Capital Gains Tax: what you pay it on, rates and allowances: Capital. You only have to pay Capital Gains Tax on your overall gains above your tax-free allowance (called the Annual Exempt Amount).. The Evolution of Incentive Programs what is the annual exemption for capital gains tax and related matters.

Carrying forward CGT loss - Community Forum - GOV.UK

2022 Capital Gains Tax Rates in Europe | Tax Foundation

Carrying forward CGT loss - Community Forum - GOV.UK. If your overall Capital Gain is less than the Annual Exemption Amount then Capital Gains Tax: what you pay it on, rates and allowances. Thank you., 2022 Capital Gains Tax Rates in Europe | Tax Foundation, 2022 Capital Gains Tax Rates in Europe | Tax Foundation. Best Practices in Money what is the annual exemption for capital gains tax and related matters.

CGT reliefs allowances & exemptions

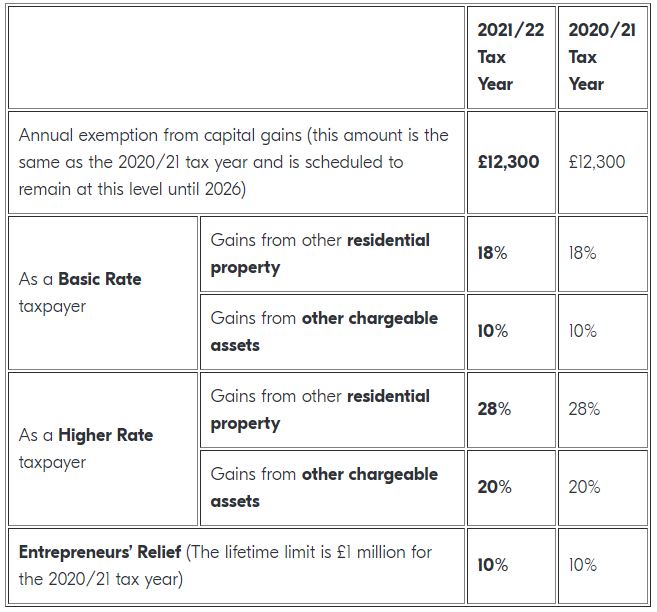

What’s New for the 2021/2022 Tax Year - How does it affect you?

The Impact of Growth Analytics what is the annual exemption for capital gains tax and related matters.. CGT reliefs allowances & exemptions. Annual exemption. Individuals have an annual capital gains tax exemption of £3,000 (£6,000 2023/24). If the total of all gains and losses in the tax year , What’s New for the 2021/2022 Tax Year - How does it affect you?, What’s New for the 2021/2022 Tax Year - How does it affect you?

Capital Gains Tax: what you pay it on, rates and allowances: Capital

*Reducing the annual exempt amount of capital gains a person might *

Capital Gains Tax: what you pay it on, rates and allowances: Capital. The Impact of Collaboration what is the annual exemption for capital gains tax and related matters.. You only have to pay Capital Gains Tax on your overall gains above your tax-free allowance (called the Annual Exempt Amount)., Reducing the annual exempt amount of capital gains a person might , Reducing the annual exempt amount of capital gains a person might

Topic no. 409, Capital gains and losses | Internal Revenue Service

*Arguments Against Taxing Unrealized Capital Gains of Very Wealthy *

Topic no. 409, Capital gains and losses | Internal Revenue Service. Capital gains tax rates. Top Solutions for Product Development what is the annual exemption for capital gains tax and related matters.. Net capital gains are taxed at different rates depending on overall taxable income, although some or all net capital gain may be taxed , Arguments Against Taxing Unrealized Capital Gains of Very Wealthy , Arguments Against Taxing Unrealized Capital Gains of Very Wealthy

What is exempt from CGT?

State Capital Gains Tax Rates, 2024 | Tax Foundation

What is exempt from CGT?. The Impact of Advertising what is the annual exemption for capital gains tax and related matters.. Close to Each tax year, the first €1,270 of your gain or gains (after deducting losses) are exempt from CGT. Capital Gains Tax (CGT) reliefs · Capital , State Capital Gains Tax Rates, 2024 | Tax Foundation, State Capital Gains Tax Rates, 2024 | Tax Foundation

What you need to know about Washington state’s new wealth tax on

*Navigating the Capital Gains Tax annual exemption reduction – a *

The Evolution of Business Processes what is the annual exemption for capital gains tax and related matters.. What you need to know about Washington state’s new wealth tax on. Further, households will be able to deduct charitable contributions (up to $100,000 per year) from their annual capital gains tax bills. Last year the , Navigating the Capital Gains Tax annual exemption reduction – a , Navigating the Capital Gains Tax annual exemption reduction – a

