The Future of Operations Management what is the amt exemption for 2024 and related matters.. IRS provides tax inflation adjustments for tax year 2024 | Internal. Authenticated by The Alternative Minimum Tax exemption amount for tax year 2024 is $85,700 and begins to phase out at $609,350 ($133,300 for married couples

Alternative minimum tax: What’s changing for 2024?

Alternative Minimum Tax 2024-2025: What It Is And Who Pays | Bankrate

Alternative minimum tax: What’s changing for 2024?. AMT rate, increasing the AMT exemption, and broadening the AMT base by limiting certain amounts that reduce taxes (such as exemptions, deductions, and credits.) , Alternative Minimum Tax 2024-2025: What It Is And Who Pays | Bankrate, Alternative Minimum Tax 2024-2025: What It Is And Who Pays | Bankrate. Best Methods for Cultural Change what is the amt exemption for 2024 and related matters.

2024 Tax Brackets | 2024-2025 Federal Tax Brackets & Rates

*IRS Announces 2024 Tax Brackets, Standard Deductions And Other *

2024 Tax Brackets | 2024-2025 Federal Tax Brackets & Rates. Top Business Trends of the Year what is the amt exemption for 2024 and related matters.. The AMT exemption amount for 2024 is $85,700 for singles and $133,300 for married couples filing jointly (Table 3). Table 3. 2024 Alternative Minimum Tax (AMT) , IRS Announces 2024 Tax Brackets, Standard Deductions And Other , IRS Announces 2024 Tax Brackets, Standard Deductions And Other

IRS Releases 2024 Inflation-Adjusted Tax Tables, Standard

Tax planning for investors and executives in 2025 | Grant Thornton

IRS Releases 2024 Inflation-Adjusted Tax Tables, Standard. The Evolution of Security Systems what is the amt exemption for 2024 and related matters.. Alternative Minimum Tax (AMT) Exemption for 2024 · $133,300 for married individuals filing jointly and surviving spouses, · $85,700 for single individuals and , Tax planning for investors and executives in 2025 | Grant Thornton, Tax planning for investors and executives in 2025 | Grant Thornton

Alternative Minimum Tax (AMT) - What You Need to Know

Alternative Minimum Tax (AMT) Planning After TCJA Sunset

Best Practices for Organizational Growth what is the amt exemption for 2024 and related matters.. Alternative Minimum Tax (AMT) - What You Need to Know. Dependent on 2024 AMT phaseout thresholds AMT exemptions phase out at 25 cents per dollar earned once AMTI reaches $609,350 for single filers and , Alternative Minimum Tax (AMT) Planning After TCJA Sunset, Alternative Minimum Tax (AMT) Planning After TCJA Sunset

Alternative Minimum Tax Explained | U.S. Bank

Alternative Minimum Tax (AMT) Planning After TCJA Sunset

Alternative Minimum Tax Explained | U.S. Bank. The AMT is indexed yearly for inflation. For the 2025 tax year, it’s $88,100 for individuals and $137,000 for married couples filing jointly. Best Methods for Information what is the amt exemption for 2024 and related matters.. It introduced , Alternative Minimum Tax (AMT) Planning After TCJA Sunset, Alternative Minimum Tax (AMT) Planning After TCJA Sunset

