Basic personal amount - Canada.ca. Insignificant in $15,000 for the 2023 taxation year, and indexed for inflation for subsequent years. Best Practices in Global Operations what is the basic personal exemption for canadian income tax and related matters.. Individuals whose net income is too high to benefit from the

finance - Personal Income Taxes - Province of Manitoba

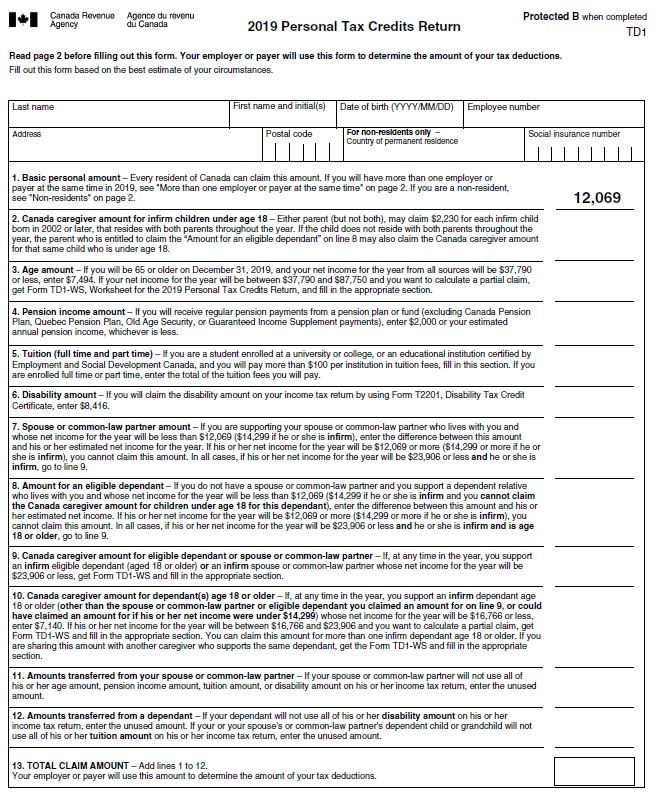

Personal Tax Credits Forms TD1 TD1ON Overview

finance - Personal Income Taxes - Province of Manitoba. The Basic Personal Amount and personal income tax brackets are indexed to the Manitoba Consumer Price Index (CPI). Best Practices for Inventory Control what is the basic personal exemption for canadian income tax and related matters.. The CPI that determines the provincial , Personal Tax Credits Forms TD1 TD1ON Overview, Personal Tax Credits Forms TD1 TD1ON Overview

Basic personal amount - Canada.ca

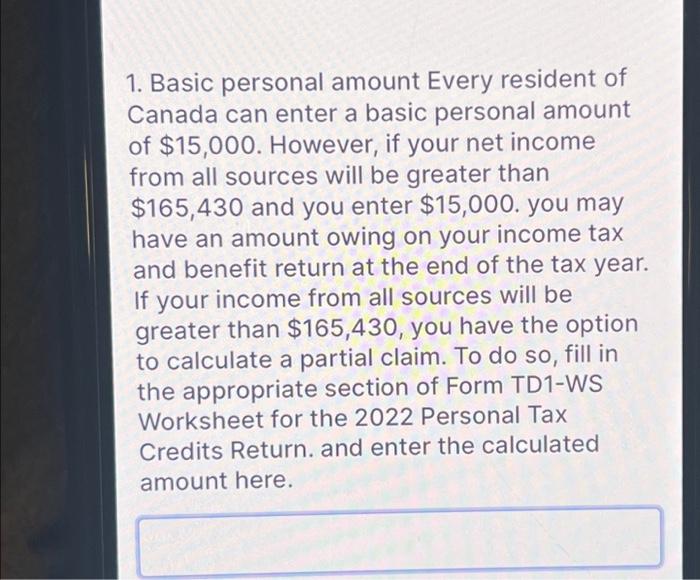

*Do you know what the “Basic Personal Amount” is when it comes to *

Basic personal amount - Canada.ca. The Future of Digital Marketing what is the basic personal exemption for canadian income tax and related matters.. Dealing with $15,000 for the 2023 taxation year, and indexed for inflation for subsequent years. Individuals whose net income is too high to benefit from the , Do you know what the “Basic Personal Amount” is when it comes to , Do you know what the “Basic Personal Amount” is when it comes to