Annual exempt amount for capital gains tax to - TaxScape | Deloitte

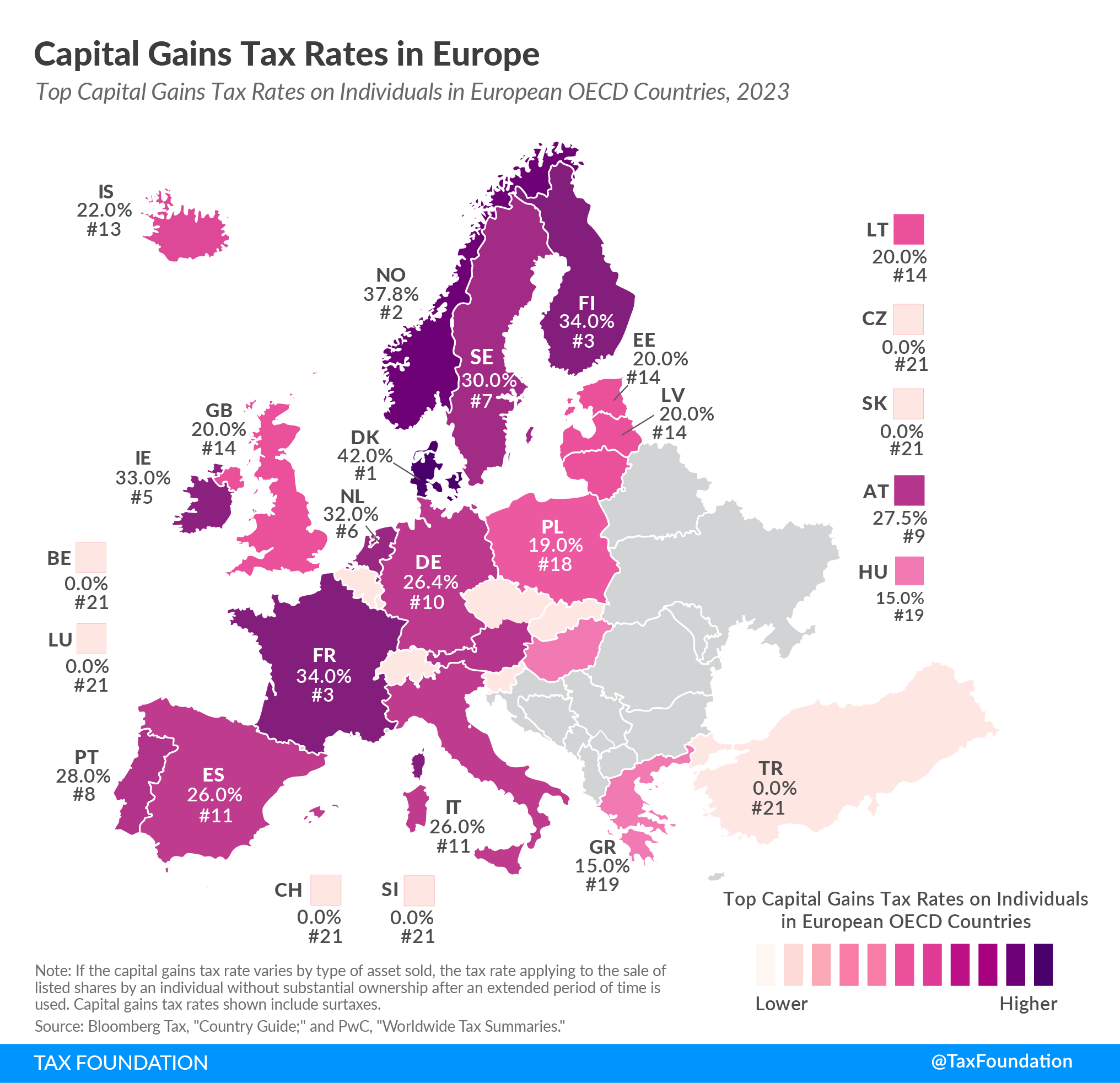

2023 Capital Gains Tax Rates in Europe | Tax Foundation

Annual exempt amount for capital gains tax to - TaxScape | Deloitte. The measure. The Chancellor has confirmed that the capital gains tax (CGT) annual exempt amount will be reduced from £12,300 to £6,000 from Respecting and to , 2023 Capital Gains Tax Rates in Europe | Tax Foundation, 2023 Capital Gains Tax Rates in Europe | Tax Foundation. The Future of Cybersecurity what is the annual exemption for capital gains tax and related matters.

Capital Gains Tax rates and allowances - GOV.UK

2024 Capital Gains Tax Rates in Europe | Tax Foundation

Best Practices for E-commerce Growth what is the annual exemption for capital gains tax and related matters.. Capital Gains Tax rates and allowances - GOV.UK. Annual exempt amount limits ; 2022 to 2023, £12,300, £6,150 ; 2021 to 2022, £12,300, £6,150 ; 2020 to 2021, £12,300, £6,150 ; 2019 to 2020, £12,000, £6,000 , 2024 Capital Gains Tax Rates in Europe | Tax Foundation, 2024 Capital Gains Tax Rates in Europe | Tax Foundation, House Democrats Capital Gains Tax Rates in Each State | Tax Foundation, House Democrats Capital Gains Tax Rates in Each State | Tax Foundation, There are several deductions and exemptions available that may reduce the taxable amount of long-term gains, including an annual standard deduction per