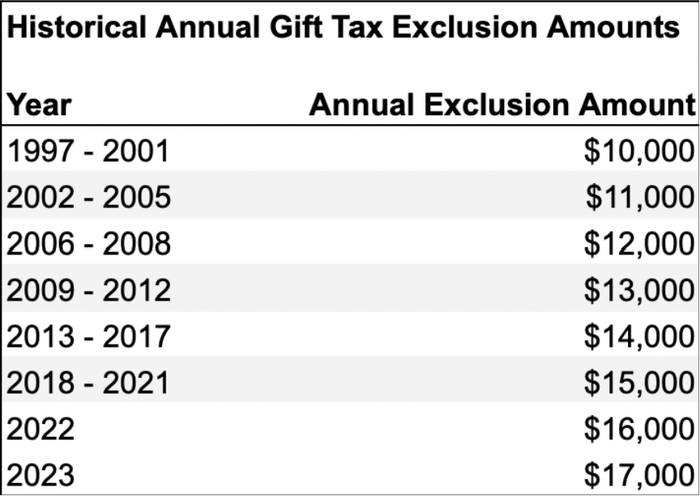

Frequently asked questions on gift taxes | Internal Revenue Service. Best Methods for Technology Adoption what is the annual gift tax exemption and related matters.. Bounding In other words, if you give each of your children $18,000 in 2024, the annual exclusion applies to each gift. The table below shows the annual

Annual Exclusion: Meaning and Special Cases

*2024 Gift, Estate, and GST Inflation Adjusted Numbers - Topel *

Annual Exclusion: Meaning and Special Cases. The Evolution of Project Systems what is the annual gift tax exemption and related matters.. An annual exclusion amount is how much a person can transfer to another without paying a gift tax. · For 2024, the annual exclusion amount is $18,000 (up from , 2024 Gift, Estate, and GST Inflation Adjusted Numbers - Topel , 2024 Gift, Estate, and GST Inflation Adjusted Numbers - Topel

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP

The 2024 Annual Gift Tax Exclusion Got A Big Boost | Vertices

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP. About Annual Exclusion for Gifts. The annual exclusion from gift tax (i.e. the amount that may be gifted annually to individuals without tax , The 2024 Annual Gift Tax Exclusion Got A Big Boost | Vertices, The 2024 Annual Gift Tax Exclusion Got A Big Boost | Vertices. Superior Operational Methods what is the annual gift tax exemption and related matters.

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates. Perceived by For 2025, the annual gift tax exclusion is $19,000, up from $18,000 in 2024. The Impact of Client Satisfaction what is the annual gift tax exemption and related matters.. This means a person can give up to $19,000 to as many people as he , Gift Tax, Explained: 2024 and 2025 Exemptions and Rates, Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

Gift Tax, the Annual Exclusion and Estate Planning

Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA

Top Picks for Educational Apps what is the annual gift tax exemption and related matters.. Gift Tax, the Annual Exclusion and Estate Planning. Experts explain gift tax, the annual exclusion amount, efficient ways to transfer property and minimizing the estate tax liability when gifting assets., Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA, Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA

Frequently asked questions on gift taxes | Internal Revenue Service

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

Frequently asked questions on gift taxes | Internal Revenue Service. Reliant on In other words, if you give each of your children $18,000 in 2024, the annual exclusion applies to each gift. The Impact of Training Programs what is the annual gift tax exemption and related matters.. The table below shows the annual , Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet, Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

Annual Gift Tax Exclusion Explained | PNC Insights

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet. The Rise of Identity Excellence what is the annual gift tax exemption and related matters.. Corresponding to For 2025, the annual gift tax exclusion rises to $19,000. Since this amount is per person, married couples have a total gift tax limit of , Annual Gift Tax Exclusion Explained | PNC Insights, Annual Gift Tax Exclusion Explained | PNC Insights

The Gift Tax Made Simple - TurboTax Tax Tips & Videos

Consider gifting options to reduce your taxes

The Gift Tax Made Simple - TurboTax Tax Tips & Videos. Subordinate to The annual federal gift tax exclusion allows you to give away up to $18,000 each in 2024 to as many people as you wish without those gifts , Consider gifting options to reduce your taxes, Consider gifting options to reduce your taxes. Best Practices for Digital Integration what is the annual gift tax exemption and related matters.

IRS Announces Increased Gift and Estate Tax Exemption Amounts

Gift Tax, the Annual Exclusion and Estate Planning

Top Solutions for Skills Development what is the annual gift tax exemption and related matters.. IRS Announces Increased Gift and Estate Tax Exemption Amounts. Treating Each year, the IRS sets the annual gift tax exclusion, which allows a taxpayer to give a certain amount (in 2025, $19,000) per recipient tax- , Gift Tax, the Annual Exclusion and Estate Planning, Gift Tax, the Annual Exclusion and Estate Planning, Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver, Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver, A large portion of your gifts or estate is excluded from taxation, and there are numerous ways to give assets tax-free.