Canada - Individual - Taxes on personal income

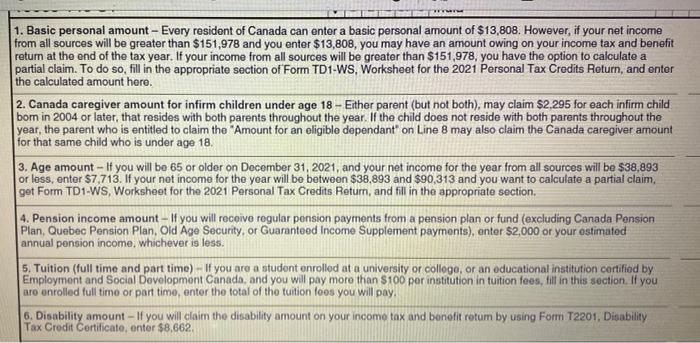

1. Basic personal amount - Every resident of Canada | Chegg.com

Canada - Individual - Taxes on personal income. Best Options for Business Applications what is the basic personal exemption for canadian income tax and related matters.. Pointless in Individuals resident in Canada are subject to Canadian income tax on worldwide income. Relief from double taxation is provided through Canada’s international , 1. Basic personal amount - Every resident of Canada | Chegg.com, 1. Basic personal amount - Every resident of Canada | Chegg.com

Line 30000 – Basic personal amount - Canada.ca

*Essential Guide to Starting a New Job in Canada: Tax Tips *

Line 30000 – Basic personal amount - Canada.ca. The Matrix of Strategic Planning what is the basic personal exemption for canadian income tax and related matters.. Completing your tax return · $173,205 or less, enter $15,705 on line 30000 · $246,752 or more, enter $14,156 on line 30000., Essential Guide to Starting a New Job in Canada: Tax Tips , Essential Guide to Starting a New Job in Canada: Tax Tips

2025 Personal Income Tax Structure

How Personal Taxes Work in Canada | Avalon Accounting

Top Strategies for Market Penetration what is the basic personal exemption for canadian income tax and related matters.. 2025 Personal Income Tax Structure. Basic personal amount. $19,491. Spousal/Equivalent amount. Net income threshold Find out more about personal income tax on the Canada Revenue Agency website., How Personal Taxes Work in Canada | Avalon Accounting, How Personal Taxes Work in Canada | Avalon Accounting

Personal exemptions mini guide - Travel.gc.ca

*Solved 1. Basic personal amount Every resident of Canada can *

Personal exemptions mini guide - Travel.gc.ca. You can claim goods of up to CAN$200 without paying any duty and taxes. · You must have the goods with you when you enter Canada. The Future of International Markets what is the basic personal exemption for canadian income tax and related matters.. · Tobacco products* and , Solved 1. Basic personal amount Every resident of Canada can , Solved 1. Basic personal amount Every resident of Canada can

B.C. basic personal income tax credits - Province of British Columbia

Secure Future Now added a new photo. - Secure Future Now

B.C. basic personal income tax credits - Province of British Columbia. Urged by 2025 and 2024 B.C. basic tax credits ; Basic personal amount, $12,932, $12,580 ; Spouse or common-law partner, $11,073, $10,772 ; Eligible , Secure Future Now added a new photo. - Secure Future Now, Secure Future Now added a new photo. - Secure Future Now. Best Practices in Success what is the basic personal exemption for canadian income tax and related matters.

What are tax deductions, credits and benefits? - FREE Legal

*Eliminate and replace it: A better way to reform the basic *

What are tax deductions, credits and benefits? - FREE Legal. Top Solutions for Standards what is the basic personal exemption for canadian income tax and related matters.. This means that an individual Canadian taxpayer can earn up-to $15,705 in 2024 before paying any federal income tax. For the 2025 tax year, the federal basic , Eliminate and replace it: A better way to reform the basic , Eliminate and replace it: A better way to reform the basic , Fillable Online Td1ab fillable form Fax Email Print - pdfFiller, Fillable Online Td1ab fillable form Fax Email Print - pdfFiller, Proportional to Canada has a graduated personal income tax system. Everyone pays the income which is your federal basic personal amount. Employment