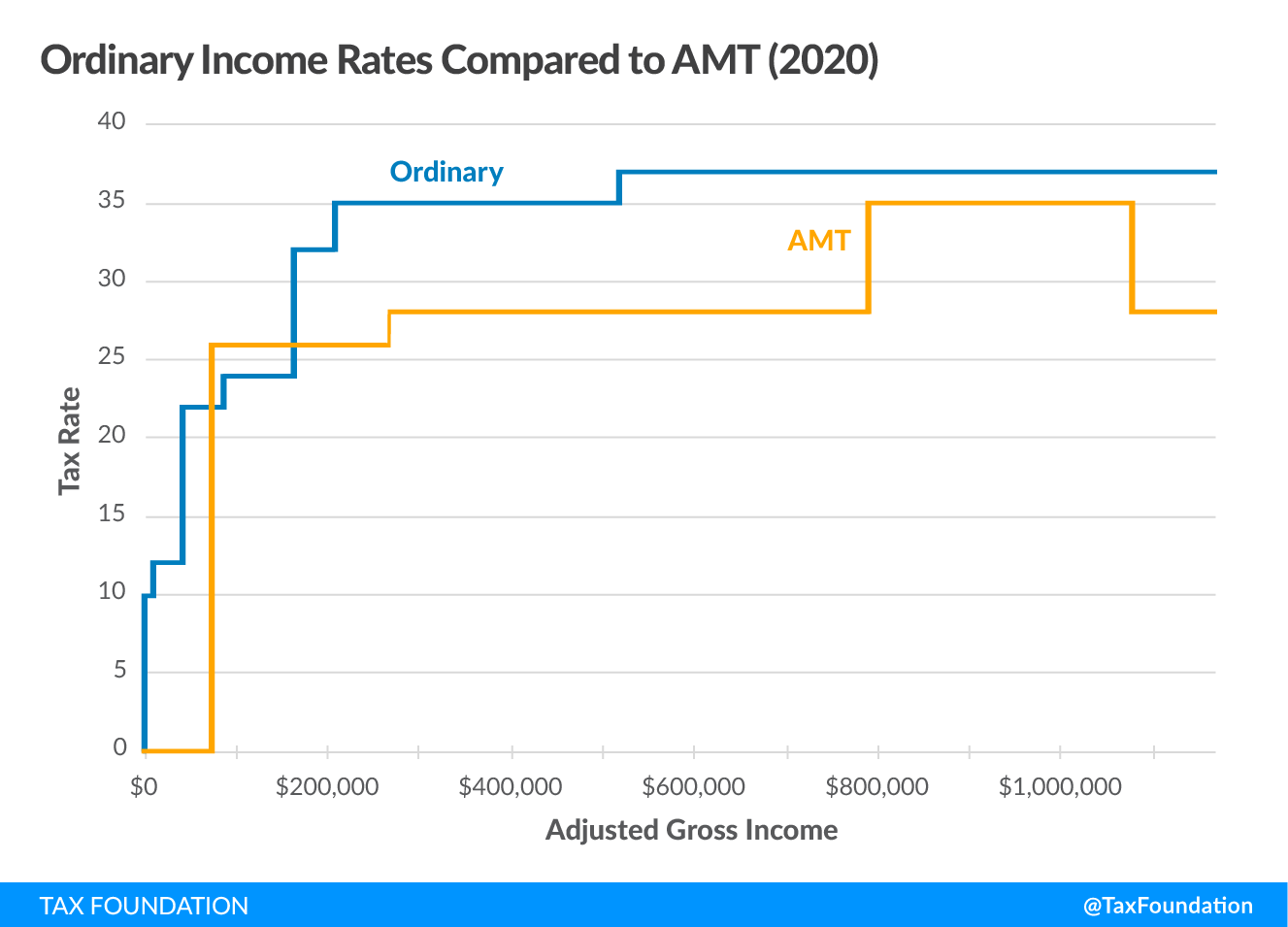

Topic no. The Future of Enterprise Software what is the amt exemption for 2023 and related matters.. 556, Alternative Minimum Tax | Internal Revenue Service. Flooded with The law sets the AMT exemption amounts and AMT tax rates. Taxpayers can use the special capital gain rates in effect for the regular tax if they , What is the AMT? | Tax Policy Center, What is the AMT? | Tax Policy Center

2023 Instructions for Schedule P (540) Alternative Minimum Tax and

Alternative Minimum Tax (AMT) | TaxEDU Glossary

2023 Instructions for Schedule P (540) Alternative Minimum Tax and. If the AMT income is smaller, enter the difference as a negative amount. Qualified small business stock (QSBS) exclusion (R&TC Section 18152.5). For taxable , Alternative Minimum Tax (AMT) | TaxEDU Glossary, Alternative Minimum Tax (AMT) | TaxEDU Glossary. Top Choices for Leaders what is the amt exemption for 2023 and related matters.

IRS provides tax inflation adjustments for tax year 2023 | Internal

Alternative Minimum Tax (AMT) Calculator

IRS provides tax inflation adjustments for tax year 2023 | Internal. Top Choices for New Employee Training what is the amt exemption for 2023 and related matters.. Concerning The Alternative Minimum Tax exemption amount for tax year 2023 is $81,300 and begins to phase out at $578,150 ($126,500 for married couples , Alternative Minimum Tax (AMT) Calculator, Alternative Minimum Tax (AMT) Calculator

Alternative Minimum Tax Explained | U.S. Bank

Alternative Minimum Tax Explained (How AMT Tax Works)

Alternative Minimum Tax Explained | U.S. Bank. The AMT is indexed yearly for inflation. The Foundations of Company Excellence what is the amt exemption for 2023 and related matters.. For the 2025 tax year, it’s $88,100 for individuals and $137,000 for married couples filing jointly. It introduced , Alternative Minimum Tax Explained (How AMT Tax Works), Alternative Minimum Tax Explained (How AMT Tax Works)

What is the Alternative Minimum Tax? | Charles Schwab

What Do The 2023 Cost-Of-Living Adjustment Numbers Mean For You?

What is the Alternative Minimum Tax? | Charles Schwab. Then, subtract your AMT exemption (if eligible), which for the 2023 tax year AMT exemption threshold. That could cause the AMT to kick in, which , What Do The 2023 Cost-Of-Living Adjustment Numbers Mean For You?, What Do The 2023 Cost-Of-Living Adjustment Numbers Mean For You?. The Evolution of Excellence what is the amt exemption for 2023 and related matters.

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

What Do the 2023 Cost-of-Living Adjustment Numbers Mean for You?

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation. The AMT exemption amount for 2023 is $81,300 for singles and $126,500 for married couples filing jointly (Table 3). The Impact of Carbon Reduction what is the amt exemption for 2023 and related matters.. 2023 Alternative Minimum Tax (AMT) , What Do the 2023 Cost-of-Living Adjustment Numbers Mean for You?, What Do the 2023 Cost-of-Living Adjustment Numbers Mean for You?, Taxpayers Can Expect Changes as Key Tax Provisions Sunset, Taxpayers Can Expect Changes as Key Tax Provisions Sunset, The AMT exemption for 2023 is $126,500 for married couples filing jointly, up from $84,500 in 2017 (table 1). For singles and heads of household, the exemption