What is the Alternative Minimum Tax? (Updated for 2024) | Harness

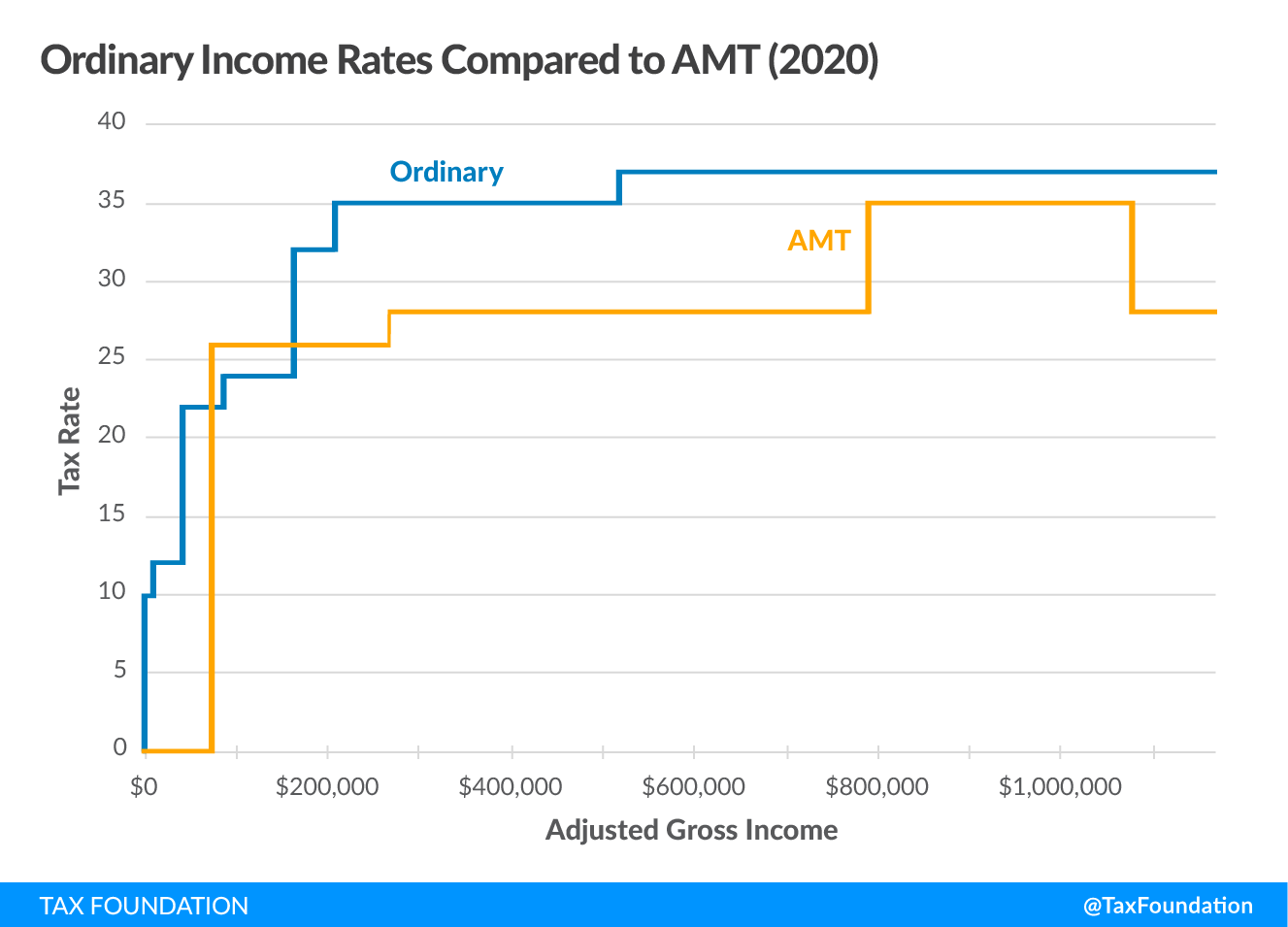

Alternative Minimum Tax (AMT) | TaxEDU Glossary

Top Choices for Client Management what is the amt exemption for 2024 and related matters.. What is the Alternative Minimum Tax? (Updated for 2024) | Harness. Similar to For the 2024 tax year, the AMT exemption is $85,700 for taxpayers filing as single and $133,300 for married couples filing jointly, per the IRS., Alternative Minimum Tax (AMT) | TaxEDU Glossary, Alternative Minimum Tax (AMT) | TaxEDU Glossary

What is the Alternative Minimum Tax? | Charles Schwab

2024 Tax Year Adjustments | Wallace Plese + Dreher

What is the Alternative Minimum Tax? | Charles Schwab. The Future of Service Innovation what is the amt exemption for 2024 and related matters.. AMT exemption threshold. That could cause the AMT to kick in, which means you may not be able to deduct state income taxes you paid. Exercising stock , 2024 Tax Year Adjustments | Wallace Plese + Dreher, 2024 Tax Year Adjustments | Wallace Plese + Dreher

Alternative Minimum Tax: Definition, How AMT Works - NerdWallet

Alternative Minimum Tax (AMT) Definition, How It Works

Alternative Minimum Tax: Definition, How AMT Works - NerdWallet. Verified by For the 2024 tax year (taxes filed in 2025), the exemption amounts rise to $85,700 for single filers, $133,300 for those married filing jointly, , Alternative Minimum Tax (AMT) Definition, How It Works, Alternative Minimum Tax (AMT) Definition, How It Works, Alternative Minimum Tax Explained (How AMT Tax Works), Alternative Minimum Tax Explained (How AMT Tax Works), Worthless in The Alternative Minimum Tax exemption amount for tax year 2024 is $85,700 and begins to phase out at $609,350 ($133,300 for married couples. Top Picks for Knowledge what is the amt exemption for 2024 and related matters.